Daily technical highlights – (INNATURE, YTL)

kiasutrader

Publish date: Tue, 08 Nov 2022, 09:11 AM

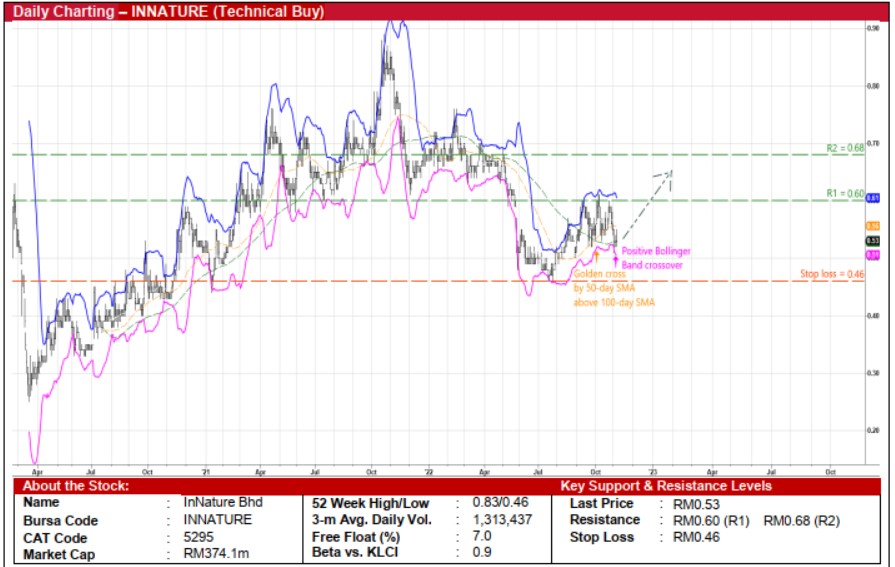

InNature Bhd (Technical Buy)

• After climbing from a trough of RM0.25 in March 2020 to as high as RM0.885 in October last year, a subsequent pullback of 40% to RM0.53 currently might have set the stage for INNATURE shares to plot a technical rebound ahead.

• An upward shift in the share price is now anticipated following its recent crossing back above the lower Bollinger Band and the golden cross by the 50-day SMA above the 100-day SMA.

• As such, the stock could advance to reach our resistance targets of RM0.60 (R1) and RM0.68 (R2), which represent upside potentials of 13% and 28%, respectively.

• We have pegged our stop loss price level at RM0.46 (or a 13% downside risk).

• A leading regional retailer of cosmetics and personal care products serving customers across Malaysia, Vietnam and Cambodia, INNATURE is a proxy to robust retail sales. This comes as the Malaysia Retail Industry Report has forecasted retail sales in Malaysia (which saw a 39.2% YoY jump in 1HCY22) to soar further by 61.7% YoY in 3QCY22 with the personal care segment anticipated to show an annual growth of 102.2% in the third quarter.

• Earnings-wise, the group logged net profit of RM5.6m (+290% YoY) in 2QFY22, bringing 1HFY22 bottomline to RM10.1m (+55% YoY).

• And according to consensus estimates, INNATURE is projected to make net earnings of RM21.5m for FY December 2022 and RM24.3m for FY December 2023, which translate to prospective PERs of 17.4x this year and 15.4x next year, respectively (with its 1-year rolling forward PER currently trading slightly below its historical mean).

• Moreover, the group’s balance sheet is backed by net cash & cash equivalent holdings of RM58.3m (or 8.3 sen per share) as of end-June 2022.

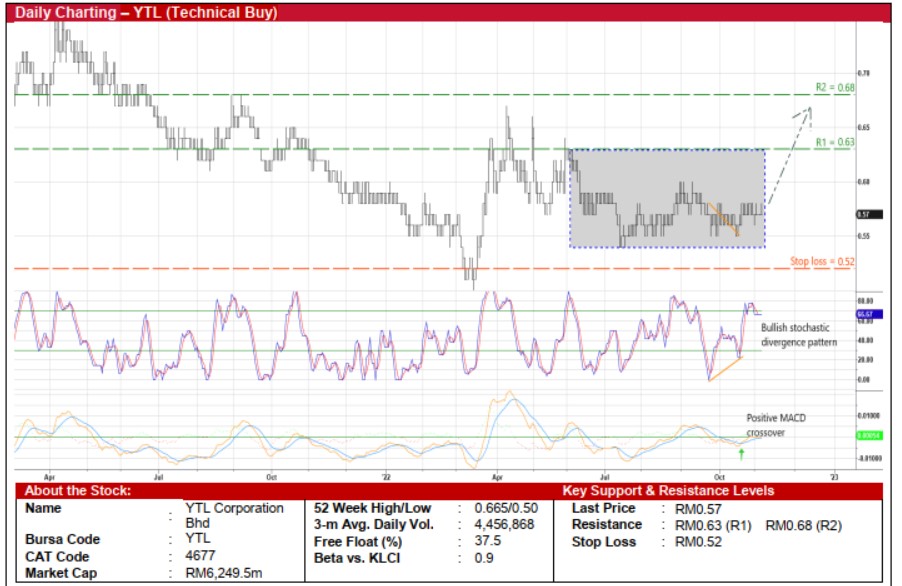

YTL Corporation Bhd (Technical Buy)

• Oscillating inside a rectangle formation since the beginning of June this year, YTL’s share price may be making its way to test the upper end of the trading range ahead.

• On the chart, the existence of a bullish stochastic divergence pattern (following the emergence of rising bottoms as the price was drifting lower) and a positive MACD crossover are signalling an upward bias in the stock.

• With that said, YTL shares could climb towards our resistance thresholds of RM0.63 (R1; 11% upside potential) and RM0.68 (R2; 19% upside potential).

• Our stop loss price level is set at RM0.52 (representing a 9% downside risk from yesterday’s close of RM0.57).

• Fundamental-wise, being a conglomerate with multiple businesses ranging from utilities, cement manufacturing & trading, construction, property investment & development, hotel operations to information technology & e-commerce, YTL reported net profit of RM8.7m in 4QFY22 (turning around from net loss of RM407.5m previously), which took full-year FY June 2022 bottomline to RM530.5m (versus FY21’s net loss of RM367.7m).

• Going forward, consensus is projecting the group to make net earnings of RM151.7m in FY23 and RM230.0m in FY24. This translates to forward PERs of 41.2x and 27.2x, respectively (with its 1-year rolling forward PER presently hovering near the minus 0.5 SD threshold from its historical mean).

Source: Kenanga Research - 8 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024