GENETEC – A Multiyear Growth Company That You MUST HAVE In Your Portfolio

SilentCapital

Publish date: Fri, 25 Mar 2022, 05:29 AM

After a much-anticipated bull run by GENETEC, the share price had finally retraced to a level which investor could now fit into their appetite. In this article, I will explain in depth as to why it is ridiculous for GENETEC to trade at a T12M 48.17 times PER.

As most of you may have been made aware that GENETEC is a direct proxy to EV multiyear growth story via its key customer – Customer T, it is obvious that the EV penetration rate is going much faster than the market expects. In 2020, there are approximately 3.1 million EVs are sold, but it is expected to more-than-double in 2022 to hit 7.7 million EVs to be sold.

2022 could, and will be a pivotal year for EVs and HIS market expects to see at least 30 new EVs to be introduced into the market. While some may find the EV prices are 20% higher than average transaction price of new vehicle, which by comparison is $46,000 to $56,000, the surge in oil price had inevitably sped up global initiatives to push towards cleaner energy.

I mean, nobody wants their balls to be held, right?

Standing on the shoulder of giants, which includes one of the largest EV and EV battery manufacturer in the world – Customer T, I couldn’t resist but repeat that GENETEC still have much growth await, especially with RM198.0 million worth of orderbook on hand, with 89% of it was contributed by the EV and energy storage segment.

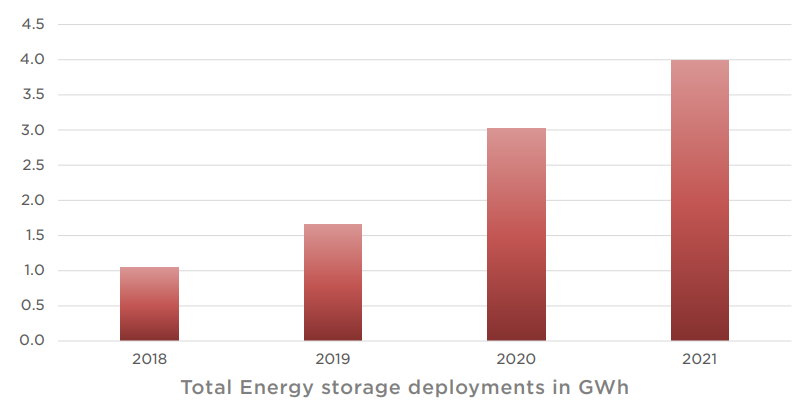

This, is a chart for the energy storage deployments in terms of GWh for Customer T. With more deployment and their mega factory coming up, GENETEC is most likely to win contracts beyond the current scope. As one of the investors said “Tis but just an iceberg”.

I would also like to cite what CGS-CIMB had done in their report:

By now, you should be aware that the company had entered into an MOU with Asia Precision Public Company which is based in Thailand for a feasibility study for factory automation facility for energy storage system in Thailand. Bear in mind that after my talk with another analyst who covers the Thailand region, there are no one else who had, or even in talk with APCS for this mega sized project.

As for now, the ACPS may not seem substantial but once the MOU change into MOA, my guess is it will be too late for you to buy.

Just look at chart above by NEVPC, on how huge the market could be. Even a 10% capital expenditure plan fall onto GENETEC lap, it will be more than enough to sustain the next 10 years growth of the company.

I also understand that investors are concerned of what is going on with GENETEC’s trade receivables. Will it be another SD?

We are talking about tier-1 EV player on a global scale, not some random company in the Middle East. A study also was done to match the trade payable days between Customer T and GENETEC, and the discrepancy was just days off. Hence, operating cash flow will not be an issue for the company.

If this does not convince you, I do not know what else I can say. Perhaps, your mind would change when the share price soars?

See you at RM5.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trend 2022

Created by SilentCapital | Dec 21, 2022

Created by SilentCapital | Mar 15, 2022