This Company is Buying More Renewable Assets?

Lenalu

Publish date: Wed, 28 Feb 2024, 07:46 PM

Fresh news from today, Kinergy Advancement, or better known as “KAB”, a sustainable energy player, is purchasing shares of a mini-hydropower project from a subsidiary of Vizione, another listed entity on Bursa Malaysia.

Based on the announcement, this acquisition is almost “free” to a certain extent, as the total consideration is only RM200, which is a steep bargain for KAB.

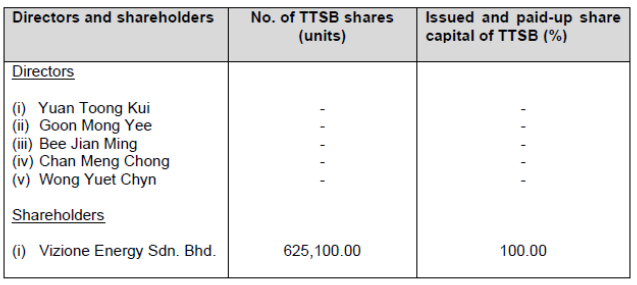

If we look deeper into the announcement, the acquired target is Tunjung Tenaga S/B, or “TTSB” in short, where TTSB in turn own 80% shares in a joint venture company, SDF Hydro S/B, of which the remaining 20% shares belong to Menteri Besar Incorporated of Kedah.

When MBI Kedah is involved, basically this would mean the asset itself should be very attractive.

However, as TTSB and SDF Hydro do not effectively run the mini-hydropower plant yet, it would be more accurate to say that this is the purchase of rights as well as various licences for the plant.

As a matter of fact, this mini-hydropower plant is expected to yield 9.6MW upon completion, which is quite significant for KAB, as this would further enhance the asset portfolio of the company, especially for hydropower assets, where the company currently owns a 11MW mini-hydropower plant in Indonesia.

This project is actually located in Pedu Dam, Kedah, and from the announcement and press release by the company, this project is expected to start by April 30, 2027, which means there is approximately 3 years construction period from now on.

Normally, any mini-hydropower plant would take longer than that.

If we were to study the area, Pedu Dam, Kedah already has facilities to ease the construction of the project, and as for the licences, SDF Hydro already procured it. So in short, KAB, with their prior experience in a wide array of renewable energy assets, is pretty much set to benefit greatly from the acquisition.

In conclusion, KAB is indeed building their recurring stream of income over time, and funds are seemingly buying into this company. Perhaps, this is a sign to look into KAB now?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|