Uchi hooks investors with strong brew of consistent growth

zaclim

Publish date: Wed, 03 Jan 2024, 11:09 AM

Uchi Technologies Bhd is one of the rare companies which has seen its EBITDA margins going up for the past 10 years or so. Its EBITDA margin was 46% in 2013 and recorded a high of 59% in 2022.

The counter has also been on a rise, up 13.8% year-to-date to close at RM3.71 on Dec 29. It touched a 52-week high of RM3.78 recently versus a low of RM3.14 in January.

Investors are probably happy that the counter has not only appreciated but received good dividend yield of 6.3%, which is expected to increase to 7.6% in the next two years. These positive returns are possible as the company saw good revenue growth fuelled by multiple reasons.

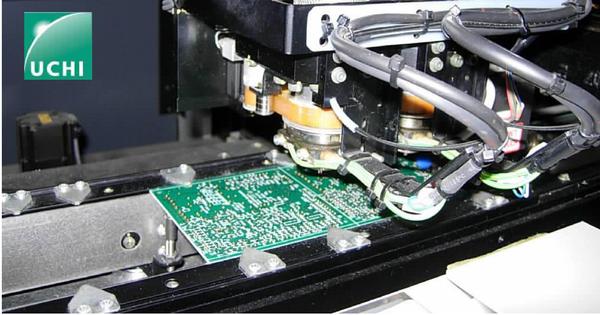

Uchi holds the advantage being a supplier of its coffee module product to its key customer and the strong alliance created has helped build a partnership that allows both parties to grow.

The Penang-based company constantly invests in research & development to improve its design. It is also able to increase its efficiencies having achieved economies of scale via using more common parts.

The margin enhancement is also driven by favourable product mix changes especially with higher end models which see most of the enhancement in product features. The above are mostly within its control - enhance efficiencies through improved processes while better margins via cost efficiencies and product mix. The uncontrollable factor would be the currency movements, which have worked in Uchi’s favour.

It is to be noted that the weakening of the ringgit against the US dollar has resulted in its USD-denominated sales rising by 63%. As long as there is no share appreciation of the ringgit, Uchi margins are expected to stay intact.

Not only that, the company enjoys tax exemption for new products and this will incentivise Uchi to step up the production of new models in order to enjoy its pioneer tax status. It is estimated that only 14% of its products are qualified for tax exemption. It would therefore make sense for Uchi to gradually increase the introduction of new products as older ones reach end of life.

Overall, management maintains its 2023 revenue growth guidance of high single digits in USD terms, implying a relatively firm 4Q23.

Affin Hwang research believes the fully automated coffee machine market is underpenetrated, while its major European customer continues to gain traction in the high end segment. Therefore, investors can clearly see what’s in store for Uchi, which will continue to drive higher market share and growth.

Here are some of the setup based on Weekly Chart:

1. Price moving in uptrend with several healthy pullback

2. Breakout resistance with higher volume. Potential retest to support again

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | May 31, 2024

Tek Seng Holdings Bhd has been gaining traction although it has not moved much in the past year. What is driving the positive momentum?

Created by zaclim | May 30, 2024

It has been tough for InNature Bhd, having seen declining sales and margins. But the counter appears to be looking positive with an upward bias expected.

Created by zaclim | May 29, 2024

Parkson Holdings Bhd has been trending higher to close at a 3-month high recently. Does this signal better days for the department store operator?

Created by zaclim | May 27, 2024

Glomac Bhd has touched a multi-year high of 44 sen recently. It is likely to trend higher given its huge growth potential.

Created by zaclim | May 27, 2024

Evergreen Max Cash Capital Bhd has garnered much trading interest in the past month hitting a high to close at 48 sen recently. Can it surpass its high of 56 sen soon?

Created by zaclim | May 24, 2024

Aemulus Holdings Bhd posted its 6th losses in 2Q results recently. However, it is garnering investors attention as semiconductor industry takes a positive spin.

Created by zaclim | May 23, 2024

ahvest Resources Bhd has been going on a good run, hitting a new high of 62 sen recently. Sustainably higher gold prices should drive investors to this counter.

Created by zaclim | May 21, 2024

Perdana Petroleum is poised for further upside after touching its new high recently. It is a key beneficiary of an increase in upstream maintenance activities, drawing in plenty of trading activities.

Created by zaclim | May 20, 2024

MGB Bhd has been on the uptrend as it picks up contracts to ensure growth is sustainable. Its undemanding valuations should draw investors in.

Created by zaclim | May 17, 2024

Cengild is on a downtrend since its listing in 2022 although it managed to touch a high of 46 sen in August 2023. But there seems to be more excitement for the counter as it rises from the oblivion.