Capital A 2Q2022 Preliminary Operating Statistics

Tan KW

Publish date: Mon, 25 Jul 2022, 06:56 PM

Capital A highlights significant performance improvement in 2Q2022

-

Number of passengers carried jump 633% YoY with highest load factor since 2020 of 84%

-

Relaunching of 159 international routes as international traffic returns

-

Incremental digital users and record breaking e-commerce delivery orders

KUALA LUMPUR, 25 July 2022 - Capital A Berhad (formerly known as AirAsia Group Berhad) (“Capital A” or the “Group”) has announced its operating statistics for its aviation, digital and logistics businesses for the Second Quarter of the Financial Year 2022 ("2Q2022").

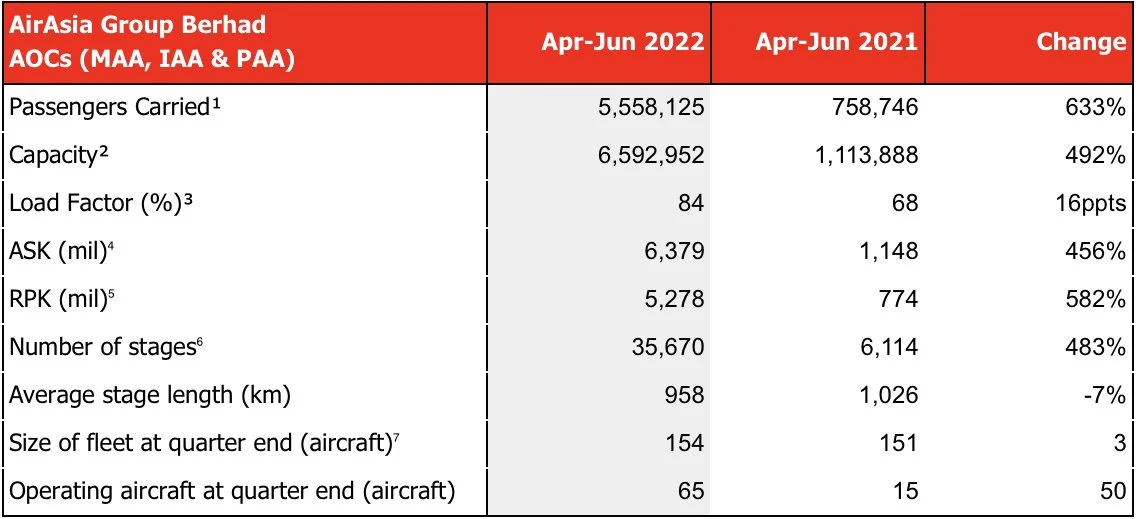

Capital A Berhad Consolidated Airlines continues to post significant performance improvement, with a notable load factor of 84%, akin to its pre-pandemic levels, signalling that air travel revival is well underway. The Consolidated Airlines carried over 5.6 million passengers, a 633% increase year-on-year ("YoY") and 48% increase quarter-on-quarter ("QoQ").

The Consolidated Airlines flew more than 35,000 flights in the quarter, up 483% YoY compared to the same period last year, supported by the growing domestic demand and the resumption of international travel in Asean countries. Correspondingly, Available Seat Kilometres (“ASK”) rose by 456% YoY and Revenue Passenger Kilometres (“RPK”) increased by 582% YoY. In 2Q2022, total operating aircraft for AirAsia Malaysia, AirAsia Indonesia and AirAsia Philippines were 45, 12 and 8 respectively.

