HEKTAR REITs, the new yield monster in town?

AhmadMuda

Publish date: Tue, 21 Feb 2023, 02:34 PM

With seemingly more Q4 results disappoints investors, we are seeing a trend of investors shifting towards safer assets such as REITs and defensive stocks for the past trading week.

When it comes to defensive stocks or REITs, it is critical for investor to access if the targeted investment had both the characteristic; (i) relatively stable earnings and cash rich, and (ii) not shy from distributing dividends.

You see, defensive stocks or REITs generally do not give investors too much of a capital gain or capital loss, hence the name defensive stocks.

And as for REITs, save for a few obvious conglomerates that is trying to monetize their under-utilized assets, most of the REITs are able to generate a satisfactory yield that well covers the rate of inflation.

Coming back to HEKTAR REITs (KLSE HEKTAR) itself is trading at a lucrative yield of 7.37%, based on the trailing 4 quarters DPS of 5.230, and is still well below its NTA of 1.182 based on the last traded price of RM0.710.

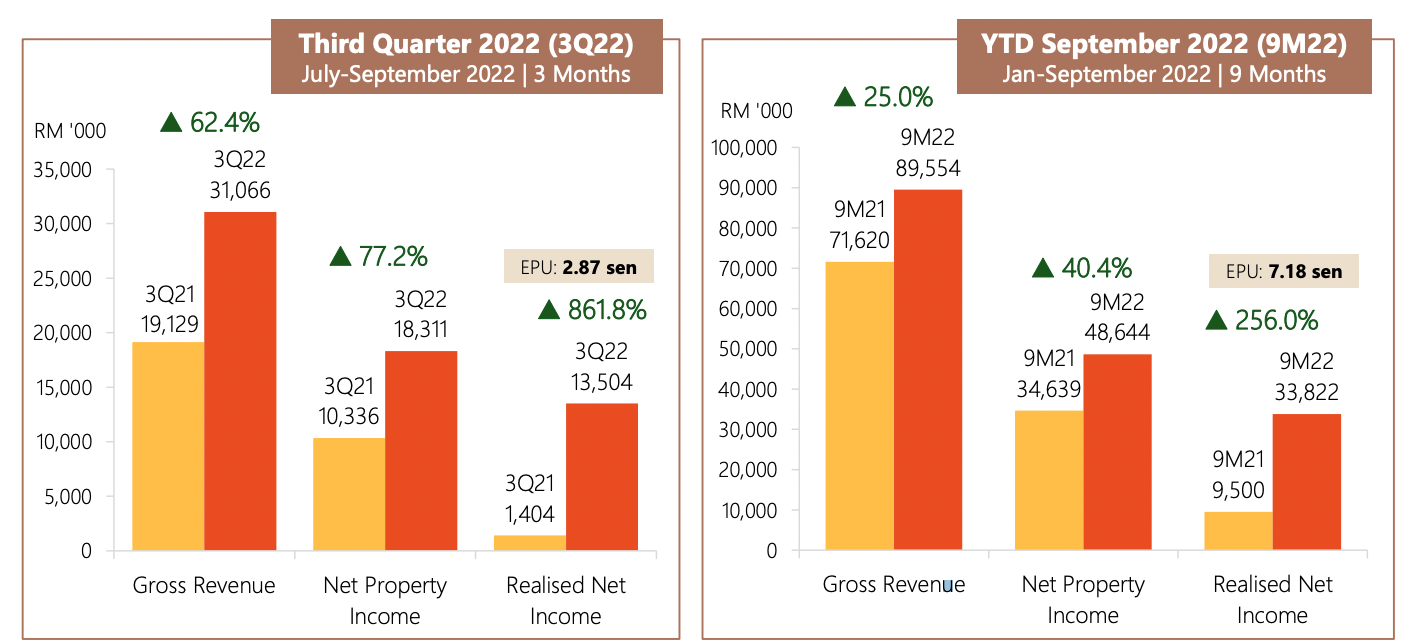

If we were to track on the financial performance of HEKTAR, one could easily note that the yield accretive REIT is well on its’ track to recovery since the non-cash asset revaluation loss the company had suffered in financial year 2020 and 2021, primarily due to the pandemic.

Ironically, this is also the very reason that investors like us able to leverage on the mispricing between the value of HEKTAR and the current traded price.

Based in FY22Q3 of the company, HEKTAR had an overall portfolio occupancy rate of 82.3%, and this is expected to increase in the fourth coming quarter.

If we take other retail REITs Q4 financial performance as a reference, most of them experienced an increase in terms of tenant sales, as well as better rental reversion.

Not to mention the chance of HEKTAR having another revaluation loss is close to NIL, and the quarter to come is likely to reflect a revaluation profit instead due to the strong recovery of the REIT.

On hospitality end, Classic Hotel – the flagship hotel in the Muar region is regaining its ground in terms of occupancy rates, as well an increasing trend in the Average Room Rates (ARR).

As a point of reference, AmInvest Research had recently pegged a fair value of RM0.810 to HEKTAR, which is still at discount after the revaluation of assets (forwarded) of RM1.270. So, aside from high yielding, there are still room for the share price of HEKTAR to trend higher after this.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Igb a bit expensive oh .

More advice to pavreit(growth), hektar(growth) & kipreit(stable)

2023-02-23 01:18

speakup

for pure retail, best is IGBREIT

even PAVREIT is better than HEKTAR

2023-02-22 07:54