Kenanga Research & Investment

Actionable Technical Highlights – (UZMA)

kiasutrader

Publish date: Wed, 11 Oct 2023, 09:40 AM

UZMA BERHAD (Technical Buy)

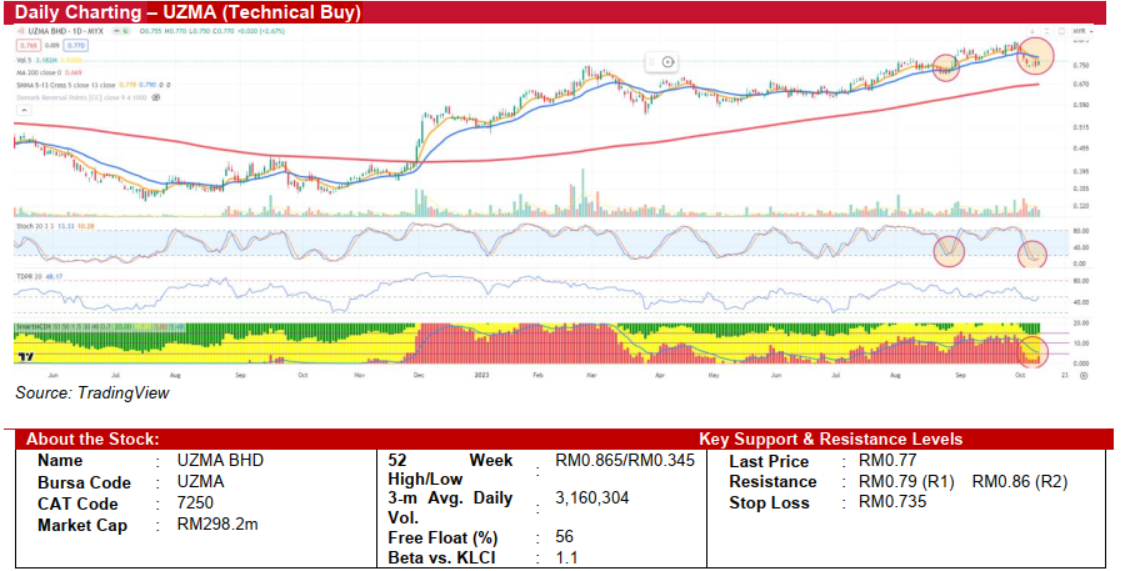

- After reaching a recent peak of RM0.865 in late September, UZMA has undergone a constructive retracement and is currently stabilizing within the RM0.74-RM0.77 range. The emergence of a “bullish harami” candlestick pattern in the most recent trading session indicates a potential shift in direction.

- On the technical front, the stochastic oscillator is currently in oversold territory. However, the fast-moving %K line has begun to display early indications of an upward trajectory, crossing above the %D line, signalling a possible trend reversal. Furthermore, the Tom DeMark Pressure Ratio (TDRP) has ascended to the 50-level threshold, suggesting renewed buying interest may be on the horizon.

- A definitive breach above the immediate resistance level of RM0.79 could pave the way for the stock to revisit its recent high of RM0.865. On the flip side, a decline below the recent low of RM0.74 would initiate a new downtrend, with immediate support established at RM0.67, which aligns with its 200-day SMA.

- Our recommendation is to initiate a position in the stock at RM0.77, with a partial profit-taking strategy at RM0.79, followed by RM0.86. This approach offers an estimated upside potential of approximately 7.1%. We also advocate setting a stop-loss at RM0.735, which corresponds to a downside risk of 4.5%.

Source: Kenanga Research - 11 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Malaysian Pacific Industries - Recovery Prospects Brighten Further

Created by kiasutrader | May 17, 2024

Malaysia Airports Holdings - A Privatisation Offer at RM11/share

Created by kiasutrader | May 16, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments