A Golden Opportunity for Mestron Holdings

Nathan92

Publish date: Thu, 12 Jan 2023, 02:01 PM

Being a business driven and low-profile company, it is fair to say that Mestron Holdings is well recognized by investors around the market, especially with their strong set of results in financial year 2022.

But how much do YOU understand about Mestron?

A bit of background of Mestron Holdings. The company had started off with products offering such as street lighting poles and provide one-stop destination to its customers, complemented by its trading segment, which includes the distribution of products by lighting brands such as Philips, General Electric, Gruppe, Nikkon and Osram.

However, challenges and headwinds are always in place, no matter the industry.

Mestron Holdings too, was not spared from challenges along the way. Fortunately, near 7 years ago, the group had transformed themselves into a unique proposition where they started to manufacture telecommunication monopoles under the 1BestariNet project, which allows them to penetrate into telco poles and towers industry.

To date, the company had business presence across Malaysia, Australia, Singapore, Brunei, Korea, Myanmar, Sri Lanka as well as Maldives.

Notably, some of the projects where Mestron had completed includes Pekan Expressway, Iskandar Coastal Highway Southern Link, LRT Ampang line extension, Sungai Buloh – Kajang MRT and Bukit Jalil Sport Complex Refurbishment project.

To add on, Mestron Holdings currently had a production capacity of 8,000 tonnes of poles and towers annually.

