MASTEEL, STEELING YOUR WAY TO 100% PROFIT

100percentprofits

Publish date: Sat, 24 Sep 2016, 10:58 PM

In the last 2 weeks, the steel industry stocks has been climbing very aggressively. There has been plenty of articles on specific steel players. However, what I’ve noticed is that a majority of the articles tend to focus on the steel sheet players.

Therefore, for the purpose of this article, I want to both educate and learn from the i3 community regarding the steel industry. Therefore, if I do make any mistakes in this article, please feel free to correct me because I am merely a novice investor who is trying to learn. This article will give a wide angle on the steel industry and then focus on rebar players, specifically MASteel which had rallied by 9% last Friday to a closing price of RM0.895.

First off, please prepare your brains if you’re not familiar with the steel industry because I’m giving you a lot of information.

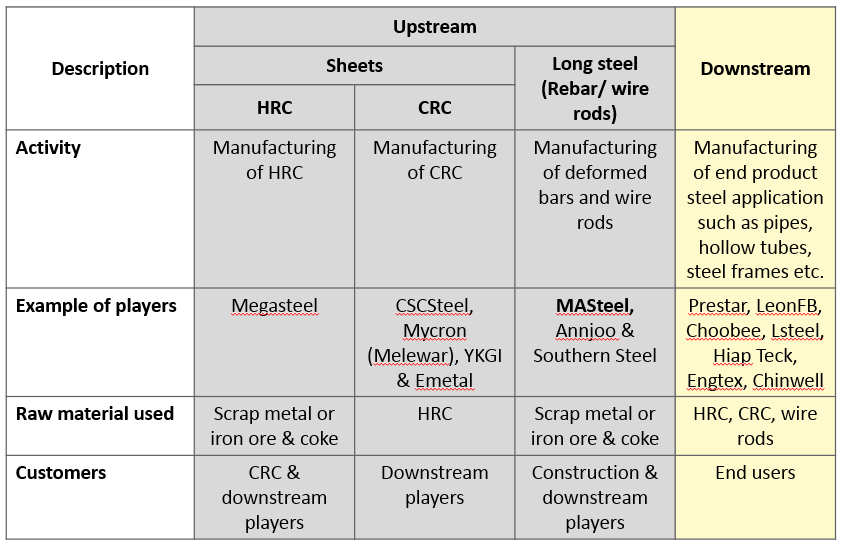

Please digest this table properly because this will set the overall context of steel players in the industry. First of all, there are the upstream and downstream players. I am going to ignore the true upstream of iron ore mining and coke manufacturing because it is not prominent in Malaysia.

Therefore, broadly, the upstream players are divided into the sheets and the long steels. Sheets are basically flat steel as per the picture below which are usually sold in coil form. There are two kinds of sheets the HRC (hot roll coil) and the CRC (cold roll coil). It’s not that the HRC is hot when you touch it, but rather it was produced under high temperature. CRC uses HRC as a raw material to make the steel coils stronger/ thinner under non heated environment.

Recently, with the closure of Megasteel, the CRC steel players have been rallying because previously Megasteel was charging a higher price for HRC used to manufacture CRC compared to HRC imported from China. Quick note, while many sources state that Megasteel is a monopoly on production, there are other players such as SSteel & Eastern Steel (JV of Hiap Teck) which have license for production but are not producing HRC (from my research).

I am not going to write anymore about CRC because there are many articles on it already. We all know that these players have a good potential to realize higher profits in the future.

http://klse.i3investor.com/blogs/koonyewyinblog/104931.jsp

http://klse.i3investor.com/blogs/undervalue/103112.jsp

http://klse.i3investor.com/blogs/wealth123/103812.jsp

Skipping ahead to the downstream players, these are basically users of HRC, CRC, wire rods and rebars which cut or mold the steel to manufacture end products. For example, Prestar is in the business of slitting HRC and CRC into more narrow sheets, manufacturing hollow tubes, highway rails and steel racks. Basically the end or close to end product.

Touching slightly on whether Megasteel closing has an impact on downstream producers such as Prestar or recently popular ChooBee is an interesting question.

http://klse.i3investor.com/blogs/Insight1/104546.jsp

I was reading the article above which mentioned that ChooBee uses scrap based HRC to manufacture their products. Therefore with Megasteel out of the picture, ChooBee should benefit from lower raw material prices (imported HRC from China). I do not know the extent of application of HRC by ChooBee of Prestar, however if there are some applications of HRC, then they will benefit from lower raw material prices.

