TDM: Can TDM Become A Healthcare Powerhouse? Unveiling A Hidden Gem (KingKKK) - 103% upside, Intrinsic Value 60 sen

KingKKK

Publish date: Thu, 11 Apr 2024, 04:10 AM

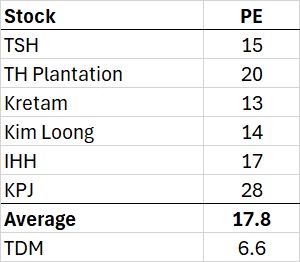

A. How much is TDM worth? 60 sen by using P/E method (103% upside)

TDM's intrinsic value is 60sen.

This is calculated by multiplying 13.6x PE with FY24 EPS of 4.4 sen.

13.6x PE is at a 40% discount to the average healthcare stocks PE in Malaysia.

It is also at a 20% discount to plantation stocks average PE of 17x. Lower PE because of a lower marker cap.

Over time, TDM PE should be higher than this as its earnings become more concentrated in healthcare.

In FY2023, healthcare earnings (PBT) are RM31m compared to plantation RM14m.

Healthcare contributed 69% of 2023 earnings. This is much higher than 2022 healthcare contribution of 22%.

B. Q4 earnings confirmed the turnaround is working

| | Q4-2023 | Q4-2022 | Change |

| Revenue | 170.58 | 158.06 | 7.9% |

| Gross Profit | 76.89 | 53.99 | 42.4% |

| Profit Before Tax | 19.867 | 14.921 | 33.1% |

| Net Profit | 37.674 | -21.566 | Turn profitable |

| EPS | 2.13 | -1.25 | Turn profitable |

| Core EPS | 1.16 | 0.88 | 31.8% |

TDM's Q4-2023 earnings from continuing operations grew 34% against Q4-2022 to RM19.9 million. This is a strong turnaround compared to the 1H loss. The reason behind the strong earnings growth is because of an 8% increase in revenue in Q4-2023. Strong revenue growth by 18% in the healthcare segment more than offset the 2% decline in the plantation segment. Healthcare EBITDA jumped 42% to RM19.2 million as average revenue per inpatient increased 11% to RM10,520 and occupancy rate improved by 7 percentage points to 72%. Plantation segment earnings decline is in line with the industry as CPO price was down 4% to RM3,817 per tonne.

