CSCSTEL is under-valued

DividendGuy67

Publish date: Mon, 20 May 2024, 07:01 PM

If you haven't heard of CSC Steel Holdings, this is one of the better managed steel counters out there, not to mention under-valued with a large amount of Net Cash position and growing.

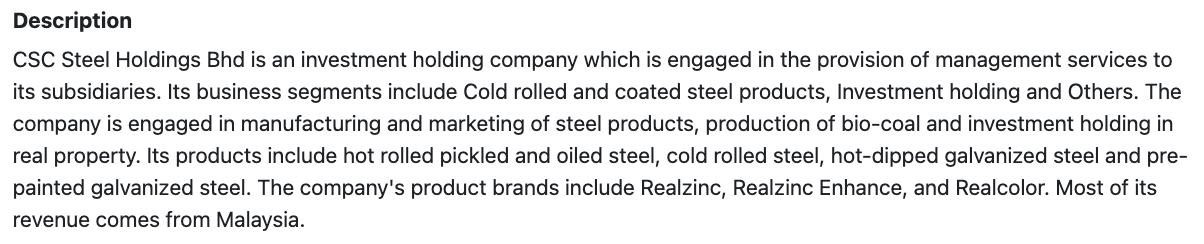

Past 10 years metrics

It's a cyclical business - see the ups and downs in both EPS and DPS, notwitstanding, it scores a plus in its RPS and NAPS CAGR positive growth. What's not shown above is its Net Cash - the company is prudent to grow its Net Cash to nearly RM350 million. My lowest entry price is 1.15, and the Net Cash was 92 sen, i.e. this business is available for sale at only 23 sen, equal to FYE2021 EPS of 23 sen.

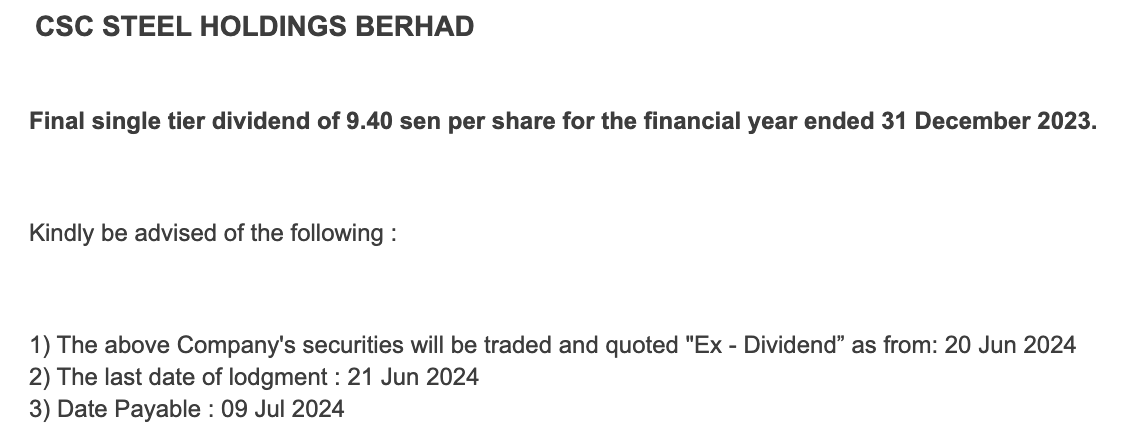

CSC Steel announced a decent 9.4 sen dividend this coming 20 June, to be paid 9 July. At 1.15, that dividend yield is a massive 8.2%. At 1.52 current price, it is still attractive at 6.2%. However, as a cylical business, don't expect a constant dividend yield, cyclicals are best bought during cycle lows and sold during cycle highs.

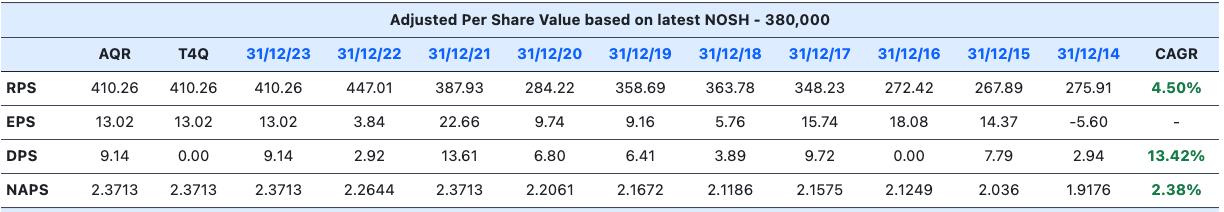

Long term Price Chart

The price cycles are obvious. The Buy Zones are obvious and the Sell Zones are quite obvious too (albeit quite a wide range).

In the immediate term, there is a confluence of 61.8% Fibonacci Retracement off 2 big cycles, both pointing at the same number which is RM1.64. This on its way up acts as a magnet typically and later could become a resistance - if this was a weak market, it could well be the lower end of the price sell zone. However, as the business is well run, the uptrend line will eventually get there in say a decade, so, the lines on the sand is likely to shift upwards.

So, RM1.64 at this juncture does not appear to be the place to take 100% of profits. If the bull market is strong, business well run, Net Cash keeps growing and Management shares it more consistently, then, there will be a re-rating of the stock With NAPS of RM2.37, at the peak of the bull market, not surprising to see the company trades at Book Value or higher. The Company's balance sheet is pristine, no reason why it couldn't attempt to hit there one day at the last quartile of the bull run.

In short, nothing to do, but just sit and ride. In the short term, expect the price to fall after ex-div on 20th June by more than 10 sen (they usually do) but if it falls too much, I wouldn't mind averaging up if the thesis to make new highs are still intact, especially if next year in 2025, it pays another high dividend larger than 9.4 sen just recently declared. It has the Net Cash to do so.

My personal view is that its NAPS of 2.37 is too high. It can easily pay 12 sen dividend at FYE2025 and 15 sen dividend at FYE2026 to bring down the NAPS slightly and the market will reward this stock to go past RM2.25 quite easily. All it takes is clear dividend policy to give shareholders more visibility.

Nothing is guaranteed, global steel business is cyclical, if you still want to buy and hold, be sure to take enough profits at the right places so that your average cost is well below RM1 because one day, it's quite likely to come back down again.

.png)