Finally, let’s talk about wire rods and rebars. These are known as the long steel products. Wire rods are typically used to manufacture bolts, nuts, nails, screws, wire ropes, bearing steel and vehicle tires. Rebars are used mainly in construction for structural integrity.

Source: http://www.steel-n.com/esales/general/us/catalog/wire_rod/use.html

The main players in this segment are MASteel, AnnJoo & SSteel. These players exclusively do not benefit from Megasteel’s closure because they do not use steel sheet products in their manufacturing.

http://klse.i3investor.com/blogs/koonyewyinblog/104931.jsp

This author is quite on point with his argument on the rebar and wire rod players. However, he has pointed out a few good arguments which I wish to borrow:

-

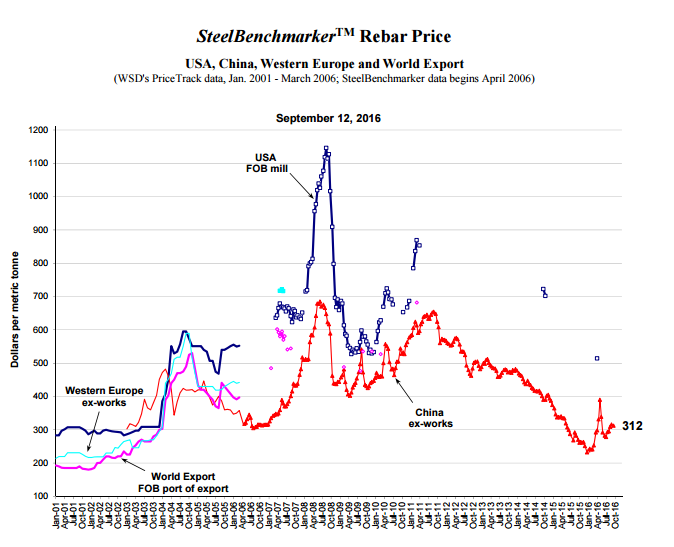

Steel prices have been recovering since the beginning of 2016 and have gone up more than 40%

- In June 2016 the Edge reported that rebar players have lodged a complaint to MITI on steel dumping by China and are currently awaiting result pending investigation. If successful, they will be protected by the government imposing a safeguard tax on imported steel bars.

Point number 1 is very important, however it applies not just to rebar players but to all steel players.

Source: http://steelbenchmarker.com/files/history.pdf

From 2011 to early 2016, Chinese rebar has been dropping from the high of USD660/MT to the low of 250/MT (we are using China because they produce more steel than the rest of the world combined). That is a whopping 62% drop. In the meantime, all steel players have been suffering with high inventory write downs and continuous lower average selling price. It’s no surprise that many steel players were in the red in 2015. However, in 2016, there is a change in wind where steel prices have staged a rebound. The current steel price of USD312/MT is not even half of the peak in 2011.

This is why although Megasteel closure does not affect rebar players, they have also rallied with strong Q earnings.

Going back to point #2, this is something that happened very recently – the MITI application for import duties for rebar & wire rods from Chinese dumping. Now read carefully. Just on Friday, at 3PM, our Malaysian government applied a safeguard duty rate of 13.42% for rebars and 13.9% for wire rods and deformed bar in coils.

Now we know why MAsteel, SSteel & Annjoo were flying on Friday afternoon.

So the next logical question is whether this import duty will have a financial impact on the rebar & wire rod players and the answer is a resounding YES. Imagine, if our local players had to previously compete with the Chinese exporters, and had to lower their prices to match them, now they can afford to increase their prices by a 13.42%. Or at least 10% - while being able to give a discount.

While 10% may not seem like a whole lot, we must remember that the steel players are all suffering from terribly low or sometimes even negative margins.

