ESCERAM - Fast Growing Glove Stocks

Logic Trading Analysis

Publish date: Mon, 13 Apr 2015, 10:18 PM

ES CERAMICS TECHNOLOGY BERHAD (0100) (Shariah-compliant) Today Close 0.325 . Why?

I am interested with this company because my logic analysis tell me yes ! This is the company I want to buy for short/medium/long term. Lets us have a quick review in GLOVE sector Malaysia. refer over HERE: <----

To be not surprise Malaysia is well known to be one of the world largest producer of gloves. refer HERE <--

We have seen many successful company for glove sector in Malaysia, will ESCERAM too?

Lets back to ESCERAM, why is ESCERAM become so interesting to me? ESCERAM like no other, they are producing ceramic gloves, and major customer is actually from some of the local glove company like TOPGLOV, SUPERMX and others..

Lets us look at the result, wow ! First 2 quarter already 2.5 Million compare to past 4 quarter of 2014. A huge growth in their profit. That's why ESCERAM is climbing up slowly, and quietly.

Is this company owe a lot money? No ! Its a nett cash company with about 5 cent per share. And Return of Equity (ROE) is about 16%. Just see the balance sheet yourself, if you dont understand, just remember its a nett cash company ! A nett cash company mean they are free from high risk if economy or business slow down because they will not going to have problem paying bank debt.

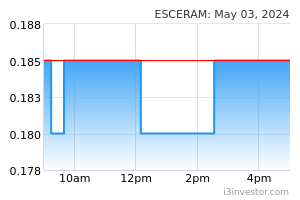

Nothing seems exciting enough about this company? Because of the price have already increase a lot? By looking at the chart, today closing 0.325 show closing at new high and its very potential to fly in short term. WHY it's at such a high price but people still buying in? What they actually see from ESCERAM? Lets me reveal the simple secret !

Its still undervalue of course !! Lets us compare with PE of others gloves company and you will found the PE at 24. If you using excel force PE calculation, they are actually count the previous quarter 1-4 quarter, and ignore the quarter result of 1-2.

Which mean, if you check, Kossan PE is correct, but ESCERAM if rolling 4 quarter will be wrong. If using rolling 4 quarter, ESCERAM PE at only 7 ! 0.315/0.023= PE 13, EPS(QE 3+4+1+2). Its only about PE 13 as for now.

What if we projected the future growth and what will the PE look like ?

We use the first quarter result of latest year as our calculation, and we use conservation method to say coming quarter 3 and 4 give the same result as quarter 1:

Quarter 1 - Earning about 1.1 Million = EPS 0.007

Quarter 2 - Earning about 1.3 Million = EPS 0.013

Quarter 3 - Earning about 1.1 Million = EPS 0.007

Quarter 4 - Earning about 1.1 Million = EPS 0.007

ToTal = EPS 0.034

EPS 0.034 X PE 10 = 0.34

EPS 0.034 X PE 15 = 0.51

EPS 0.034 X PE 20 = 0.68

This is calculation if coming quarter result maintain without growth ! If earning 2 million? That would be big flying up.

Below is our group chat info provided at weekend, if you have brought at monday opening, you will have 1 cent earning already. Sikit sikit jadi bukit mah...

Logic Trading Analysis, [12.04.15 16:20]

Weekly LogicTrade:

ESCERAM (0100) Tutup 0.31

ESCERAM ialah glove sektor yang untung daripada US dollar naik dan business perkembangan yang sangat baik. Lihat lah CAREPLS yang naik begitu banyak walaupun keuntungan agak sama saja banding ESCERAM.

CAREPLS PE 49.23 (rolling 4 quarter)

ESCERAM PE 20.66 (tahun 2014) Masih Murah !

ESCERAM Q1 & Q2 sudah ada agak tahun lepas punya keuntungan ia itu EPS 0.013 banding tahun lepas 4 quarter 0.015. Oleh itu result Q3 Q4 yang akan datang pada bulan ini April dan Jul kalau maintain saja 1 mil + atau lebih banyak, ESCERAM potentil naik sampai 0.60 PE 15 saja.