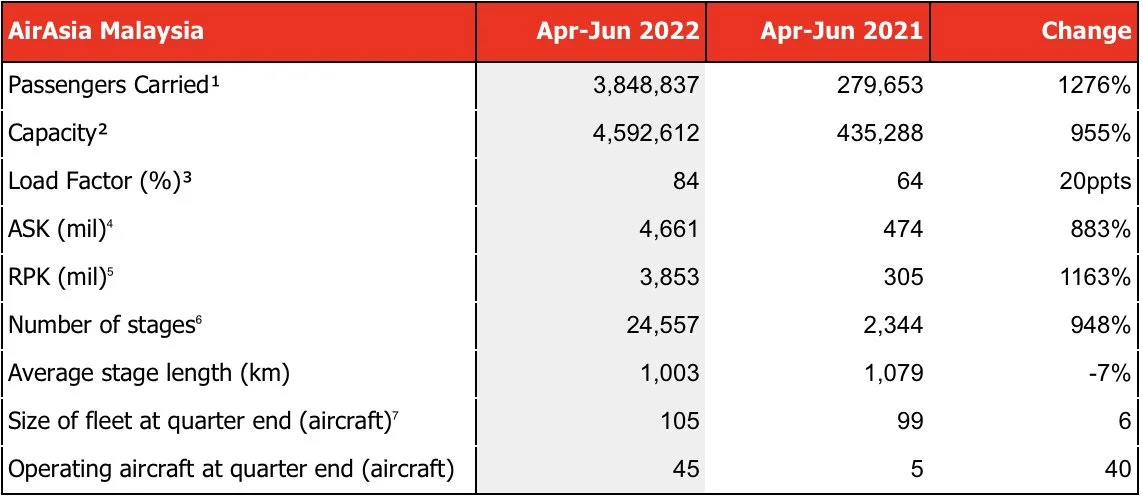

AirAsia Malaysia posted a stronger load factor of 84% in 2Q2022, up by 20 percentage points (“ppts”) YoY and 10 ppts QoQ. Passengers carried and capacity increased significantly by 1276% YoY and 955% YoY to 3.8 million and 4.6 million respectively, with more operating aircraft added to support the huge surge in demand for both domestic and international flights. Load factor for international flights achieved 81% with 31 additional destinations reinstated and the highest number of international passengers carried post pandemic, attributed mainly from Malaysia-Singapore routes, followed by Malaysia-Indonesia and Malaysia-India routes.

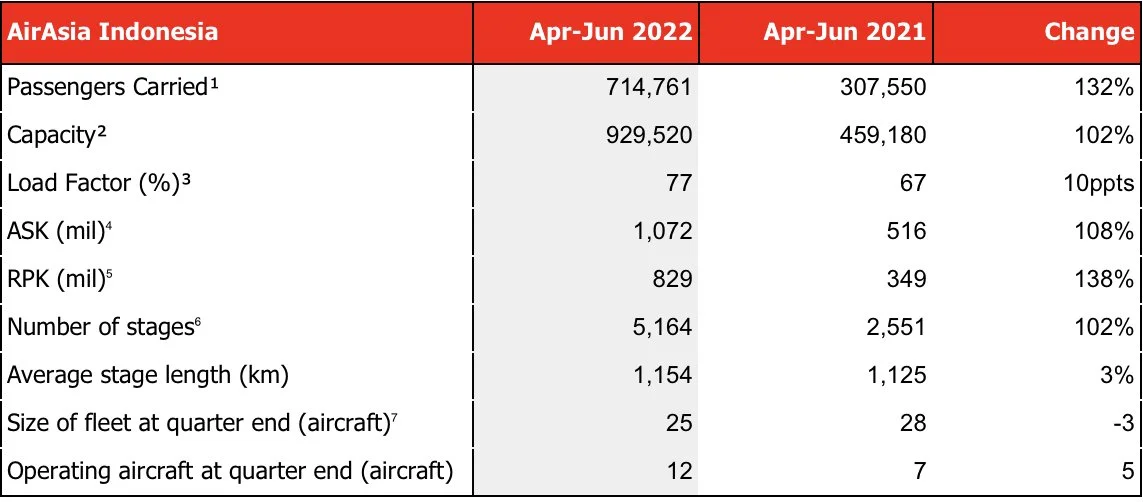

AirAsia Indonesia recorded an encouraging load factor of 77% in 2Q2022, an increase of 10 ppts YoY. Domestic flights achieved a healthy load factor at 73% while the load factor for international flights was stronger at 86%. Passengers carried and capacity improved by 132% YoY and 102% YoY respectively, on the back of the resumption of international flights, with 29% of the total number of seats sold from international flights. The number of flights flown has increased by 102% YoY.