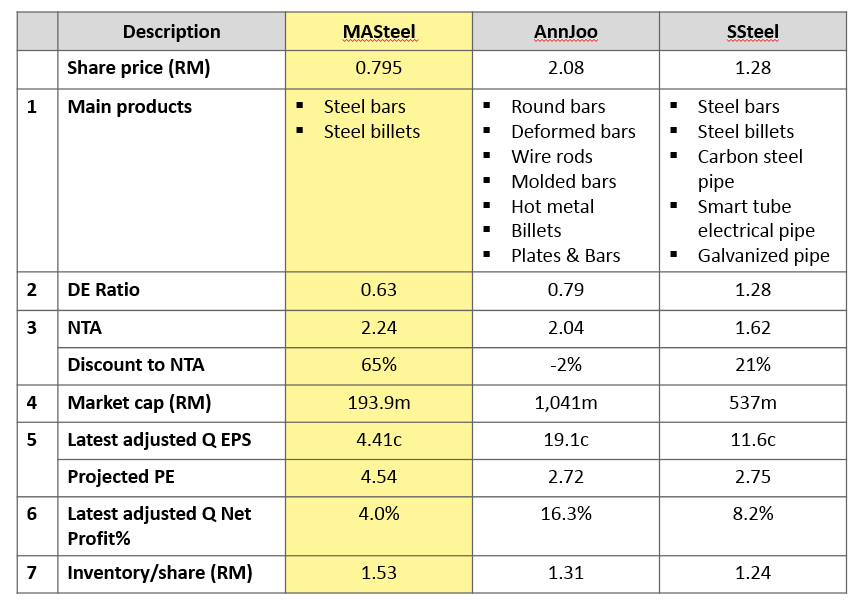

Now we should compare the 3 main steel rebar players:

-

First of all notice that MASteel is the most specialized that they only produce steel bars and billets unlike AnnJoo & SSteel which produces other downstream end products as well. This means that MASteel will benefit the most from the protection duty.

-

MASteel has the best DE ratio among the 3 despite the fact that they recently completed their expansion adding another 150,000MT production from previously 450,000MT or a 33% increase.

-

MAsteel has the deepest discount to NTA of 65% even comparing to all other steel players

-

MAsteel has the lowest market cap

-

For adjusted EPS, I used the latest Q less any inventory write off or asset impairment given the assumption that steel prices are stabilizing/ recovering. Therefore based on the latest Q, using a lazy simplistic method of multiplying the latest Q by 4, MASteel has the highest PE of 4.5 compared to 2.7 for the other two.

This is mainly because MASteel has the lowest net profit margin currently. I believe that this is due to the excessive dumping of steel from China, and therefore since they are specialized in steel rods and billets, they are the most impacted compared to SSteel and AnnJoo. However in the coming quarters, with the safeguard tax, MASteel’s margin will improve significantly.

-

This brings us to the Net profit %. In addition to my previous explanation of low profits, MASteel also recently expanded their capacity, which usually impacts profitability before reaching a normalized utilization. This part is important because assuming that the safeguard tax increases each player’s NP by 10% (not 13.42%), MASteel will stand to increase profit by 250% while AnnJoo and SSteel will increase 64% and 121% respectively. There is a saying – when an industry turns around, the players with the worst profit margins will benefit the most because the improvement in margin is exponential.

- Finally, of the 3, MASteel has the highest inventory/share. While usually high inventory is a bad thing because it denotes poor use of capital, when steel prices are rising, this is a good thing because it has a higher stockpile of cheap inventory that will be sold at a higher price. In MASteel’s 2015 Annual Report, roughly 90% of inventory are raw material – which means that the high inventory is not due to its inability to sell to customers but due to MASteel stocking up in 2015 when raw materials were at its cheapest (MASteel doubled its inventory from 2014 to 2015)

So what’s the valuation? Really, it depends on the market. If you want to use PE, you need forward earnings. Historical earnings aren’t going to help you. However, as a start, I think it is safe to assume that MASteel’s profit will at least double from the import duties and the sustained steel prices.

Therefore, a full year EPS of 28.8 (4.4c * 4Q * 2) shouldn’t be too surprising. Assigning a PE of 5 would yield a TP of RM1.76, close to double the current price.

Finally, if you haven’t seen a cup and handle, this is a perfect one. In technical trading, what usually follows is "The Sky is the Limit."

Conclusion

While I think that all steel players are poised to benefit from the recent increase in steel prices, we have to be strategic in picking the counter which we want our money to grow in.

Therefore, in my opinion, due to the recent safeguard duty imposed by the government, rebar players have the highest potential – similar to how sheet players benefited the most from the closure of Megasteel.

I understand that many retail investors are afraid of heights, looking at how high steel players have come from 1 month ago, however I must encourage you that there is still a lot of room. This is because:

-

Steel players at their low were clearly trading as if they were going bankrupt. MASteel was at a low of 40c with an NTA of RM2.2. People are only now starting to invest as if these steel companies can survive and generate profit.

-

Newspapers & investment banks have not started to cover steel stocks extensively. Have you noticed that coverage usually starts very late? This weekend’s edge only started covering Mycron – one of the CRC players.

-

The cash flow and profitability haven’t even started to show – the potential is extremely big. Don’t think about where the stock is today. Think about where it will be tomorrow (or next year)

Finally, these are my own thoughts. I may be well wrong on many points of argument, therefore I would implore that you kindly comment below where I have gone wrong and refrain from attacking me.