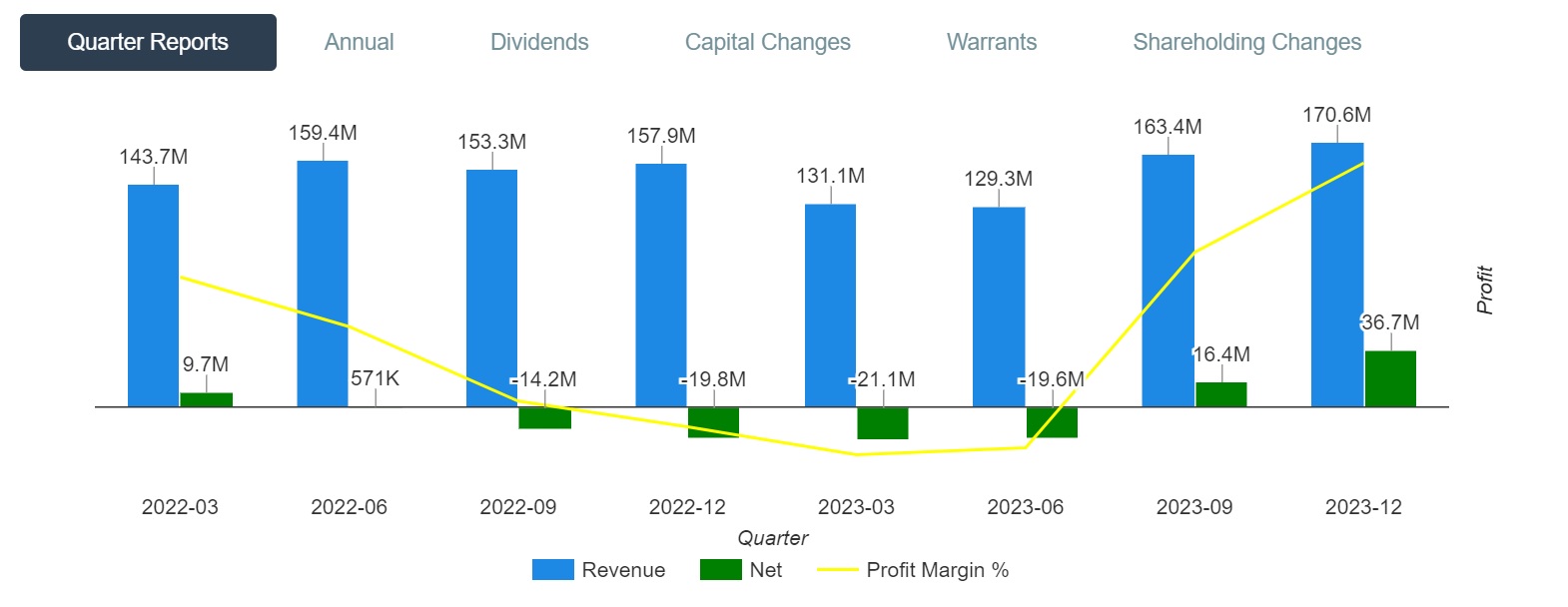

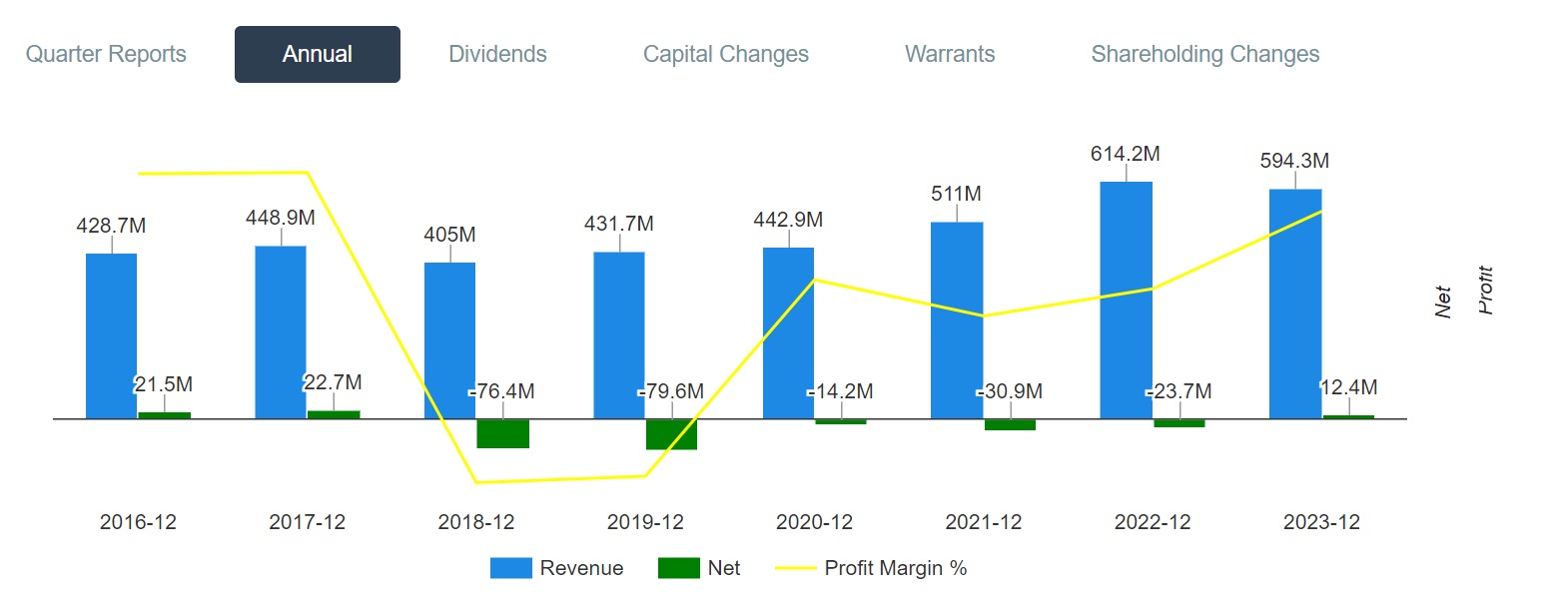

We can see from the Quarterly trend and Annual trend below that the turnaround strategy has worked well and is still progressing with more to come. These are from KLSE screener.

Quarterly revenue and net profit trend

Annual revenue and net profit trend

C. Earnings to improve in Q1-2024

1. Healthcare segment earnings to grow QoQ and YoY due to higher occupancy rate.

2. Plantation segment earnings to improve QoQ but flat YoY in line with CPO price movement. In Q1 2024, average CPO price is RM3982 per tonne (flat YoY) but higher QoQ by 8.6%.

D. Long term prospect is positive

Healthcare segment will benefit from its development of sub-specialty services in respect of existing disciplines and the introduction of

new specialized care areas supported by additional consultants and expansion of brownfield hospital previously acquired.

Plantation segment focus will be in Terengganu going forward. The disposal of PT Rafi Kamajaya Abadi ("PT RKA") and PT Sawit Rezki Abadi ("PT SRA") is ongoing and should finalize by 31-Aug-2024. TDM will focus on Terengganu operation after the completion.

E. Undervalued

TDM is undervalued at 6.6x FY24 PE.

I assume TDM can generate 4.4 sen EPS in 2024.

In Q4 2023, TDM EPS for continuing operation is 1.1 sen.

F. Company Background

TDM Berhad, established in 1965, is a company with a presence in two key sectors:

Oil Palm Plantation: TDM cultivates oil palm across 13 estates and operates palm oil mills. It owns about 25,000 ha of plantation land in Terengganu.

Healthcare: The company owns and operates five community specialist hospitals in Malaysia. These five hospitals are:

1. KMI Kelana Jaya Medical Centre, Petaling Jaya, Selangor

2. KMI Kuantan Medical Centre, Kuantan, Pahang

3. KMI Kuala Terengganu Medical Centre, Kuala Terengganu

4. KMI Taman Desa Medical Centre, Kuala Lumpur

5. KMI Tawau Medical Centre, Tawau, Sabah

TDM Berhad's recent investments in new hospitals signal a strategic focus on expanding its healthcare segment. This dual-pronged business approach offers diversification and potential for growth in both established and emerging markets.

Video of KMI Healthcare as below:

KMI Healthcare - Your modern neighborhood specialist hospitals. (youtube.com)

Video of TDM plantation operation as below:

TDM Plantation Sdn Bhd (youtube.com)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Market Enthusiast

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024

Created by KingKKK | Apr 04, 2024

Created by KingKKK | Mar 31, 2024

Discussions

I let my track record speak for itself. I am ranked no 8 in i3 competition in Q1.

3 weeks ago

speakup

someone stuck at high price desperate enough to come up with this article

3 weeks ago