JAKS Resources Berhad - Lack of Skin in the Game

warchest

Publish date: Mon, 10 Jul 2023, 08:09 PM

On 6 July 2023, JAKS awarded 70.5 million free shares under the Restricted Share Plan (“RSP”) of JAKS' Long Term Incentive Plan (“LTIP"). This represents a total value of RM12.7 million. This has further increased the issued share to 2.29 billion, with market capitalisation of around RM400 million.

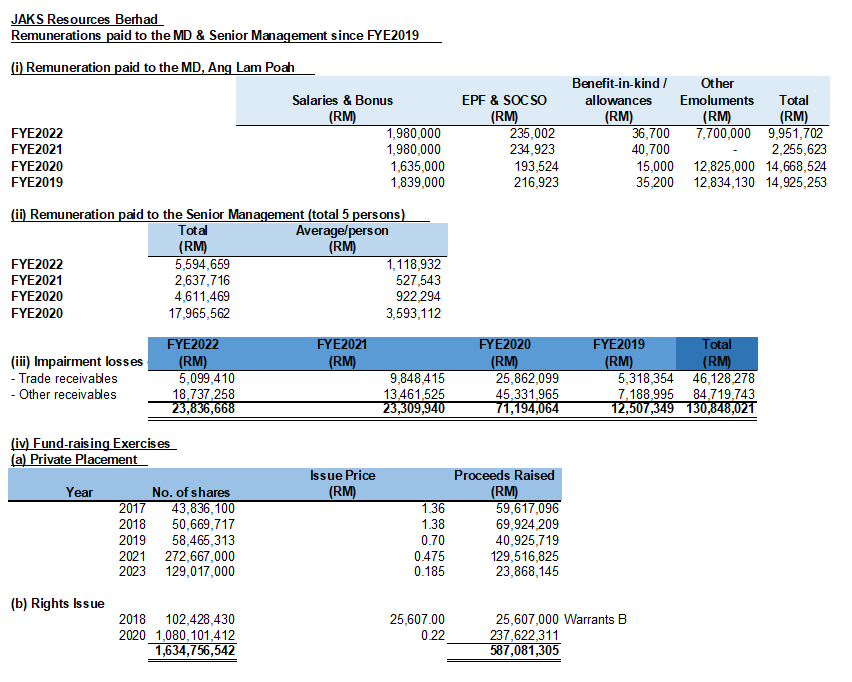

Over the years, we can see the Group keeps participating in loss-making projects (i.e. property investments) and involved in countless of legal tussles. Moreover, it is constantly in need of funds and using equity capital market as a "cash machine" to issue shares via private placement, rights issues and long-term incentive plan, without corresponding growth in its earnings and operating cash flow. The proceeds raised of RM587 million from the shareholders since FYE2017 is much higher than the RM400 million market capitalisation.

Moreover, its share price is at the all time low while its ED is receiving higher remuneration than all the top companies in Bursa https://wargabiz.com.my/2022/02/07/meet-the-10-highest-paid-ceos-in-malaysia-gentings-ceo-tops-the-list/. It is absurd to pay RM10 million & RM5.87 million to the MD & management team of 5 respectively, for such a small Group with erratic earnings, poor cash flow management & written off of RM130.8 million of receivables for the last 4 years.

The "skin in the game" is quintessential to ensure that the directors and the management team work towards value creation, in terms of growth in market capitalisation, share price, operating cash flow & consistent dividend policy. So far, it is a disappointment as the share price now is at an all time low but the remunerations of the directors & management team are at an all time high. Why should shareholders pay exorbitantly on the remunerations and salaries when negative shareholders value was created for the last few years? It should be halted or at least 50% reduction for the non-performance.

The minority shareholders can only pray hard that the directors and management team can finally go back to the basic; to create shareholders' value which is lacking for almost a decade long.

For now, the unhealthy Long Term Incentive Plan needs to be aborted as it is highly detrimental to the shareholders interests. By hook or crook.. it needs to be reversed as the Group is non-performing for many years

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Timeless investment advice

Created by warchest | Jul 26, 2020

Created by warchest | Jul 24, 2020