Thank you.

Appendix

I realized that the steelorbit webiste makes it difficult to view the import duty news, therefore I am copying it into the appendix.

Please excuse the small words. You may right click and open in a new tab for better clarity.

There was a very insighful commentor below, so I thought it would be good to address his questions systematically in the appendix.

Hi MonkeyBusiness, first of all thank you for contributing so many counter arguments! It’s only by challenging each other that we can continue to grow! Also, thank you for pointing out so many sources which we are all benefiting from.

I will try to answer all of your points systematically, however I do foresee that there will be many points which we will differ on, and I think that is alright. I don’t control your money and you can choose to do as you please with it :)

1. You were showing the prices of steel which was high in early 2015, fell to the low in late 2015/early 2016 and then spiked in May 2016 and then has softened again today.

I’m not sure what you’re trying to point out here – you didn’t mention. Hopefully you can elaborate

2. You are not wrong that Q1 would be a loss without the forex gain. The Q report states that the commissioning of the 200K MT roll mill is progress well suggesting that it started in Q1 2016. Usually new commissioned plants will impact the profitability of the company. I try to look into the future for stronger profits instead of picking on the past.

3. “Malaysia experienced shortage of rebar in April & May, causing the price rocketed to sky level, but the revenue of Masteel for quarter (1/4/2016-30/6/2016) was RM268m, slightly higher than last year's same period RM242m.”

Revenue was weak for sure. I may be wrong here – I understand that steel mills usually have 3 month contracts with their customers and don’t charge spot rate for each batch – otherwise planning would be chaotic. Therefore, and I may be wrong here – if I am right, the next Q should show the strong earnings.

4. “Did the profit in that quarter helped by clearance of stocks at much higher prices because of cancellation of supplies from China? Rebar price has since then gone down.”

I’m going to assume that “that” quarter means Q2 2016. Part of the earnings did come from stronger average price. However as I mentioned earlier, I don’t know the industry well enough to know whether they charged spot prices and whether they were able to meet demand at a moment’s notice when China was not able to supply the rebar.

If you track global steel prices, you will notice that steel prices dipped in June 2016 and rebounded in Aug – Sept before finding a base. Malaysia’s steel prices look like it is a less volatile version of global prices. It has ended lower than the peak in Apr/May 16 but on average it is higher than where it was a year ago. So I disagree that “Rebar price has since then gone down.”

I try to look at overall prices of steel and I have no idea where it will be one year from now (if I did, I won’t be writing this). However, this does not only affect MASteel but every steel counter in the industry now.

http://www.100ppi.com/vane/detail-927.html

5. How about cost of productions for rebar? Has it gone down as well? What is the margin before the sudden surge & after? Not knowing the rebal prices in malaysia, not knowing the cost structure of producing rebar, not knowing the exact prices in China, what can we predict the performance of a company?

There are a lot of questions here. I believe that it is almost impossible to know everything before you start investing – unless you have management access which I don’t. If you do, I hope you can share it with us. Overall the thesis is rebars are made mainly from scrap metal. I understand that scrap metal, iron ore and steel prices usually move in tandem – therefore you can think of MASteel almost as cost plus players since the raw material and finished products prices move in parallel direction. Therefore a movement upwards will benefit MASteel and all other steel players because there is a lag between supply and selling the finished products.

6. “I knew this website way before this article, I did not trust this analysis because it has not stated the sources of data, users contributed towards the date & so on. Nothing was mentioned in their website. I have even registered with the website but getting the same report every week. http://steelbenchmarker.com/files/history.pdf”

What website? Okay, if you don’t trust my analysis, I’m not going to hold it against you. Which sources of data did you not get? I thought I put a lot of sources? :/

Which website is “their website?” I don’t know what website you’re talking about :/

Also I couldn’t load the link here.

7. I will publish an article to discuss further about this topic

Yes please do :)

8. Please take note that MRT2 project won't help much because it is just continuous part of MRT1 project. It's is not something new demand, it is just making demand for steel to continue sustain at previous level.

I agree with you :)

9. The article just touch on the face of industry, not deep discussion into prices & costs, then projected huge profits in coming months assuming rebar price is now still RM2,400 as in April & May 2016.

You’re right. I’m not a paid professional analyst – I did mention that I am a novice investor at the beginning. Also, I did mention that the 4Q earnings was a lazy estimate – which I do not think is too farfetched given the right environment the sector is in now.

However, thank you for all your questions! Overall, I think that the MITI safeguard tax will help MASteel, AnnJoo & SSteel simply because they don’t have to compete with China at the below cost dumping levels that they had to before this.

