Is Kucingko's Share Price Justified Despite Strong Financial Results??

ExecutionTrade

Publish date: Sat, 31 Aug 2024, 08:07 PM

The stock market is often unpredictable, and Kucingko, affectionately dubbed the "fortune cat stock," is no exception. Despite its strong debut, Kucingko has seen a significant decline in its share price, driven by profit-taking activities post-IPO and an overall weak market sentiment.

But the pressing question remains: Is Kucingko a value buy at its current price?

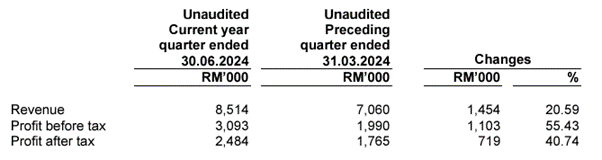

A closer look at Kucingko’s Q2 FY2024 financial results reveals impressive performance metrics that warrant attention. The company reported a total revenue of RM15.6 million for the first six months of FY2024, with RM8.5 million generated in Q2 alone. More strikingly, Kucingko achieved a Profit Before Tax (PBT) of RM3.1 million for the quarter, translating into an enviable PBT margin of 36.33%.

In comparison to many newly listed companies on Bursa Malaysia that have struggled to deliver profits post-IPO, Kucingko stands out as a clear outperformer. The company's Q2 results show a 20.59% increase in revenue and a remarkable 55.43% growth in PBT compared to Q1 FY2024, driven by stronger demand for 2D animation production services.

Given Kucingko’s recent listing, there are no comparative figures from FY2023. However, the company’s cash flow remains robust, with an operating cash flow of RM6.2 million recorded over the six-month period, though no dividend has been paid to shareholders thus far.

One of the key challenges facing Kucingko is the market’s concern over the potential impact of Artificial Intelligence (AI) on traditional 2D animation services. Despite these concerns, Kucingko has successfully delivered strong results and maintains a confident outlook, as highlighted in their management commentary. The company plans to expand domestically into East Malaysia, specifically Sabah and Sarawak, and internationally into Los Angeles, USA, to be closer to key clients.

It's also worth noting that the demand for 2D animation is expected to grow, driven by the increasing competition among streaming platforms such as Netflix, Amazon Prime Video, Disney+, Max, Tencent Video, iQiyi, and YouTube, all of which are seeking unique in-house content.

Now, let’s delve into the valuation of Kucingko.

With a current market capitalization of approximately RM157.5 million, Kucingko's valuation presents an interesting case. If we annualize the PAT for the first half of FY2024, excluding one-off IPO expenses, the company is on track to achieve a PAT of RM8.5 million for the full year. This places Kucingko’s forward Price-to-Earnings (PE) ratio at 18.5 times, which is notably lower than its listing PE valuation, suggesting a potential undervaluation.

Supporting this outlook, Mercury Securities has assigned a fair value of RM0.540 per share for Kucingko, based on a 20x PE multiple and a projected PAT of RM11.0 million. This valuation further reinforces the idea that Kucingko may indeed be undervalued at its current price.

In conclusion, while market sentiments and external factors have impacted Kucingko's share price, the company's solid financial performance and growth prospects suggest that it could be a compelling value buy. As with any investment, it's crucial to weigh the potential risks, but based on the current data, Kucingko appears to be an attractive opportunity for discerning investors.

More articles on IPOWatcher

Created by ExecutionTrade | Jul 12, 2024

.png)