A Rare Opportunity for Bottom Fishing: Synergy House Berhad’s Potential Upside

HawardHo

Publish date: Thu, 08 Jun 2023, 06:56 PM

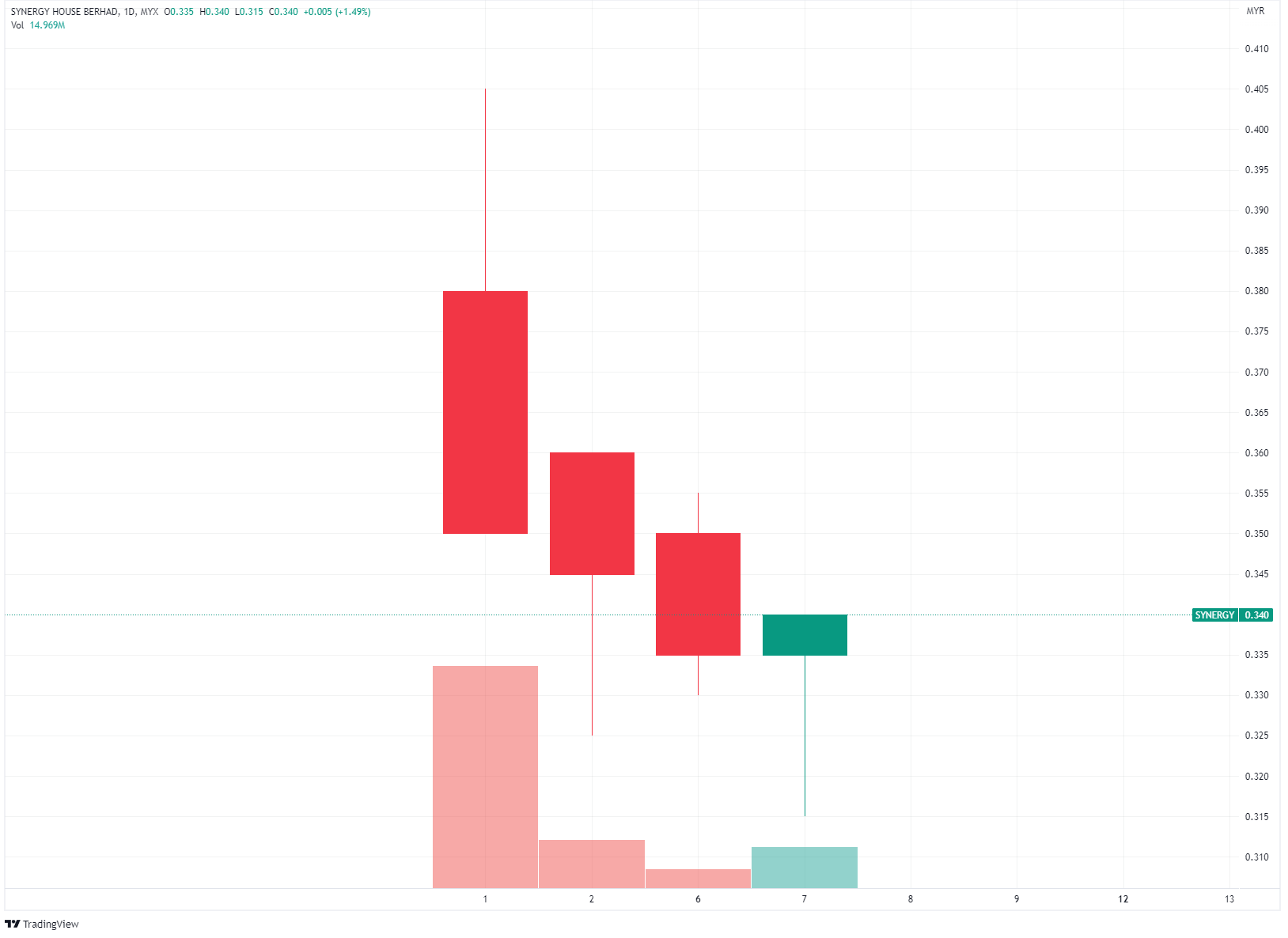

In the Malaysian market, it is uncommon for a company to trade below its IPO price. Today, we turn our attention to Synergy House Berhad (KLSE: SYNERGY), currently trading below its IPO price of RM0.430 at RM0.340, representing a decline of approximately 20.93%.

Synergy House Berhad's listing price-to-earnings ratio (PER) of 12.93 times aligns with its industry peers listed on Bursa Malaysia. Notably, Synergy House Berhad stands out as the only affordable ready-to-assemble (RTA) company that operates as a "fabless" entity. Despite operating in a challenging market, the company has demonstrated commendable growth.

Unlike most RTA companies on Bursa Malaysia, Synergy House Berhad has successfully entered the B2C market in Europe and the US, showcasing a promising marketing strategy devised by its management team.

Significantly, the company's management had started buying back shares from the market. Such a repurchase initiative indicates the management's confidence in the company's prospects. This differs from share buybacks conducted at the company level, as the management utilizes personal funds to repurchase shares.

Moreover, the decline in Synergy House Berhad's share price can be attributed primarily to the lacklustre performance of another property development company's IPO, which, in our opinion, was overvalued.

It is worth highlighting that several research houses have assigned relatively higher Fair Value (FV) estimates to Synergy House Berhad compared to its current price:

Apex Securities: RM0.500 (47.06% upside)

Rakuten Trade: RM0.490 (44.12% upside)

TA Securities: RM0.450 (32.35% upside)

CGS-CIMB: N/A

Mercury Securities: RM0.520 (52.94% upside)

These estimates underscore the market's recognition of Synergy House Berhad's true value, indicating that the recent decline in share price is a result of market panic rather than a reflection of the company's intrinsic worth.

In conclusion, the current market situation presents an excellent opportunity for value investors to acquire Synergy House Berhad at a significantly discounted price, which is currently trading just above a PER (x) of 10 times. This favourable scenario positions the company for potential upside in the near future.