I look forward to your article :)

More articles on 100% PROFITS

Discussions

The financial period ended 31/3/2016 were largely helped by forex gain of RM 6,049,000

The profit of RM5,076,000 would become loss of RM973,000

2016-09-25 18:55

Malaysia experienced shortage of rebar in April & May, causing the price rocketed to sky level, but the revenue of Masteel for quarter (1/4/2016-30/6/2016) was RM268m, slightly higher than last year's same period RM242m.

2016-09-25 18:58

Did the profit in that quarter helped by clearance of stocks at much higher prices because of cancellation of supplies from China?

Rebar price has since then gone down.

2016-09-25 19:01

100%PROFIT:a full year EPS of 35.2 (4.4c * 4Q * 2) shouldn’t be too surprising. Assigning a PE of 5 would yield a TP of RM1.76

100% 净利:感恩你专业与诚实的分享,谢谢了。

2016-09-25 19:04

How about cost of productions for rebar? Has it gone down as well? What is the margin before the sudden surge & after?

Not knowing the rebal prices in malaysia, not knowing the cost structure of producing rebar, not knowing the exact prices in China, what can we predict the performance of a company?

2016-09-25 19:06

I knew this website way before this article, I did not trust this analysis because it has not stated the sources of data, users contributed towards the date & so on.

Nothing was mentioned in their website.

I have even registered with the website but getting the same report every week.

http://steelbenchmarker.com/files/history.pdf

2016-09-25 19:09

Please take note that MRT2 project won't help much because it is just continuous part of MRT1 project.

It's is not something new demand, it is just making demand for steel to continue sustain at previous level.

If during the execution of MRT1 project in previous did not make all steel producers profitable, what so special about MRT2 project to steel producers, especially those producing long products.

2016-09-25 19:26

The article just touch on the face of industry, not deep discussion into prices & costs, then projected huge profits in coming months assuming rebar price is now still RM2,400 as in April & May 2016.

2016-09-25 19:28

wah..that means the whole pile of Inventory (double of the McaP) will be written down?

2016-09-25 19:35

Monkey Business, you're just a theory king. Pls go and get more knowledge about steel industry before talk like a pro.

2016-09-25 19:36

from 2400 drop to 1870..thats like 22% drop in the value of its inventory?

2016-09-25 19:39

ok..may be 4% drop in the value of inventory only since they must have accumulated it long time ago slowly...but at 4% margin on revenue...things can get very critical.

2016-09-25 19:42

IBanker, you just want to listen to what you wanted to listen, never look at my points.

I am not pro, but judging from my comments & yours, I know more than you.

2016-09-25 19:53

WB2F Last year posted RM50 million losses. Are you all sure that this counter still can buy ??? Overall global steel industry still not so good. :(

2016-09-25 19:56

probability, the author has not discussed about it.

But for me, I don't know, it could be worse, maybe.

2016-09-25 19:56

Posted by MonkeyBusiness > Sep 25, 2016 06:53 PM | Report Abuse

Before everyone feeling too excited about the steel industry, maybe author or someone can help to explain the following:

Prices of Rebar in Malaysia (Source: MITI)

----------Low-----High

21/9/2016 1,720 1,870

15/9/2016 1,720 1,870

8/9/2016 1,800 1,950

30/8/2016 1,750 1,990

26/8/2016 1,840 1,990

26/7/2016 1,780 1,930

24/6/2016 1,750 1,950

30/5/2016 2,180 2,380

22/4/2016 2,100 2,300

21/3/2016 1,650 1,800

26/2/2016 1,520 1,620

27/1/2016 1,450 1,550

22/12/2015 1,450 1,550

17/11/2015 1,500 1,600

27/10/2015 1,500 1,600

22/9/2015 1,600 1,700

26/8/2015 1,580 1,680

28/7/2015 1,650 1,750

30/6/2015 1,760 1,860

27/5/2015 1,840 1,940

28/4/2015 1,840 1,940

31/3/2015 1,850 1,950

24/2/2015 1,800 1,900

27/1/2015 1,900 2,000

Calvin replies,

Rebar prices are in middle range pricing BUT LOOK AT COST OF PRODUCTION WHICH FELL EVEN MUCH MORE DUE TO VERY CHEAP IRON & SCRAP STEEL PRICES. So the profit margin increases by a much bigger margin overall

And with Rm32 Billions New Mrt Orders Masteel's order book will scale and spike upwards

See

http://marketrealist.com/2015/02/latest-steel-industry-indicators-mean-investors/

http://www.indexmundi.com/commodities/?commodity=iron-ore&months=120

2016-09-25 19:57

When existing price is similar to last year's price and last year suffering huge loss, what is the magic can make the profit double than even when price was RM2,400 in April & May 2016?

