A sweet deal for Scoop Capital in the Apollo Food buy

zaclim

Publish date: Thu, 21 Dec 2023, 09:45 AM

Shares in Apollo Food Holdings Bhd skyrocketed to a seven-year high of RM5.78 on Dec 19 following news that Scoop Capital Sdn Bhd, is acquiring a controlling stake in the company. It was indeed a sweet treat to investors who bought shares in Apollo Food when it was trading at a 52-week low of RM3.61.

The counter has surged 59.1% in the past year. At RM5.76, its market capitalisation stood at RM460.8 million.

On Dec 18, Scoop Capital, which is the franchisee of Baskin-Robbins, said it is buying a controlling 51.31% stake in Apollo for RM238.1 million cash. Scoop Capital is purchasing the 41.05 million Apollo shares from Keynote Capital Sdn Bhd at RM5.80 each, translating to a 7.4% premium to the last closing price of RM5.40.

Keynote Capital is the investment vehicle of Singaporeans Liang Chiang Heng and his younger brother Liang Kim Poh. Chiang Heng, 73, is currently Apollo’s executive chairman, while Kim Poh, 62, is the group's managing director.

Scoop Capital is obliged to extend an unconditional mandatory takeover offer to acquire all the remaining 48.49% stake in the group, but it intends to maintain the listing status of Apollo on the Main Market of Bursa Malaysia. Scoop Capital is 90%-owned by Datuk Cheah See Yeong, with the remaining 10% owned by his wife Datin Soon Gock Lan.

This is a nice ‘scoop’ for Cheah as Apollo is viewed as undervalued given that it has no borrowing and sits on more than RM130 million cash and deposits while paying decent dividends annually. Apollo makes compound chocolates, chocolate confectionery products and layer cakes under its own “Apollo” brand for both the local and overseas markets.

This deal is indeed a sweet one for Scoop Capital which will be able to boost Apollo’s revenue and net profit. As it is, Apollo has fared pretty well in terms of financial results.

Its net profit rose 5.15% to RM10 million for the 2Q ended Oct 31, 2023 from RM9.5 million a year earlier despite registering a 6.13% drop in revenue to RM66 million from RM70 million. The company saw lower export sales but investors should be relieved that it managed to record higher gross profit margin.

For the six months just ended, its net profit rose 25.4% to RM17.6 million from RM14 million a year ago while revenue fell marginally to RM124.3 million from RM125.8 million.

A change in ownership may be just what Apollo needs given that Chiang Heng and his brother might want to ‘retire’ comfortably after being with Apollo since 1979. Certainly, it is too early to tell if Cheah can do a better job in taking Apollo to the next level but investors are hopeful he can inject something exciting into the company.