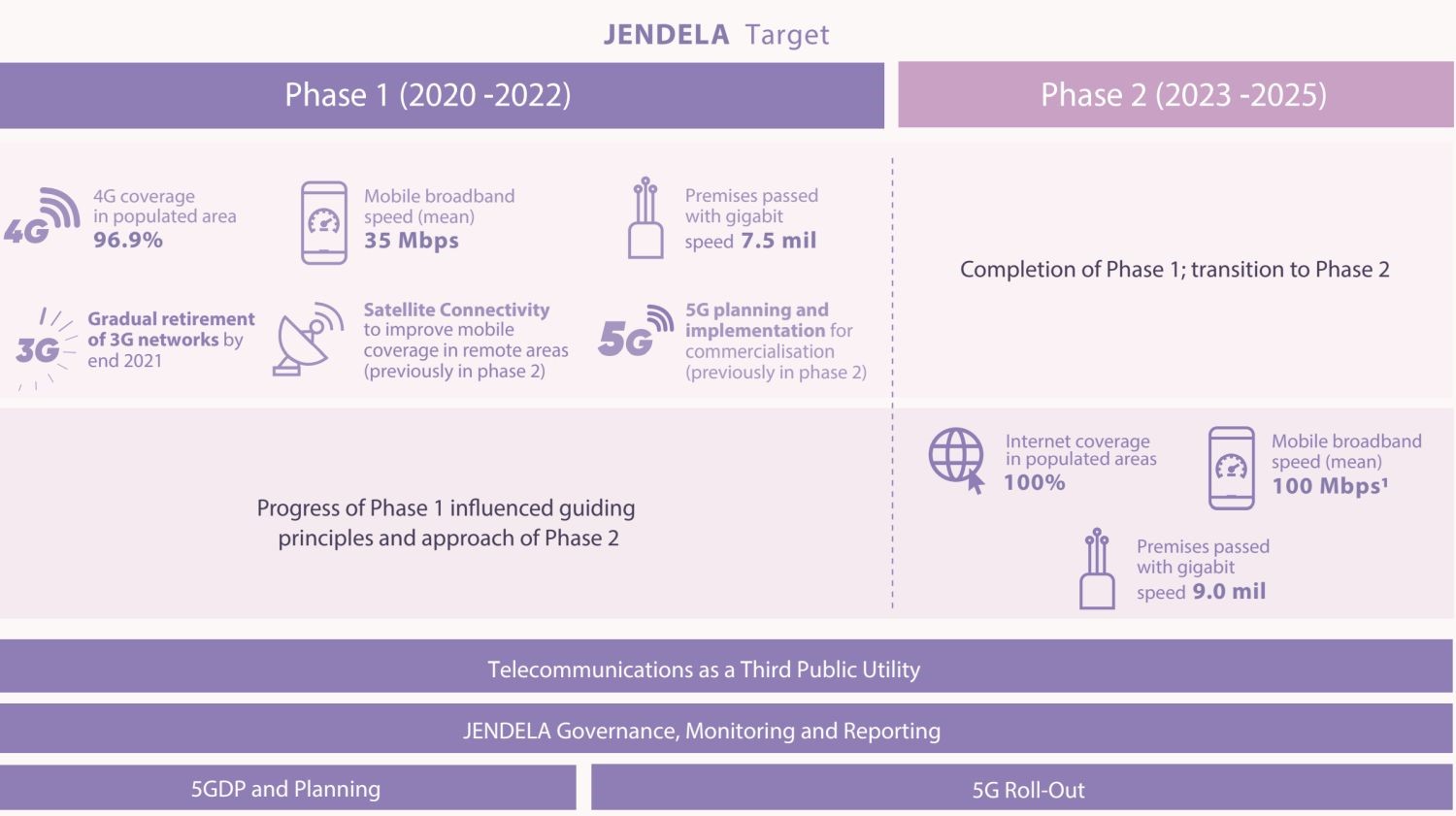

With the track record of Mestron Holdings, it shouldn’t be hard for investors to relate the company to Jaringan Digital Negara (JENDELA) as well as various 5G programmes, where a massive number of products from Mestron are needed to transform the connectivity of the country.

A few things that investors should note about JENDELA includes the plan for Malaysia to increase 4G coverage by 5% from 91.6% to 96.9% by the end of 2022 (Phase 1).

In terms of numbers, Phase 1 involves 1,661 towers across 106 areas and MCMC only gave the players in the industry approximately 9 months to deliver the said towers.

Taking a conservative number of 30%, or approximately 500 towers from Phase 1, our ground check resulted in RM135k to RM160k range for the towers that are going to be constructed for the JENDELA project, with an average gross margin of 20% to 25%.

In short, this could result in RM67.5 million to RM80.0 million in revenue, and RM13.5 million to RM20.0 million in gross profit, do note that the contract is additional to what revenue Mestron is generating.

Despite cloud of doubt exists in MyDigital – Malaysia’s plan on rolling out 5G connectivity, the whole rollout costs is expected to be RM16.5 billion where RM12.5 billion are contributed by network equipment as well as infrastructure.

The government had also planned for the implementation of smart meter for communication between substation and meters, for tracking purposes.

In 2022, there are only 2 companies that are awarded the contract for 1,000 to 2,000 monopoles to be installed, and Mestron is one of the two winners, where there are remaining 4,000 to 5,000 monopoles left to be completed in years ahead.

The prices of the monopole is expected to be anywhere between RM5,000 to RM6,000, with an average gross margin of 30% to 40%, this is another growth catalyst for the company.

In terms of earnings sustainability, Mestron had been actively investing in renewable energy projects. One example would be the company’s investment in Liliz Biogas that had commenced operation in June 2022, with a 21-year Power Purchase Agreement (PPA) signed with TNB.

According to the company’s proposal, the biogas division is expected to generate RM6.0 million per annum, with EBITDA margin of 60% to 70%.

Winstar Aluminium Manufacturing, which is one of the largest one-stop aluminium extrusion and accessories centre in Malaysia, is one of the direct proxies to the solar industry. Mestron had acquired 10% stake in Winstar, with an option to acquire another 20% in a year.

Yes, we understand that Mestron is without a doubt, a quality company for investment.

However, investment comes from 2 aspects, growth, and valuation.

On the valuation part, Mestron had RM3.3 million net profit in Q3, financial year 2022. However, the number is excluding any growth coming from:

· Additional contracts under JENDELA Phase 2;

· Tower uninstallation and maintenance;

· MyDigital rollout in 2023;

· Full revenue and profit stream from renewable energy segment; and

· Growth on existing businesses.

JENDELA Phase 2 is targeting a 100% coverage within populated areas, and this is certainly not easy to be perfect.

A sum of RM8.0 billion had been budgeted for JENDELA Phase 2, which if we assume a minimal 10% of it would be spent on infrastructure, it will result in RM800.0 million.

Taking out a 30% share from the RM800.0 million as what Mestron had secured during phase 1, this would translate to RM240.0 million in revenue, about 2.17 times of Mestron’s financial year 2022 annualised results.

Please do note that this is JENDELA Phase 2 alone, and we are not considering any other contributions from the existing business.

As for the first phase for MyDigital, DNB will be spending RM1.3 billion to increase 5G population coverage up to 70%. This could be another aggressive stream of revenue to Mestron.

Let’s work out the numbers in revenue:

Existing business (conservative basis): RM25.0 million per quarter

JENDELA Phase 2 (conservative basis): RM120.0 million per annum

MyDigital first Phase with DNB (conservative basis): RM130 million per annum

Renewable energy: RM9.0 million per annum

Expected revenue for Mestron in financial year 2023: RM359.0 million

The net profit margin for Mestron is anywhere between 6% to 8% and using a median of 7% for the next financial year, we are looking at a potential RM25.1 million in net profit for financial year 2023, which represents a forward PE ratio of 16.17 times.

Bear in mind that the numbers are extremely conservative, and certainly for high growth company such as Mestron, they easily deserve a forward PE margin of 20 times, representing a minimum 24.02% upside from the current price.

Hence, this is not only the golden opportunity for Mestron, but another golden opportunity for investors.

.png)