2016-09-25 19:58

New production line does not guarantee lower cost, look at Megasteel, huge unutilised production capacity, finally dead.

2016-09-25 19:59

Also look at China, increased production capacity to lower cost, end up lower selling price because too much capacity.

that's the reason China government has been working hard to cut down capacity.

2016-09-25 20:00

https://www.metalbulletin.com/Article/3458686/Domestic-rebar-prices-in-Malaysia-continue-to-weigh-down-by-imports.html

Domestic rebar prices in Malaysia continue to weigh down by imports

Domestic rebar offer prices in Malaysia continued to retreat over the past month as mills made cuts to compete against an influx of cheap imports from China, market participants said on Tuesday June 2.

Malaysian mills are offering 16-32mm rebar at 1,750-1,760 ringgit ($475-477) per tonne delivered this week, down from 1,820 ringgit ($494) per tonne a month ago. The price is not inclusive of a 6% goods and services tax, which came into effect on April 1. The premium for smaller-sized rebar remained unchanged at 100...

2016-09-25 20:00

Calvin tan, please look at my earlier comment about MRT2 project:

Please take note that MRT2 project won't help much because it is just continuous part of MRT1 project.

It's is not something new demand, it is just making demand for steel to continue sustain at previous level.

If during the execution of MRT1 project in previous did not make all steel producers profitable, what so special about MRT2 project to steel producers, especially those producing long products.

25/09/2016 19:26

2016-09-25 20:02

MonkeyBusiness, it would be good if you can provide the link on the rebar prices you had presented.

Calvin, please don't link price of raw material with products at different time frame.......and confuse people.

2016-09-25 20:05

probability, my price list below was extracted from Ministry of International Trade and Industry, so it is reliable:

Please visit http://www.miti.gov.my/index.php/pages/view/3060?mid=73 & read the MITI Weekly Bulletin.

Prices of Rebar in Malaysia (Source: MITI)

----------Low-----High

21/9/2016 1,720 1,870

15/9/2016 1,720 1,870

8/9/2016 1,800 1,950

30/8/2016 1,750 1,990

26/8/2016 1,840 1,990

26/7/2016 1,780 1,930

24/6/2016 1,750 1,950

30/5/2016 2,180 2,380

22/4/2016 2,100 2,300

21/3/2016 1,650 1,800

26/2/2016 1,520 1,620

27/1/2016 1,450 1,550

22/12/2015 1,450 1,550

17/11/2015 1,500 1,600

27/10/2015 1,500 1,600

22/9/2015 1,600 1,700

26/8/2015 1,580 1,680

28/7/2015 1,650 1,750

30/6/2015 1,760 1,860

27/5/2015 1,840 1,940

28/4/2015 1,840 1,940

31/3/2015 1,850 1,950

24/2/2015 1,800 1,900

27/1/2015 1,900 2,000

2016-09-25 20:05

Page 9 MITI Weekly Bulletin 2016 : Volume 404 - 21 September 2016

http://www.miti.gov.my/miti/resources/MITI%20Weekly%20Bulletin/MITI_Weekly_Bulletin_Volume_404_-_21_September_2016.pdf

2016-09-25 20:08

Monkey Business, in the recent QR of Megasteel under Prospect Section, the Company has hinted that the demand for next few months will be much higher. Apart from this, MITI safeguard on long products will benefit to the Company significant if it's approved.

2016-09-25 20:08

MonkeyBusiness New production line does not guarantee lower cost, look at Megasteel, huge unutilised production capacity, finally dead.

25/09/2016 19:59

5 Things Will Increase MASTEEL'S PROFITS EXPONENTIALLY:

1) Stoppage from illegal China's Rebar Dumping.

2) Imposing levy on China rebar.

3) Very Cheap Scrap Steel as raw material. Masteel capitalizes from even cheaper Scrap metal than imported iron ore. This sets its cost even lower than others.

4) Increase of Demand due to Many MRT, LRT & Heavy Infrar works.

5) Proximity to supply source saves on transport. The recent launch of MRT 2 with Rm32 Billions job is nearest Masteel's factories in PJ & Klang. It is far cheaper for Masteel than other steel cos.

MASTEEL IS ON TO GOLDEN YEARS AHEAD.

The very name means EMAS - STEEL

2016-09-25 20:09

Fair said, wallstreet82, so please closely monitor the price via MITI website.

