UNIMECH - POTENTIAL UPCOMING BETTER QR (BASED ON BOARD COMMENTS) !!!

BURSAMASTER

Publish date: Mon, 27 May 2019, 05:14 PM

UNIMECH - POTENTIAL UPCOMING UPCOMING BETTER QR

(BASED ON BOARD COMMENTS) !!!

(PERSONAL TP 1.40 Short Term, 1.60 Mid to Long Term).

Recently I had spotted this mid cap company; an investment grade, which is pending to announce its quarter result -UNIMECH GROUP BHD or UNIMECH (Stock Code 7091, listed on MAIN BOARD, INDUSTRIAL PRODUCTS/SERVICES, market cap RM 174.65M as at writing)

In summary, UNIMECH is a company whose core business is in supply and trading of valves. instruments and fittings.

I noticed considerable interest starts to build in on Monday where the volume registered a sizeable increase to 1.1 million units.

With this positive momentum & enthusiasm ahead of the quarter report, I believe, should carry forward this week. I foresee it trending to the next resistance of 1.20 before heading to my personal TP of 1.40 (short term) to 1.60 on the intermediate to long term.

WHY I THINK THIS STOCK COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

1. Potential Stellar Quarter Results Coming - Better Prospects from INDONESIA Business & Higher Orders for 2019

Refer below recent article on 18/3/2019 in the Star where they had interviewed Group Executive Director Y.F. Sim.

A few key take aways that we can note which might contribute to a better QR :

1. UNIMECH supplies industrial valves to palm oil mills in INDONESIA. The group current has 33 sales offices in Indonesia and plans to open up 4 more this year.

2. INDONESIA government is expected to implement the B30 biodiesel blend soon, which would boost palm oil output, resulting in higher orders for UNIMECH valves.

3. Contribution from INDONESIA would hit over 30% as compared to about 23% in 2018, contributed by positive outlook in palm oil business and also supply of valves to non-palm oil sector.

4. Higher demand for products as UNIMECH would deliver an estimated product value of RM 130 million in first half of 2019, which is 10% more than in previous year corresponding period. This is based on orders in hand and forecast from existing customers.

5. Presently the group has an office in Ho Chi Minh. Due to Vietnam being the highest growth rate in ASEAN, UNIMECH aims to open another sales office in Hanoi by year end.

https://www.thestar.com.my/business/business-news/2019/03/18/unimech-counts-on-export-markets/

Also, we should note the Board's comments on the prospects for this 2019 results as taken from the latest February 2019 QR, that the Board is in view UNIMECH shall report a better performance for the FY ending 2019.

http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=204206&name=EA_FR_ATTACHMENTS

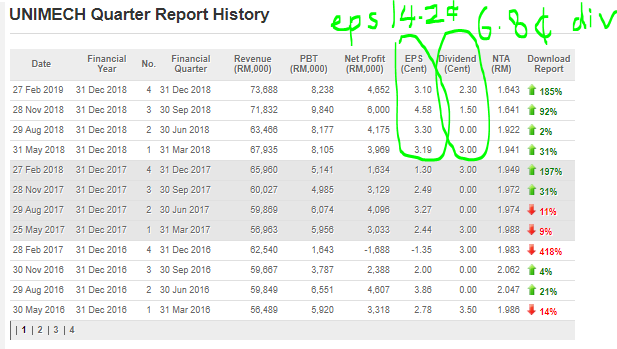

Long Term Price Target Based on EPS

Recent Financial Year 2018-2019, UNIMECH had posted a full year EPS of 14.2 cents. Taking a conservative PE Ratio of 10 times, we would get a short term Target Price of RM 1.42.

However, let's say we account future growth of about 5% into a longer term target, then we would see a longer term target of RM 1.60 (or higher depending on the growth rate of the earnings).

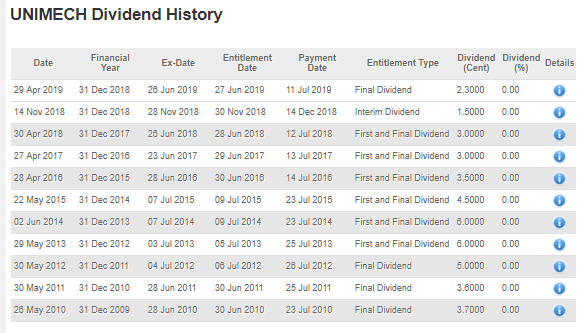

2. Dividend Policy - Payout Twice Per Year, Without Fail Since 2013

Refer below the dividend payout history for UNIMECH since 2010:

We notice that the company has consistently paid dividends, without fail, since 2010. Next dividend of 2.3 cents ex-date is on 26 June 2019. I translate a 5 years consecutively and consistently dividend payout companies as BLUE CHIP COMPANIES.

With the upcoming growth plans, it would be logical to see that the dividends should start increasing this FY onwards. For funds looking at consistent dividend payout, this stock would be a good pick for long term holding.

3. Technical Analysis - Resistance Turned Support (Monthly) & Ichimoku Breakout (Daily)

Refer below monthly and daily chart for UNIMECH.

From monthly chart, we see that UNIMECH has been on a downtrend since 2014 (5 years downtrend). However, recently after forming a double bottom W pattern in 2018, the stock has been on an uptrend since early 2019 and has made a breakout of the major resistance. The resistance area has now turned into a long term support for UNIMECH (Resistance Turned Support - RTS Area). Longterm term resistances seen at 1.40 and 1.60 respectively.

As for daily, today we see a few bullish indicators in this counter:

a. Price has achieved ICHIMOKU Cloud Breakout above 1.11 and managed to close at 1.12 conclusively

b. MACD is crossing the signal upwards

c. RSI and Stochastics are moving from oversold position, to upwards indicating uptrend momentum

d. Significant volume appeared on the solid candle day

CONCLUSION

Considering all the above, my personal TP for UNIMECH is set at RM 1.40 (Short Term), and RM 1.60 (Mid to Long Term).

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

In addition to being a mobile-first technology that reduces interaction and complies with safety regulations, QR Codes are becoming more and more popular as a distinctive marketing tool. https://cookie-clicker2.co

2022-07-25 14:36

chshzhd

div 3.8 n eps 11.2 :)

2019-05-27 22:19