Is DXN Currently Undervalued With Its Record High Earnings?

Alphabull

Publish date: Tue, 23 Apr 2024, 10:53 PM

DXN Holdings, a global manufacturer of nutraceutical products with specialty in Ganoderma (best-known as Lingzhi), reported the strongest quarter ever since their listing in 2023; where the results were announced in conjunction with a 1.0 cents dividend.

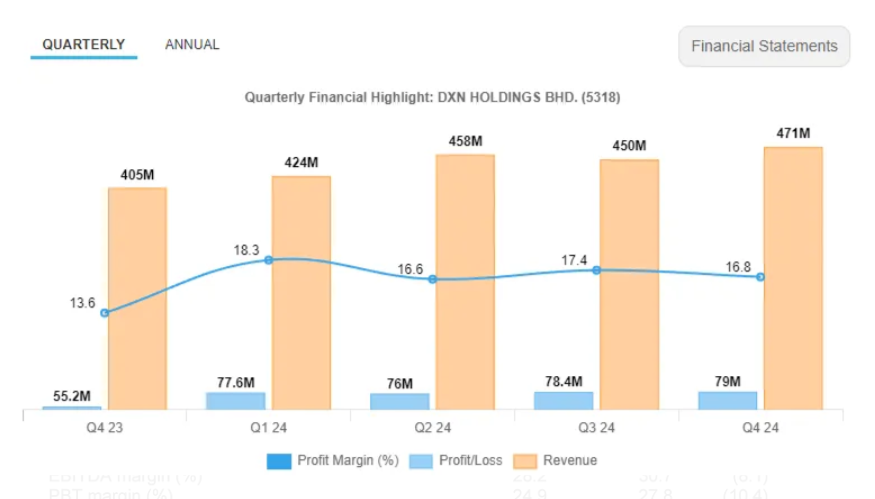

Past 5Q’s Financial Performance of DXN.

With a share price of 62.0 cents, currently DXN is trading at 9.94 times in Price-to-Earnings (PE), and 5.81% in dividend yield.

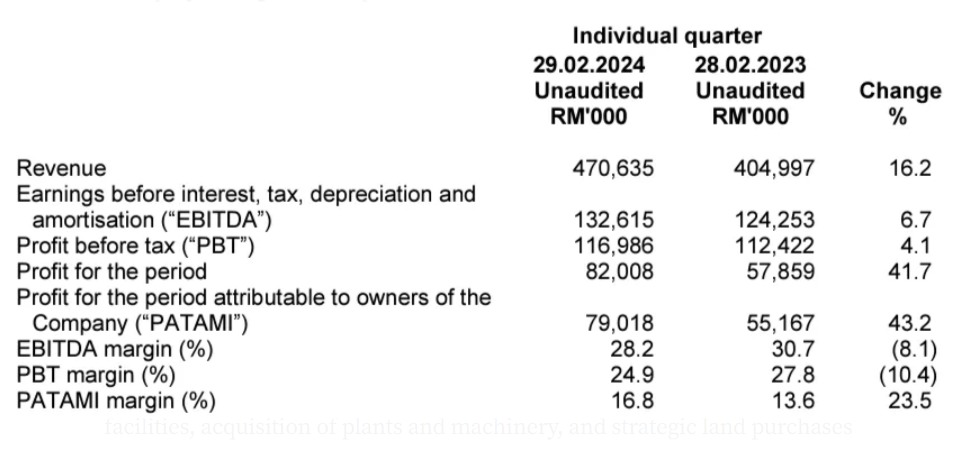

Results wise, DXN registered a strong RM470.6 million in revenue, and PAT of RM79.0 million in the current quarter (FY24Q4). On a full financial year basis (FYE24), the company recorded a revenue of RM1.8 billion and RM311.0 million in PAT.

Excerpt of FY24Q4 YoY Comparison

Zooming into FY24Q4, DXN highlighted that the growth is primarily coming from independent conventions and events organised by members in Latin America (such as Peru, Bolivia, and Mexico), as well as launching of new products which had stimulated the local market developments.

Brazil, with over 217.0 million in total population, is one of the key growth market of DXN too.

For FYE24, DXN had invested a total of RM119.2 million in capital expenditures, which includes the construction of new manufacturing facilities, acquisition of plants and machinery, and strategic land purchases across China, India, Dubai and Peru as part of the plans to boost the company’s manufacturing capacity.

Snapshot of DXN’s share price for past 52 weeks

Since the company’s listing in May 2023, DXN has been delivering fairly consistent results, this however was yet to be appreciated by the market. Given the continuous growth and strong dividend yield of the company, we do believe DXN is now deeply undervalued given the growth potential of the company as well as its strong financial position.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|