2016-09-25 20:11

Calvin tan, No.1 is the most important one, others not so convincing.

2016-09-25 20:11

To understand why Masteel can achieve better result, Monkey Business you'll have to do more homework. Not only keep quoting prices etc. A lot of analysts like you like to talk with figures without good business sense always bring investors to Holland.

2016-09-25 20:12

wallstreet82....anti-dumping duties would definitely improve the profitability of a company manufacturing products with low 'retention time' in their factory. i.e with a low inventory so that they can react on the supply pricing and selling prices according to the market.

im only worried due to the large pile of inventory Masteel, which acts as double-edged sword depending on the price trend of their products.

2016-09-25 20:13

Let's compare the rebar price in 2015 and 2016 in the same period:

21/3/2016 1,650 1,800

26/2/2016 1,520 1,620

27/1/2016 1,450 1,550

31/3/2015 1,850 1,950

24/2/2015 1,800 1,900

27/1/2015 1,900 2,000

Prices in 2016 (Jan - March) is lower than previous year corresponding period. The profit in that period:

2016 Q1: RM5M profit

2015 Q1: (RM10M) losses

Why are they making more profit when the rebar price is lower? Monkey Business, do more homework lar!

2016-09-25 20:15

its not the absolute price that matters, it is the trailing 3 months pricing of raw material compared with the forward 3 months of the products pricing. Its like you buy something ingredients cook and then sell...there is processing time involved.

2016-09-25 20:19

PROSPECTS

The domestic steel industry is set to benefit from resilient demand of steel bars in 2016 and over the coming years,

driven by the implementation of key infrastructure projects throughout the nation by the Malaysian Government. This

includes the construction of various major expressways and the Klang Valley Mass Rapid Transit (KVMRT), as well as

increased property development activity in line with population growth.

A major part of this development boost would be centred in the Klang Valley, where our manufacturing facilities are

strategically located. Being one of the two players situated in close proximity to major construction activity in this region,

2016-09-25 20:25

Posted by calvintaneng > Sep 25, 2016 08:25 PM | Report Abuse X

PROSPECTS

The domestic steel industry is set to benefit from resilient demand of steel bars in 2016 and over the coming years,

driven by the implementation of key infrastructure projects throughout the nation by the Malaysian Government. This

includes the construction of various major expressways and the Klang Valley Mass Rapid Transit (KVMRT), as well as

increased property development activity in line with population growth.

A major part of this development boost would be centred in the Klang Valley, where our manufacturing facilities are

strategically located. Being one of the two players situated in close proximity to major construction activity in this region,

NOTE THESE WORDS,

TO BENEFIT FROM RESILIENT DEMAND OF STEEL BARS IN 2016

AND OVER THE COMING YEARS

DRIVEN BY CONSTRUCTION OF MAJOR EXPRESSWAYS & KLANG MRT

OUR MANUFACTURING FACILITIES ARE SITUATED IN CLOSE PROXIMITY TO MAJOR CONSTRUCTION ACTIVITY.

2016-09-25 20:26

Hi Probability, you have a good question here. Whether the large pile of inventory hold is good, we must look at the China's continuous effort to cut their steel production, hence, price of steels will be maintained/go up higher to keep the margin much attractive.

Please read news as follows, published few days ago:

http://www.thefiscaltimes.com/latestnews/2016/09/21/Under-global-scrutiny-China-has-cut-steel-exports-industry-body

Posted by probability > Sep 25, 2016 08:13 PM | Report Abuse

wallstreet82....anti-dumping duties would definitely improve the profitability of a company manufacturing products with low 'retention time' in their factory. i.e with a low inventory so that they can react on the supply pricing and selling prices according to the market.

im only worried due to the large pile of inventory Masteel, which acts as double-edged sword depending on the price trend of their products.

2016-09-25 20:28

no one can predict the future price trend of their products...including management. Management could have overlooked this. They have no choice to buy raw material to continue running their factory - as there is cost involved by leaving the plant idle.

looking at the price trend, one should be cautiously wait and see the next qtr results.

Furthermore the effects of the recent duty imposed will take time to show the effects on the profitability..~ at least 6 months or more...

2016-09-25 20:30

"Faced with global anger from Asia to the United States and Europe over a flood of cheap Chinese steel products, Beijing promised to cut steel capacity this year by 45 million tonnes and by 100-150 million tonnes over five years.By the end of July, China had only achieved 47 percent of its 2016 target"

2016-09-25 20:30

wallstreet82, my homework is below, I said already but you pretend you never saw it:

MonkeyBusiness The financial period ended 31/3/2016 were largely helped by forex gain of RM 6,049,000

The profit of RM5,076,000 would become loss of RM973,000

25/09/2016 18:55

2016-09-25 20:41

Why loss? wallstreet82, Since you are so clever, may be you can help to let us know the reason of loss?

