|

| |

Overview

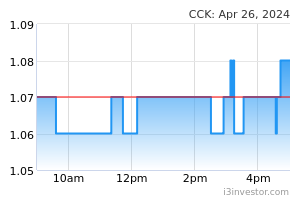

Financial HighlightHeadlinesBusiness Background CCK Consolidated Holdings Bhd through its subsidiaries is engaged in trading of cold storage products. It is also engaged in the rearing and production of poultry products, prawn and seafood products, and supply and trade of food products and related services. The group is organised into 5 main reportable segments: Poultry Segment; Prawn Segment; Food Service Segment; Retail Segment; and Corporate Segment. Poultry Segment is involved in the rearing and production of poultry products. Prawn Segment is involved in the rearing and production of prawn and seafood products. Food Service Segment is involved in the supply and trading of food products and related services. Retail Segment is involved in the trading of cold storage products.

TiffanixLVxHermes QR slightly better after taking out other income 19mil not bad but not very good 28/02/2024 5:40 PM kedsheong Those who sold today will buy it back tomorrow at a gapped-up price. 😂🤣🤣 28/02/2024 6:03 PM Papayashot wonder what is the amount of subsidy given to CCK ? Why take out 19 mil? 19 mil = subsidy?? 28/02/2024 6:32 PM ooihk899 I believe their Indonesia business will have a double digit growth in the future since the economy is booming. 28/02/2024 6:36 PM cchin CCK should command higher PE due to its strong retail segment business like QL. Retail business has better and consistent earning. At least PE of 12 to 15 29/02/2024 11:11 AM ooihk899 Just be patience. If FY2024 QR1 n QR2 continue to improve YoY,💪 consistent dividend payout ratio. Rerating is just a matter of time.😋😄 Anyway, I think will break RM 1 soon.🌈🚀 Gratz to all.😁🌞 29/02/2024 11:40 AM ITreeinvestor For FY24, we expect earnings to normalize on lower subsidy received from the Malaysian Government. Note that the subsidy for chicken has been discontinued in November 2023 29/02/2024 3:49 PM ooihk899 No subsidy for chicken also means no price control. This may help them to have more consistent QR and net profit. 29/02/2024 5:08 PM kedsheong Established and well managed company. Fresh marts, supermarket and food business will not go out of fashion, therefore it's a sustainable business. Dominant position in East Malaysia and Pontianak. Synergistic business arms. Still very undervalued despite recent price movement. Ideal for coffee-can portfolio, a potential 10-bagger. The share price will keep chasing it's earnings upwards. 29/02/2024 8:34 PM kedsheong For a good company like this, I would love the price to fall lower and lower, so that I can really load up the truck. And keep it for long term. A PE of 7.27 is equivalent to a yield of 13.8% per year, which is more than 4x FD rate. Steady business like this gives us no reason to keep money in FD which makes the banks rich while we go broke over a long period of time due to inflation. ROE 19.6%, ROCE 16.9%, Debt 11.5%. business is still run by owner operator. A truly compounding machine in bursa. Fulfilling all features of a 100 bagger as described by Christopher Mayer. Waiting for the market to realize it's true value, and the twin engine (earnings growth and PE expansion) to work for us. It deserves a PE of at least 15. 01/03/2024 10:17 PM sense maker Not sure about the market dynamics. If they increase the price, demand will drop. Recovery of margin and EPS will take many quarters after a n expected slump in May 24 quarterly results announcement.. 14/03/2024 4:16 PM ooihk899 You want to buy cheap is it,😮 that's why talk nonsense ar? Normally Q1 n Q2 result will be lower than Q3 n Q4. Let's wait for the Q1 & Q2 result n compare to last year Q1 & Q2. 14/03/2024 4:32 PM katara you can see that cck share price movement is the most sturdy among the chickens n eggs counters after the announcement of QR last month.. 14/03/2024 5:03 PM sense maker Yes it will be stable and growing. But do you expect the government subsidy foregone to be immediately reflected in increased selling prices, without any effect on demand? If so, Teoseng need not drop from rm2.50 to rm1.80. 14/03/2024 5:03 PM katara cck core business is retail , not chicken nor eggs , that's y the rev n profit are stable for many years already .. 14/03/2024 5:06 PM sense maker Anyway, my estimation for 2024 is based on zero Other Income, which stood at RM30m for FYE 2023. Hope it grows to EPS10-11sen and I am happy. 14/03/2024 5:11 PM kedsheong people are too near sighted. Real investors look 10-20 years into the future, not the next QUARTER or even next year. What a joke. 14/03/2024 5:22 PM kedsheong you watch the game on the playing field (look at the business), not by looking at the scoreboard (price fluctuations). as long as the business is fundamentally intact, products still needed and wanted by people, company still growing, management is trustworthy, there should be no TP, its "hold" forever. If the price drops, buy more. If not, just let it run. keep in coffee-can portfolio and don't touch it. keep it away from yourself. TP is also a joke. it's only for people who are ready to sell the stock to lock in profit.... only to see it go up up and up.. as the business fundamental/earnings going up in the long term. 14/03/2024 6:05 PM katara ok kedsheong , we keep cck for 'long term' , but TP is in everybody's heart ..at certain time and certain point of valuation . 15/03/2024 8:48 AM kedsheong back to basics, think and act like a business owner. we buy businesses which provide products and services to real people. Don't think of buying stock like buying a piece of paper which has a price that fluctuates up and down by the minutes. cheers guys. 15/03/2024 9:24 AM ooihk899 Great, div of 4.25sen. Divy on the increasing trend, 😁🤑 its a good sign.Grats to all. 18/04/2024 6:50 PM | | ||||||||||||||||||||||||||||||||||||