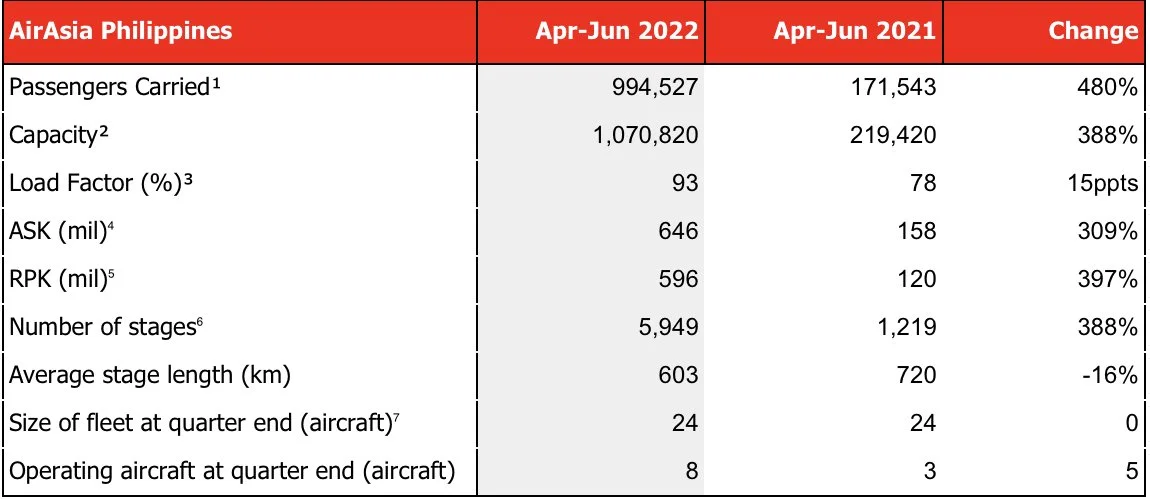

AirAsia Philippines posted the highest load factor among the Group's airlines at 93%, which grew by 15 ppts YoY. In 2Q2022, the number of passengers carried increased by 480% YoY and capacity expanded 388% YoY. Flight frequencies were added on popular routes to meet strong demand which increased ASKs by 309% and the number of flights flown jumped 388% YoY. In June, AirAsia Philippines resumed international routes to Kota Kinabalu, Seoul, Hong Kong and Guangzhou.

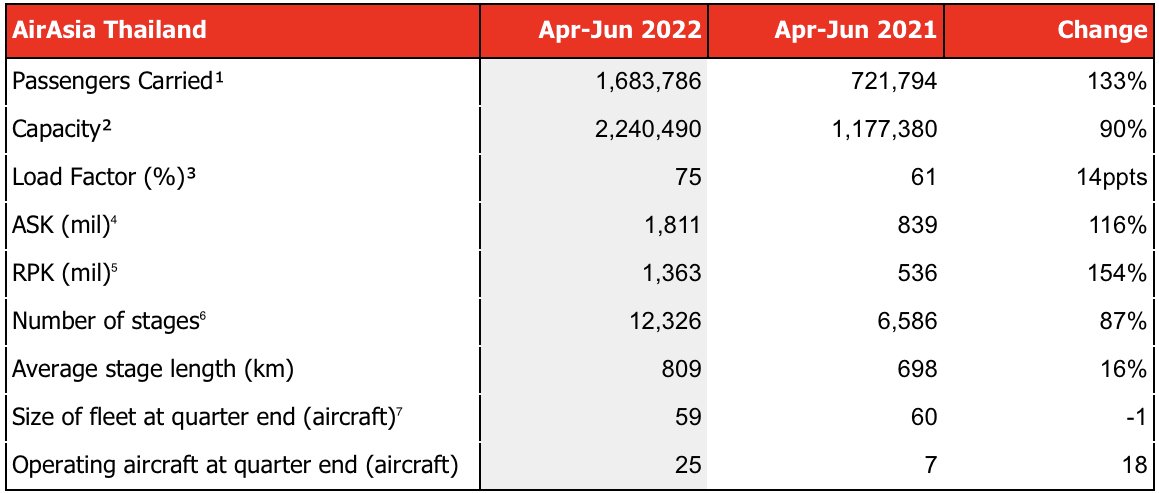

In 2Q2022, AirAsia Thailand carried over 1.7 million passengers, up 133% YoY with a load factor of 75%, rising 14 ppts compared to the prior corresponding period. The airline added flight frequencies and routes to meet rising demand, resulting in an 87% increase in flights flown, to a total of 12,326 flights with 25 operating aircraft during the quarter. More international flights were reinstated during the quarter, operating 19 routes to 8 countries by the end of 2Q2022. As a result, the ASK and seating capacity significantly rose by 116% and 90% respectively as compared to the same period last year. Additionally, the average sector length grew by 16%, mainly driven by flights from the South Asian market.

