10 things I learned from the 2021 MAHB AGM - Shak Chee Hoi

Tan KW

Publish date: Fri, 12 Nov 2021, 11:51 AM

Listed in 1999, Malaysia Airports Holdings Berhad (MAHB) operates 39 airports throughout Malaysia. They include five international, 16 domestic, and 18 short take-off and landing airports (STOLports). It also owns and operates Istanbul Sabiha Gökçen International Airport in Istanbul, Turkey. At the same time, it is involved in the retail business of duty free and nondutiable goods at selected airports in Malaysia.

As the interstate travel restrictions in Malaysia were recently lifted, this stock has gained more attention. Here are 10 things I learned from the 2021 MAHB AGM.

1. Revenue plunged 64.2% year-on-year to RM1.9 billion in 2020 as MAHB recorded a net loss after tax for the first time at RM1.1 billion in 2020. Passenger movement plummeted 69.6% from 141.2 million in 2019 to 43.0 million in 2020. MAHB’s operations were affected by the COVID-19 pandemic as well as the resultant border closures and movement restrictions. The company provided RM180.8 million worth of rebates to retailers and airlines, and the support is still ongoing. On the other hand, the cargo business was relatively resilient; cargo volume dropped just 16.8% year-on-year in 2020.

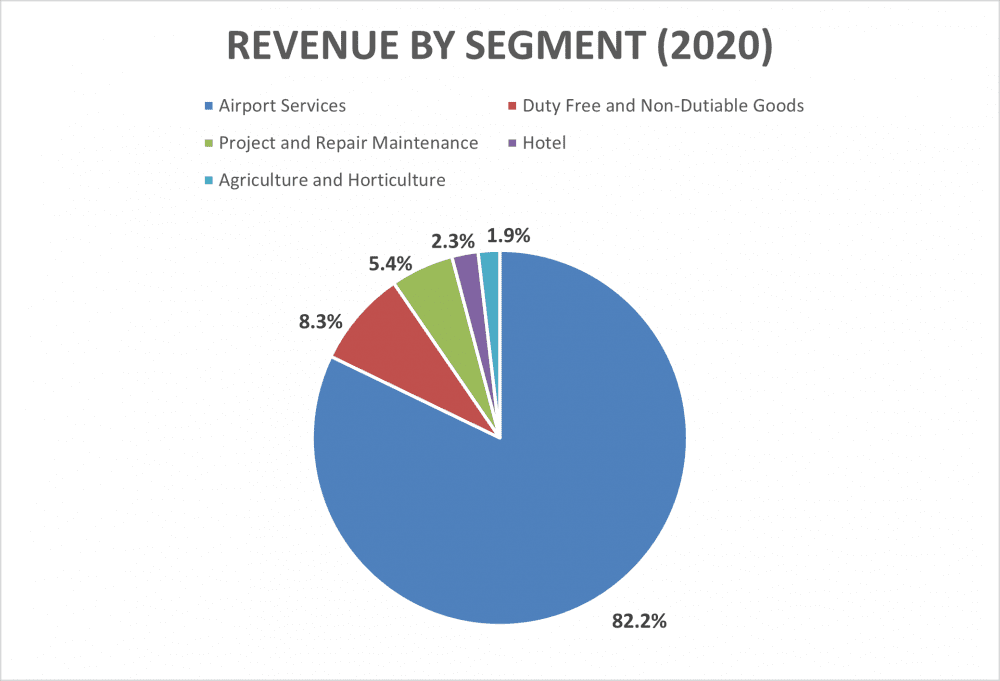

2. Despite the 62.4% decline in the company’s revenue from Airport Services in 2020, the segment still made up 82.2% of MAHB’s total revenue during the year. Its Agriculture and Horticulture, and Hotel segments are relatively small. A shareholder asked if the company would consider hiving off these two non-core segments. Chairman Dato’ Seri Diraja Dr. Zambry Abd Kadir responded that the company has no intention to sell these businesses since they are doing well especially during this critical time.

3. The company has adopted a number of measures to preserve liquidity during the pandemic:

- Focusing capital expenditure on mission critical projects including its track transit system, runway rehabilitation works, baggage handling system, and Subang Airport Regeneration.

