SL95's Blog

What's Next for PJDEV & OSKPROP?

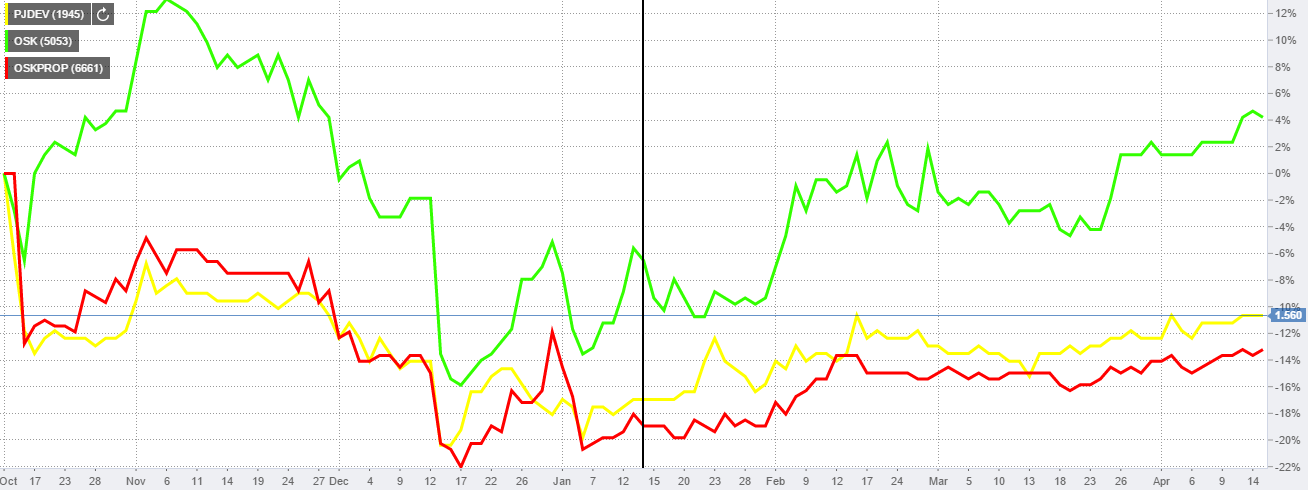

Chart Description: OSK, PJDEV, OSKPROP. The vertical line is the cut-off period when the CIMB, RHBCAP & MBSB merger is called off.

Tan Sri Ong Leong Huat (OLH) Shareholdings

- 41% stake on OSK.

- 73.3% stake on OSKPROP.

- 31.7% stake on PJDEV.

Scenario

- In 2013, OSK sells their investment bank to RHBCAP for RM400 million, in exchange for 10% of RHBCAP shares and the rest in cash.

- July 2014, CIMB, RHBCAP and MBSB proposed a possible merger.

- October 2014, OLH announces interest to merge OSK with PJDEV and OSKPROP. However, OLH proposes offer prices for PJDEV and OSKPROP which was undervaluing the company. Below is the offer prices:

| Share | Market Price | Offered Price |

|---|---|---|

| PJDEV |

RM1.78 |

RM1.60 |

| OSKPROP | RM2.14 | RM2.00 |

- OLH needs a 90% stakeholders to agree on the merger for it to take place. However, as the proposed offer undervalues both company stocks, shareholders rejects this offer. However, this stock trades below the offered price as at 15/4/2015 with a closing price of RM1.560.

This leads to the following question..

- Is there a hidden motive behind OLH plans to merge with PJDEV and OSKPROP?

- Will PJDEV and OSKPROP shareholders eventually give in to merge considering the fact that PJDEV's share price is trading below the offered price now?

Analysis

For Q1

- OLH is a professional opportunist. Knowing that a mega-Islamic bank might be formed from merger between CIMB, RHBCAP and MBSB, OLH stands to make substantial gains from the following scenario.

- OLH sells his PJDEV and OSKPROP shares for OSK stakes. With that, he increases his stake in OSK from 41% to 55%. This increases his stake on the RHBCAP shares that OSK owns.

- Now, if the mega-Islamic bank merger succeeds, RHBCAP's shares are more valuable. And since he now owns 55% of the 10% OSK owns, OLH makes an additional RM356 million just by exercising his PJDEV and OSKPROP stakes. Hence, he gains without forking out any cash.

For Q2

- From the chart above, it can be seen that both OSKPROP and PJDEV has tumbled 19% and 17% respectively until the mega-Islamic bank merger is finally called off. Without any capital gains and dividend, minority shareholders might be tempted to sell their stakes considering that the properties industry is also expected to remain weak for the year 2015.

Result

- Notice that after the mega-Islamic bank merger was called off, OSKPROP and PJDEV has slowly regained about 7% of its intrinsic value. Also, OLH has not followed through with any updates on his interest in merging with PJDEV and OSKPROP, which could prove true for his intentions of the merger.

- My take is that OSKPROP and PJDEV is clear from this merger, and they should rally with a target price of RM2.60 and RM2.07 respectively.

Reference

Disclaimer: This blog is solely for educational purposes only. The post may appear to be a buy/sell call, however it does not purport you to actually trade the securities mentioned. Please trade at your own risk. Thank you.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|