Daily technical highlights – (JHM, PTRANS)

kiasutrader

Publish date: Wed, 10 May 2023, 11:04 AM

JHM Consolidation Bhd (Technical Buy)

• JHM’s share price – which has been treading sideways since early February this year – is presently hovering at the bottom range of the rectangle pattern, suggesting that a bounce-up may be in the offing.

• Backed by positive technical signals arising from the stochastic indicator’s reversal from an oversold position and the appearance of bullish dragonfly doji candlesticks, the shares could stage an upward shift ahead.

• On the way up, the stock will probably challenge our initial resistance target of RM0.85 (R1), a break of which may then lift the price towards our next resistance hurdle of RM0.95 (R2). This represents upside potentials of 13% and 26%, respectively.

• Our stop loss price level is set at RM0.67 (or a downside risk of 11% from yesterday’s closing price of RM0.755).

• JHM’s business is segregated into 2 key segments: (a) electronics business unit, which is involved in the manufacture and assembly of surface mount technology of automotive rear, interior and front headlamp lighting (for the automotive industry) and motor controller (for the industrial sector), and (b) mechanical business unit, which provides one-stop solutions from fabrication of tooling, design to final assembly and test of LED lighting modules/applications, microelectronic components as well as precision mechanical parts.

• The group reported net profit of RM2.2m (-83% YoY) in 4QFY22, taking its full-year bottomline to RM22.6m (-34% YoY).

• Based on consensus expectations, JHM is forecasted to show a jump in net earnings to RM35.4m in FY December 2023 and RM45.0m in FY December 2024.

• This translates to forward PERs of 12.9x this year and 10.2x next year, respectively with its 1-year rolling forward PER currently standing marginally below the minus 1SD level from its historical mean.

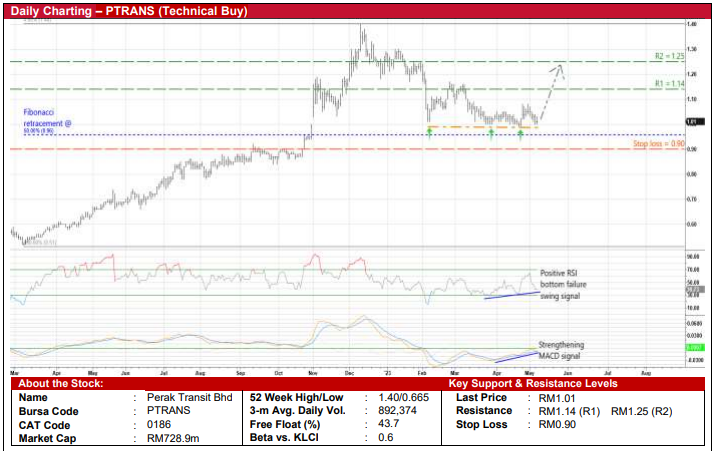

Perak Transit Bhd (Technical Buy)

• A resumption of the ascending price pattern for PTRANS shares is probable following its bounce-up from an intermediate support level of RM0.99.

• With its downside likely to be cushioned by the 50% Fibonacci retracement line (at RM0.96, as measured from a trough of RM0.51 in early March last year to a peak of RM1.40 in December 2022), an upward trajectory may ensue in view of the existence of a bottom failure swing in RSI (as the indicator has plotted higher lows recently) and the strengthening MACD signal.

• On the chart, the stock could advance towards our resistance thresholds of RM1.14 (R1; 13% upside potential) and RM1.25 (R2; 24% upside potential).

• We have placed our stop loss price level at RM0.90 (representing a downside risk of 11%).

• Fundamentally speaking, PTRANS is involved in: (i) the operations of integrated public transportation terminals, (ii) the provision of public bus services, (iii) petrol station operations, and (iv) the construction of telecommunication towers.

• After registering net profit of RM15.8m (+25% YoY) in 4QFY22, the group saw its full-year performance increasing 13% YoY to RM60.0m.

• Moving forward, consensus is projecting PTRANS to log rising net earnings of RM68.1m in FY December 2023 and RM76.0m in FY December 2024.

• In terms of valuations, the stock is presently trading at forward PERs of 10.7x this year and 9.6x next year, respectively with its 1-year rolling forward PER now hovering slightly below the +1SD threshold from its historical mean.

Source: Kenanga Research - 10 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | May 16, 2024

Created by kiasutrader | May 15, 2024