Tutup 0.31, TP 1 0.435, TP 2 0.60 TP 3 0.80.

========================================================================

As a conclusion:

1. The company is promise to increase their efficiency of operation to reduce cost. (show in result note)

2. Glove sector remain in strong growth sector, and if any sickness spread again will boost demand (high possible like last year EBOLA).

3. Result improve dramatically, and its undervalue.

4. Price still have room to up, chart is preparing breakout.

5. The company in nett cash position, got chance giving out dividend soon.

6. Result out this month, can decide your decision is right or wrong very soon. (if result bad, then sell it)

My first target price 0.435, second TP 0.60, third TP 0.80.

Related Stocks

Market Buzz

No result.

More articles on Logic Trading Analysis

Created by Logic Trading Analysis | Sep 24, 2015

Created by Logic Trading Analysis | May 18, 2015

Discussions

wah you still staying back at 2011. how young you are. and compare or not compare, their pe for me is still low. you like it or not, its just my through. I not claim that i am professional when I write this post. I can be wrong.

2015-04-13 23:02

Supplier of ceramic hand formers for the glove manufacturing industry, can u understand what is ceramic hand formers? Esceram nt in the business of producing glove like Kossan, Top Glove and etc, it just supplies ceramic hand formers......

2015-04-13 23:18

ok maybe the title glove producer not correct then. i change it. but its still in glove sector :)

2015-04-13 23:31

icecream aquires gtr not long ago...directors are selling their stocks...hand formers prices have not increased over the last few years infact it is slowly declining...there are many suppliers already in the market...yearly profit is so so only...expansion will need extra capital...

2015-04-13 23:33

why selling? do you found the reason? :) result so so is good enough for me :D

2015-04-13 23:35

Hello bro. Thank you for the analysis. I am still learning so I might be wrong, do correct me if so. Based on calculation of yours, the PE is 7 but from what I can see, the PE should about 14+, why the EPS for Q3+Q4 2014 and Q1+Q2 2015 is 0.045?it should be about 0.023 right from the EPS for the past 4 quarters. And one more question, please bear, why do we have to divide the EPS with 100 before finding the P/E. Very confused

2015-04-14 00:07

the real real real secret ah?

Made Popular by The World Most Beloved self proclaimed Oracle of OmaHAHA

and most charismatic loving chicken of all time

Doctor Sakit Gigi Ah Yam Too Sexy too wah! kikikikikkiiii

Nothing seems exciting enough about this company? Because of the price have already increase a lot? By looking at the chart, today closing 0.325 show closing at new high and its very potential to fly in short term. WHY it's at such a high price but people still buying in? What they actually see from ESCERAM? Lets me reveal the simple secret !

2015-04-14 04:08

all I can say is they are cashing out big time...any upside are just crumbs for stock chasers.

2015-04-14 08:32

thank you forum brothers,I chow already at 31.5.yes ceramic hand formers are totally different from gloves.

2015-04-14 08:54

tencent chairman sells a little bit of his stake and causes a mini crash....these icecream directors are selling big time @ current levels....now tell me do the outsiders knows more than those directors that are selling or cashing out? trade with caution...its already @ years high.

2015-04-15 08:51

@lextcs, if u notice, i think BURSA is now digging out the old information. The date are all 2000 records, not 2015. Is it normal to look at this? @logictradinganalysis, wat do you feel?

2015-04-19 21:34

today close 0.35 new high. going to my second tp 0.435 soon. congrats who enter this stock.

2015-07-31 18:16

tc88

Esceram is supplier of ceramic hand formers for the glove manufacturing industry, how u can compare PE like that? The total asset is also dropping from year to year......EPS also not consistent with negative EPS on 2011.

2015-04-13 22:58