A “Crystal Ball” for G Neptune Berhad

uemcapital

Publish date: Wed, 21 Sep 2022, 08:52 PM

What lies beyond of G Neptune in 2023?

The very first batch of investors who will be greatly benefited from G Neptune will be the unfortunate ones who got their holdings “stuck” during the suspension of trading of the company.

However, as the Gan family inject their assets into the company, upliftment of suspension is likely to come very quick.

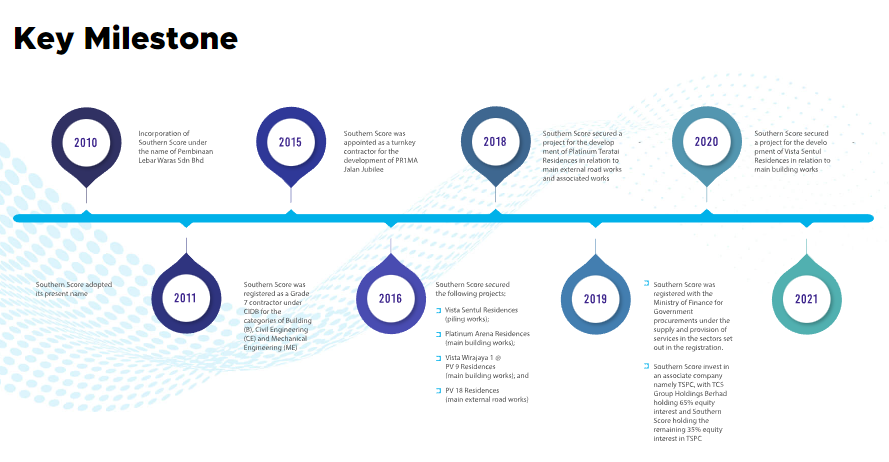

Southern Score Builders, the core asset that will be injected into G Neptune shall be one of the analyst-favoured construction company as the company enjoy the highest net profit margin in the overall construction industry.

This is possible as the Gan family is very experienced in construction as well as property development sector.

Listing at an indicative price of 22 cents, this represents a ~ 13 times in PE ratio. On the hindsight, this seems like a higher valuation amongst the peers, but investors must remember 2 key pointers.

1. The company current orderbook is being “compressed” in some manner as they cannot have too much of RPT contracts on hand during the RTO. Given how Platinum Victory held over 50 acres of land in Kuala Lumpur, chances are extremely low for GNB for register a drop growth for the next few financial years.

2. The Gan family and PAC shall be restricted to a moratorium similar manner in IPO. In other words, for the first 6 months, the family cannot sell a single holding of GNB. With a strong interest from fund managers at this juncture, the expected liquidity in market should be very low.

Based on past experience, such company will normally spike in the first day, consolidate over 1 – 2 months to shake the weaker holders out before moving on to another rally. If you are reading this, remember to hold onto your GNB shares as tight as you can.

So, will GNB shine brighter in 2023? I think the answer is obvious.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|