Stock Analysis – PEKAT (0233) – RM0.520:

zaclim

Publish date: Tue, 23 Apr 2024, 09:19 AM

PEKAT’s stock price has gone through past 8 months of pullback consolidation stage along the sideway SMA200 line and the latest additional 1 month of gradual rebound and finally today the candlestick manages to breakout and stay above previous high above RM0.510 and close at RM0.520.

The stock price finally manages to stay above all short and medium terms’ EMA lines which riding above rising SMA200 line. This indicates that the stock price is finally taking off from its initial stage of markup phase;

If the stock price could stay above RM0.510 for higher high with trending momentum and increasing volume, then let’s monitor for the next possible short-term targets around RM0.550, 0.580, 0.600, 0.620, 0.650, 0.680, and 0.700.

Long term investors may prospect for possible long-term targets to challenge around RM0.720, 0.745, 0.775, 0.800, 0.820, 0.850, 0.880, 0.900, 0.920, 0.950, 0.980, and 1.00;

Should the new higher high beyond RM0.510 be successful, trailing stop with EMA20 or EMA30 line, or if the stock price were to pullback unexpectedly, put the short-term stop loss below RM0.480 or worst case below RM0.460;

The secondary indicators like MACD, DMI and RSI are at good junctures that may biased to lead the stock price for further upside and take off from its initial stage of markup phase;

“XChart’s Trade Signal” has been triggering 4 real times today afternoon as shown above indicating the stock on “CB06: Uptrend Intact and MD01: MACD (>0) crossing up signal line”;

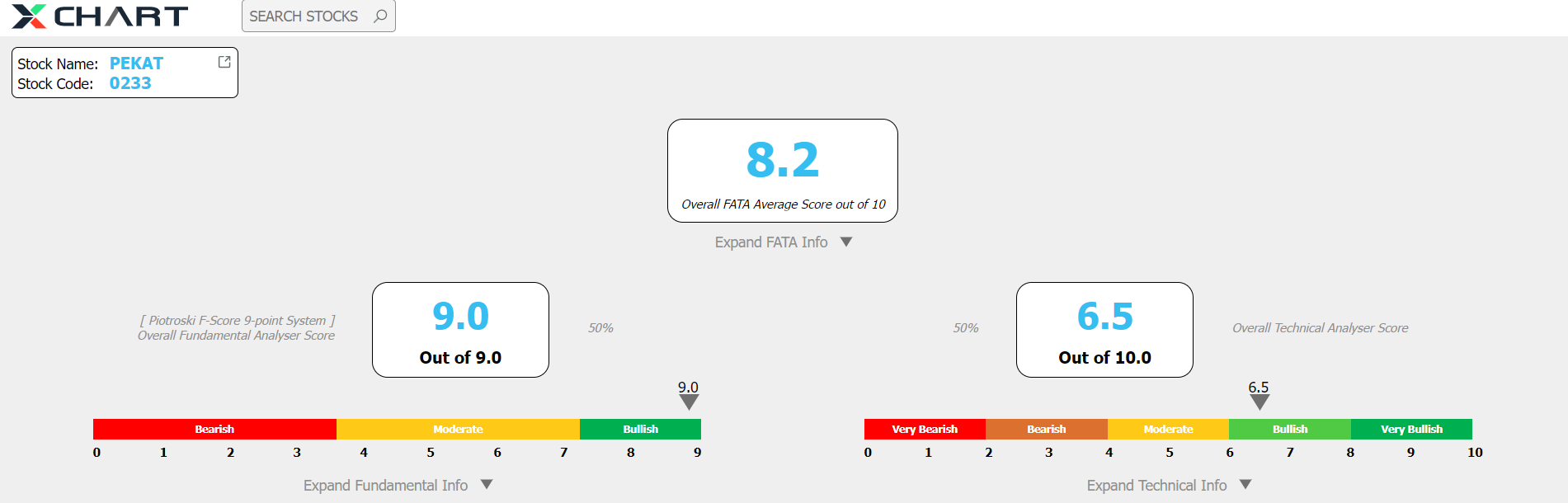

“XChart’s Stock Analyser” as shown above is fundamentally PFS9=9 indicates FA is extremely good, and technically TAS20>55% indicates that the stock price may biased for further upside after taking off the initial stage of its markup phase;

Fundamental:

PEKAT GROUP BERHAD (PEKAT, 0233) is listed under ACE market’s Industrial Products & Services Sector.

Principal Products / Services:

Solar Photovoltaic (PV) systems and power plants, Earthing and Lightning Protection systems, Electrical products and accessories.

Financial ratios:

TTM Q4-Dec-2023: DY%=1.92%, EPSG=9.28%, PER=24.53, ROE=10.02%, NGR=NetCash, DER-ST=0.01, TLER=0.30;

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | May 09, 2024

Econpile Holdings Bhd has been on investors’ radar as the counter leapt 131% in over a year. What is drawing investors to this loss making company?

Created by zaclim | May 08, 2024

SCGBHD is cruising ahead, hitting a year high of 60 sen recently. The company is poised to benefit from rising power infrastructure spending to cater for an expected rise in electricity consumption

Created by zaclim | May 07, 2024

SEALINK’s stock price has been consolidating within a symmetrical triangle for almost the past 7 months above SMA200 line

Created by zaclim | May 07, 2024

Naim Holdings Bhd has been lagging in share price versus its subsidies Dayang Enterprise Holdings Bhd and Perdana Petroleum Bhd. Has the time come for Naim to break new highs?

Created by zaclim | May 06, 2024

AEMULUS’s stock price rebounded from SMA200 line with higher low at RM0.320 two weeks ago and stayed at the initial stage of markup phase

Created by zaclim | May 06, 2024

Aurelius Technologies Bhd has grown in the past year in terms of share price performance. Will the recent demand pullback derails its good run?

Created by zaclim | May 03, 2024

TAS Offshore Bhd rose some 239% to close at 74 sen on May 2. News of booming opportunities helped spur the counter to register new highs. How high can it go?

Created by zaclim | May 02, 2024

Oppstar Bhd touched an intraday high of RM1.55 on Apr 30 following news of tie up with Samsung Electronics. With more jobs coming its way, there are ample room for the counter to trend higher.

Created by zaclim | Apr 30, 2024

CENSOF’s stock price rebounded from last week higher low at RM0.265 with increasing volume. The stock price is riding above all EMA lines which are arranged in uptrend order.

Created by zaclim | Apr 30, 2024

Ranhill Utilities Bhd was a let-down after announcing its FY23 results about two months ago. What is driving its share price higher?