A turn of tide for strong USD

Roman828wood

Publish date: Sun, 12 Jun 2022, 02:45 AM

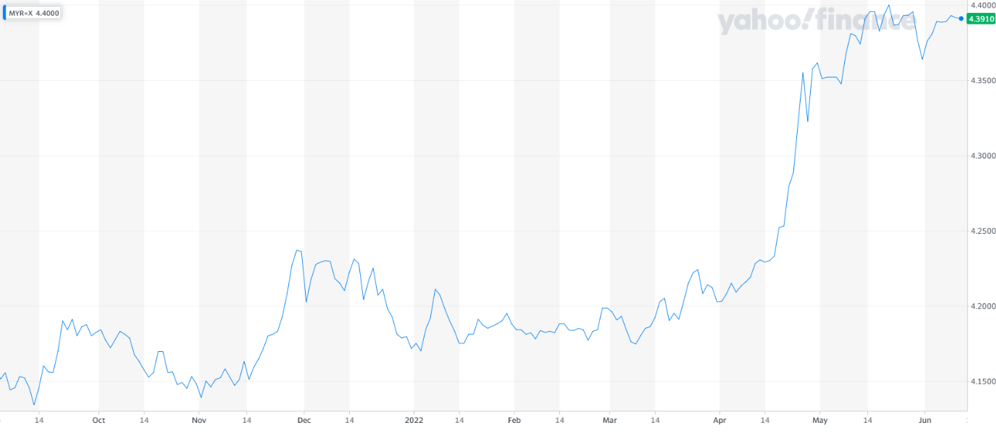

As interest rates moves higher in United States, the investors appetite for USD grows in tandem too. This is largely caused by an elevated interest in better yield assets in USD.

We – local investors, should take this opportunity to have a deeper look at some of the better performing export orientated stocks.

For example, Sern Kou Resource (KLSE, 7180).

While the company was expected to benefit from stronger USD, many investors had misunderstood Sern Kou as another furniture maker, which is not true.

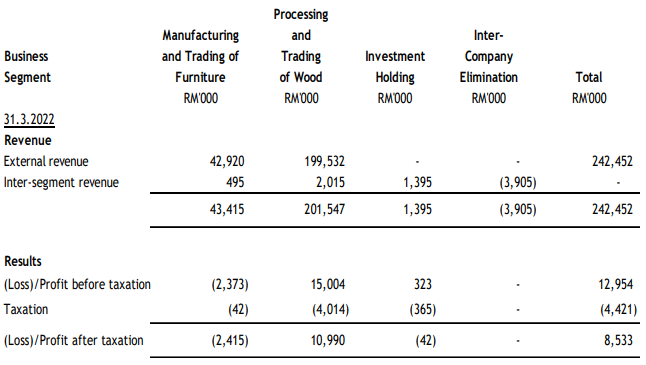

Under Sern Kou’s 3QFY22 financial results, we can see that the key revenue and profit after tax contributor is the processing and trading of wood segment. In other words, they are more inclined towards mid-stream wood processing company, supported by their downstream furniture business.

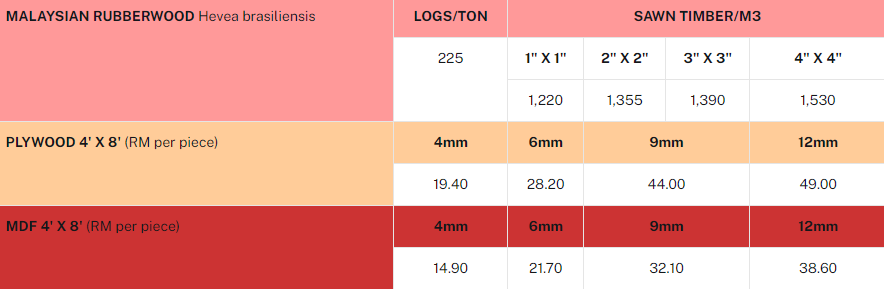

Despite prices for lumber had declined in a general sense, the price for plywood and MDF board are still remaining at an elevated level.

Hence, aside from profiting from the strong USD trend, the company is likely to benefit from the strong wood price, too.

Generally speaking, the share price of Sern Kou is not exactly on an uptrend, but they are now testing the RM0.735 level as a soft-landing point for investors who are interested in the company. Both MA 30 and MA 15 still indicates a consolidating phase and the market is trying to decide which direction Sern Kou would go next.

I strongly believe that investors should include Sern Kou in their portfolio.

DISCLAIMER: This post serves as an educational analysis and is never meant to be a buy/sell call or recommendation. Investors must always do their own due diligence before making any investment decisions. The author of this post is not liable in any way for any decisions made by any individual.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|