HIBISCS: A sneak peek into the upcoming 1Q2018(F) result through DNEX

Lau333

Publish date: Wed, 22 Nov 2017, 06:32 PM

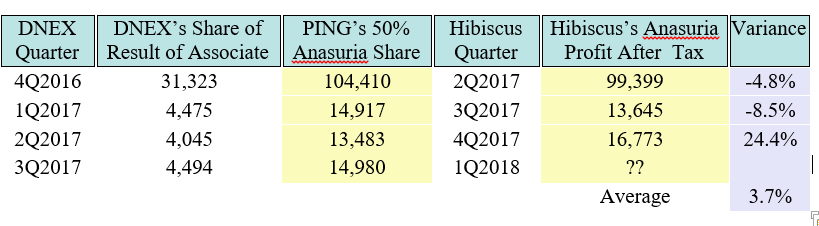

DNEX hold 30% stake in Ping Petroleum which is in 50:50 JV with Hibiscus Petroleum for Anasuria Cluster. Currently, Anasuria Cluster is the only cash generating assets for Ping Petroleum. DNEX has another associate, Global eCommerce Limited but is currently dormant. So, it is safe to assume all share of result of associate is from Ping Petroleum.

From the table above, we can fairly assume Hibiscus’s Anasuria PAT at RM 15m+/-5.0%

Meanwhile, Hibiscus has 2 operating segments aside from Anasuria:-

i) Investment holding and group activities and

ii) 3D Oil, VIC/L31 & VIC/P57.

Investment holding segment generated around RM1m revenue and posted reducing losses (before one-off items) of RM5.5m & RM2.2m respectively in last 2 quarters. 3D Oil, VIC/L31 & VIC/P57 generated zero revenue and posted losses of ~RM2m per quarter in last 2 quarters.

Assuming similar level of losses for the other 2 operating segments in 1Q2018

PAT = RM15m – RM2.2m – RM2m = RM10.8m

Compare that with the previous estimate of RM11.4m.

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Hibiscus Petroleum Berhad

Created by Lau333 | Sep 16, 2017

Created by Lau333 | Sep 14, 2017

Micht

Either 10.8 or 11.4, Lau's estimated that QoQ is declining. Let's hope he can realise his mistakes and not post such articles again. This kid has not realised how his analysis is a laughing stock.

2017-11-22 20:08