And also the main reason for profit 10m in quarter from 1/4/2016 to 30/6/2016?

2016-09-25 20:42

can that kind of profit repeat in the next quarter? i doubt it, but you can tell since you are clever than me.

2016-09-25 20:43

You just need to answer, can or can not? That's simple, no skill required at all.

2016-09-25 20:44

Remember these sequences

The Eagle SEES First

Then followed by other flying birds

The chicken on the ground sees nothing at all until too late.

Last time when 9Mp projects were announced by the then Pm Badawi I went in to buy TASEK CEMENT at Rm2.90, YTL CEMENT at Rm2.40, CMSB at Rm2.20, CIMA at Rm2.20 LAFARGE At 66 CENTS.

All went up 300% to 500% in prices later! YTL Took YTL CEMENT PRIVATE!! UEM TOOK PRIVATE CIMA

So all Long Steel Stocks will do well Especially MASTEEL

2016-09-25 20:52

actually wallsteet82 gave some hope on Masteel after discovering the recent duty announcement...but with the 'cataract eagle' around...even the rabbits will laugh and hop away..

2016-09-25 21:02

MonkeyBusiness Before everyone feeling too excited about the steel industry, maybe author or someone can help to explain the following:

Prices of Rebar in Malaysia (Source: MITI)

----------Low-----High

21/9/2016 1,720 1,870

15/9/2016 1,720 1,870

8/9/2016 1,800 1,950

30/8/2016 1,750 1,990

26/8/2016 1,840 1,990

26/7/2016 1,780 1,930

24/6/2016 1,750 1,950

30/5/2016 2,180 2,380

22/4/2016 2,100 2,300

21/3/2016 1,650 1,800

26/2/2016 1,520 1,620

27/1/2016 1,450 1,550

22/12/2015 1,450 1,550

17/11/2015 1,500 1,600

27/10/2015 1,500 1,600

22/9/2015 1,600 1,700

26/8/2015 1,580 1,680

28/7/2015 1,650 1,750

30/6/2015 1,760 1,860

27/5/2015 1,840 1,940

28/4/2015 1,840 1,940

31/3/2015 1,850 1,950

24/2/2015 1,800 1,900

27/1/2015 1,900 2,000

25/09/2016 18:53

Hercules answer:-

You can notice that within Jan -June 2015 the price is around 1900 then the price started to drop from July 2015 till Jan 2016 to as low as 1450. The sharp drop is due to imported n smuggled steel oversupply in the market. You may ask why Apr-May 2016 price surge so high? Started early of Year 2016 the market demand is so low until many of the importers are facing lost n they forced to sell even below their cost because the price keep on dropping everyday and they can't take the risk if it continue dropping. Come back to why Apr-May 2016, price surge as high as 2180 is because during this time no more imported steel. With this safeguard, I believe their future earning would be better than this year which without imported steel as a competitor.

MonkeyBusiness actually u a good analyzer n not blindly follow the crowd without detail research, kudo for u! Also hope u can do more research and provide us more information.

2016-09-26 09:45

Additionally, scrap metal costs were higher in 2015, and much higher in 2014.

2016-09-26 10:52

MonkeyBusiness

Before everyone feeling too excited about the steel industry, maybe author or someone can help to explain the following:

Prices of Rebar in Malaysia (Source: MITI)

----------Low-----High

21/9/2016 1,720 1,870

15/9/2016 1,720 1,870

8/9/2016 1,800 1,950

30/8/2016 1,750 1,990

26/8/2016 1,840 1,990

26/7/2016 1,780 1,930

24/6/2016 1,750 1,950

30/5/2016 2,180 2,380

22/4/2016 2,100 2,300

21/3/2016 1,650 1,800

26/2/2016 1,520 1,620

27/1/2016 1,450 1,550

22/12/2015 1,450 1,550

17/11/2015 1,500 1,600

27/10/2015 1,500 1,600

22/9/2015 1,600 1,700

26/8/2015 1,580 1,680

28/7/2015 1,650 1,750

30/6/2015 1,760 1,860

27/5/2015 1,840 1,940

28/4/2015 1,840 1,940

31/3/2015 1,850 1,950

24/2/2015 1,800 1,900

27/1/2015 1,900 2,000

2016-09-25 18:53