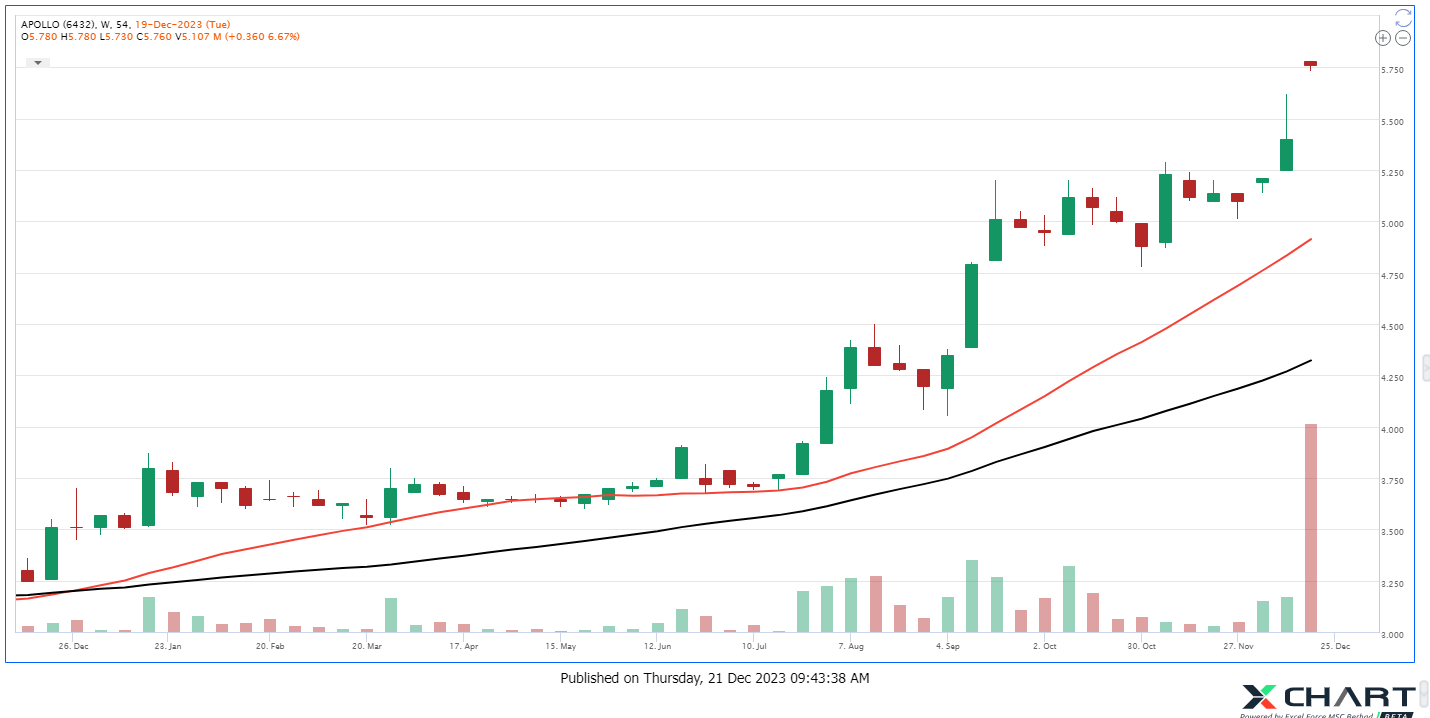

Based on Weekly Chart:

1. Apollo is riding in the strong uptrend with several pullback

2. However price currently is far from 20MA and climatic volume appeared at the top

3. This might indicates another round of pullback or sideway is likely to happen soon

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | May 09, 2024

Econpile Holdings Bhd has been on investors’ radar as the counter leapt 131% in over a year. What is drawing investors to this loss making company?

Created by zaclim | May 08, 2024

SCGBHD is cruising ahead, hitting a year high of 60 sen recently. The company is poised to benefit from rising power infrastructure spending to cater for an expected rise in electricity consumption

Created by zaclim | May 07, 2024

SEALINK’s stock price has been consolidating within a symmetrical triangle for almost the past 7 months above SMA200 line

Created by zaclim | May 07, 2024

Naim Holdings Bhd has been lagging in share price versus its subsidies Dayang Enterprise Holdings Bhd and Perdana Petroleum Bhd. Has the time come for Naim to break new highs?

Created by zaclim | May 06, 2024

AEMULUS’s stock price rebounded from SMA200 line with higher low at RM0.320 two weeks ago and stayed at the initial stage of markup phase

Created by zaclim | May 06, 2024

Aurelius Technologies Bhd has grown in the past year in terms of share price performance. Will the recent demand pullback derails its good run?

Created by zaclim | May 03, 2024

TAS Offshore Bhd rose some 239% to close at 74 sen on May 2. News of booming opportunities helped spur the counter to register new highs. How high can it go?

Created by zaclim | May 02, 2024

Oppstar Bhd touched an intraday high of RM1.55 on Apr 30 following news of tie up with Samsung Electronics. With more jobs coming its way, there are ample room for the counter to trend higher.

Created by zaclim | Apr 30, 2024

CENSOF’s stock price rebounded from last week higher low at RM0.265 with increasing volume. The stock price is riding above all EMA lines which are arranged in uptrend order.

Created by zaclim | Apr 30, 2024

Ranhill Utilities Bhd was a let-down after announcing its FY23 results about two months ago. What is driving its share price higher?