A 5-Year Sneak Peek – Why Should You Pick This Tech Company?

Angelramirez683

Publish date: Thu, 19 May 2022, 02:39 AM

Let us first take a look at this chart. Do you recognize the price movement of this “asset”?

Yes, this is the price chart for LUNA/USD.

The recent tech and crypto crash should, and must serve as a warning to all investors on overhyped industries such as De-Fi, autonomous vehicle, electric vehicles, semiconductor and more.

I think we can all agree that overhype in price would inherently kill all assets.

However, computer vision (CV) is one of the least talked subjects, let alone hype across all the hot cake industries.

So, what is CV exactly? Allow me to first bore you…

Computer vision is a field of artificial intelligence (AI) that enables computers and systems to derive meaningful information from digital images, videos, and other visual inputs and take actions or make recommendations based on that information. Computer vision works much the same as human vision, except humans have a head start. Human sight has the advantage of lifetimes of context to train how to tell objects apart, whether they are moving and whether there is something wrong in an image. Computer vision trains machines to perform these functions.

Computer vision is widely used in industries ranging from energy & utilities to manufacturing and automotive and the market is continuing to grow. There is a lot of research being done in the computer vision field. Real-world applications demonstrate how important computer vision technology is to endeavours in business, entertainment, transportation, healthcare, and everyday life. A key driver for the growth of these applications is the flood of visual information flowing from smartphones, security systems, traffic cameras, and other visually instrumented devices.

And… you may read more if you like on https://www.alliedmarketresearch.com/ai-in-computer-vision-market-A13113#:~:text=The%20global%20AI%20in%20computer,39.60%25%20from%202021%20to%202030.

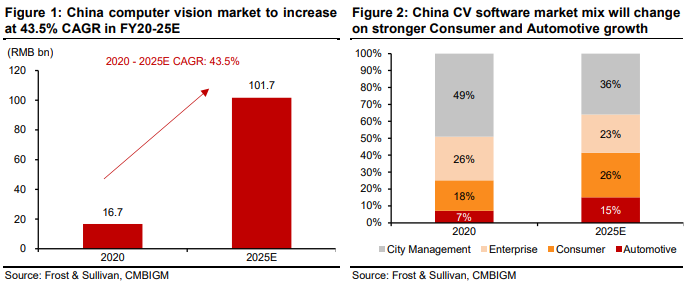

Now move on to China, one of the top countries that had successfully implemented CV, is projecting huge growth in CV in the coming market.

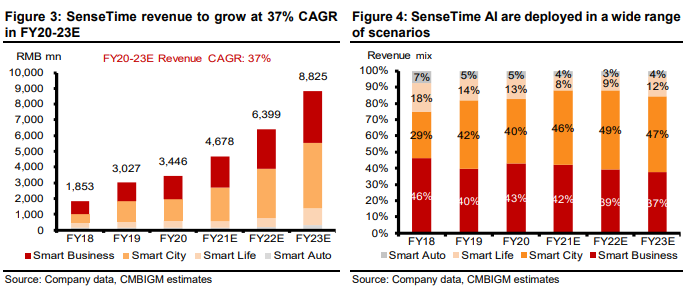

The top company in CV & AI field – SenseTime, is likely to grow alongside with the industry as a whole.

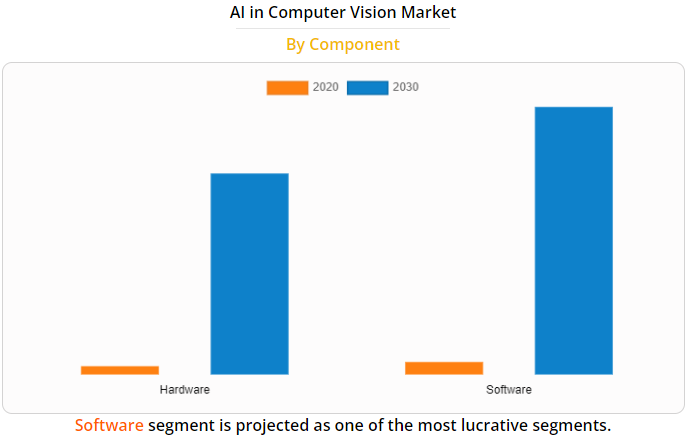

Also, as shown in the link we share above, both the hardware and software subsegment is projected to grow at a ridiculous rate, where the combined value should be 39.60% from 2021 to 2030, a much larger number than all other “hyped” subsegments in the market.

Should you blindly invest into SenseTime? In my opinion, that would be a terrible decision, at least for now.

The geopolitical tension and stress into the China market is depressing enough as it is, and China’s reopening of Shanghai policy didn’t seem to help much of the Hong Kong market either.

So, why risk your capital in somewhere that is filled in uncertain?

Moreover, the valuation of SenseTime is always not cheap on a price to sales basis.

With that in mind, I think you may invest in the only one proxy that had direct exposure into CV/AI industry, which is G3 Global Berhad.

Last week, G3 had secured a RM118.38 million contract from MAHB via the joint-collaboration effort from SenseTime to develop an airport integrated security and safety system (AIS3). There are a few questions left unanswered, but worthwhile for investors to think about.

Why of all companies, SenseTime chose G3 as a partner?

How will this contract change the fate of G3 as a listed company?

Although market capitalization is not a good comparison factor, but considering the geopolitical and currency risks, is it better to invest in SenseTime or G3?

Can G3 secure more contracts in the super expanding CV/AI industry?

Does the current price of G3 make sense?

I do not have a straightforward answer, but I think some of these questions are worthwhile for you as an investor to think.

But given how low the share price had gone, wouldn’t this reduce your risk as an investor? (Wink Wink)

I rest my case.

More articles on VoiceAbove

Created by Angelramirez683 | Apr 16, 2022