- Reducing capital expenditure by 89.5% from RM1.8 billion in 2019 to RM189.7 million in 2020.

- Deferred user fee payment in 2020 amounting to RM90.6 million to the Malaysian government until the end of 2021 without any late interest payments. The company has also applied to defer the user fee payment for this year.

- Collected RM164.4 million from the government in the form of tax refunds. Deferred tax assets totalling RM246.4 million was recognised on investment tax allowances.

- Collected RM614.9 million trade receivables in the first half of 2021.

- Secured undrawn revolving credit facilities and sukuk worth RM3.1 billion and may further draw down loans up to RM5.0 billion.

4. BP Clinical Lab was appointed to provide private COVID-19 screening facilities at the national airports. The Edge estimated that this project will bring about RM500 million in terms of revenue to MAHB. MAHB is also in the midst of appointing other parties to provide similar services at other airports.

5. In principle, the company renewed its operating agreement with the Malaysian government in 2019 to continue operating the 39 airports in Malaysia till 2069. Details are still being ironed out. The chairman responded to a shareholder that MAHB is the operator but not owner of these airports. It is worth noting that six profitable airports are actually subsidising the rest of the domestic airports that are loss-making.

6. WCT Holdings Bhd currently sub-leases the commercial and retail areas of the Sultan Abdul Aziz Shah Airport (Subang Airport) in Selangor — which is closer to the city centre compared to KLIA and KLIA2 — from MAHB. This year, WCT was keen to take over the airport from MAHB instead and submitted a new concession to the government. CEO Dato’ Mohd Shukrie Mohd Salleh’s responded to Minority Shareholder Watch Group (MSWG) thatthere is no provision within its operating agreement to solely terminate its right to operate the airport. Although, there has been a precedent. In 2013, Senai Airport in Johor was carved out of MAHB’s agreement for RM80 million.

7. Cainiao Aeropolis eWTP Hub, which is located within the KLIA Aeropolis, turned operational in November 2020. The facility is a joint development between MAHB and Alibaba. The e-fulfilment hub will strengthen KLIA’s position as a regional distribution centre and boost the last-mile delivery of goods and its cargo business. The cargo v0lume of the aviation hub is expected to double to 1.4 million metric tonnes annually by 2029. The joint venture targets to facilitate a delivery timeframe between 24 hours within Malaysia and 72 hours globally.

8. MAHB responded to MSWG that impaired trade receivables from its major customer, namely AirAsia X and AirAsia Berhad, amounted to RM108.6 million. This impaired amount relates to the RM23 increase in passenger service charge per international passenger from RM50 to RM73 that AirAsia refuses to collect from passengers. The issue is still under litigation.

9. Traffic at the Istanbul Sabiha Gökçen International Airport continues to improve. In fact, the Turkish operations recovered faster than the Malaysia’s as there is no quarantine requirement for fully vaccinated tourists in Turkey. Recently, Malaysia lifted its interstate travel restrictions. MAHB looks on track for recovery, but full recovery is forecast to happen by late 2023 or early 2024 led by domestic tourism.

10. A shareholder pointed out that the enhanced Malaysian Code on Corporate Governance discourages the appointment of politicians to the board. Director Datuk Azailiza Mohd Ahad took note of the revision. She mentioned that MAHB’s constitution allows its special shareholder, the Ministry of Finance, to appoint MAHB’s chairman. Notably, the current chairman is a politician who has served as the Pangkor state assemblyman in Perak since 2004.

The fifth perspective

MAHB’s share price has rebounded almost 60% from its bottom in October 2020. I dislike the operating agreement whereby it manages a number of loss-making domestic airports in Malaysia with the profitable ones subsidising them. Moreover, the potential disposal of the profitable Subang Airport is also a risk that investors should take note of.

https://fifthperson.com/2021-mahb-agm/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Created by Tan KW | Apr 25, 2024

Created by Tan KW | Apr 25, 2024

Created by Tan KW | Apr 25, 2024

Created by Tan KW | Apr 25, 2024

Created by Tan KW | Apr 25, 2024