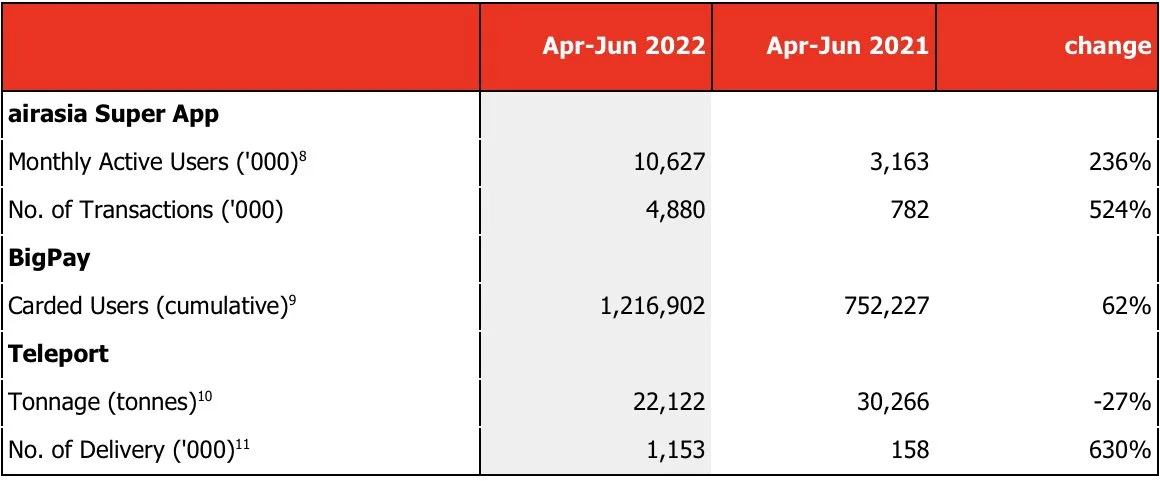

For Capital A's digital businesses, airasia Super App achieved a record high growth in average Monthly Active Users (“MAU”) which stood at 10.6 million in 2Q2022, up 236% compared to the same period last year. This is primarily due to the strong return of travel and increased user acquisition on the mobile app. Additionally, the number of transactions increased 70% for QoQ comparison and climbed five times as compared to the second quarter last year. These were driven primarily by increasing transactions from Flights, airasia ride, FlyBeyond, and SUPER+.

BigPay reached 1.2 million carded users in 2Q2022, a 62% increase from the same period last year. This was mainly driven by strong market adoption over the past year and throughout this year in line with the travel recovery and the expansion of product offerings, such as DuitNow payments and transfers, additional remittance corridors, and one of the first digital lending products in Malaysia.

For Capital A's logistics business, Teleport transported slightly lower cargo tonnage by 27% YoY due to the extended lockdowns imposed in China that began in March 2022. Delivery, on the other hand, improved significantly, up 630% YoY. Teleport achieved a record-breaking total of 1.15 million deliveries in 2Q2022. This was in part due to Teleport’s onboarding of a large new ecommerce platform in 2Q2022 which accounted for 10% of delivery volume. The new platform is expected to boost growth in the industry significantly with Teleport’s robust expansion plans across the region this year.

Capital A Berhad Consolidated Airlines - Malaysia, Indonesia & Philippines

2nd Quarter 2022 Operating Statistics

Note: (i) The fleet count excludes:

Two (2) A320 aircraft leased to a third party airline

One (1) A330 aircraft wet-leased from AirAsia X (AAX) and operated under AK flight code

(ii) The operating statistics derived from one (1) A330 aircraft wet-leased from AAX and operated under AK flight code were included in table above except for the fleet count and operating aircraft

Malaysia

2nd Quarter 2022 Operating Statistics

Note: (iii) The fleet count excludes:

Two (2) A320 aircraft leased to a third party airline

One (1) A330 aircraft wet-leased from AirAsia X (AAX) and operated under AK flight code

(iv) The operating statistics derived from one (1) A330 aircraft wet-leased from AAX and operated under AK flight code were included in table above except for the fleet count and operating aircraft

Indonesia

2nd Quarter 2022 Operating Statistics

Philippines

2nd Quarter 2022 Operating Statistics

Thailand

2nd Quarter 2022 Operating Statistics

Capital A Berhad’s Digital and Logistics businesses

2nd Quarter 2022 Operating Statistics

Airlines

1) Number of earned seats flown. Earned seats comprise seats sold to passengers (including no-shows)

2) Number of seats flown

3) Number of Passengers Carried as a percentage of Capacity

4) Available Seat Kilometres (ASK) measures an airline’s passenger capacity. Total seats flown multiplied by the number of kilometres flown

5) Revenue Passenger Kilometres (RPK) is a measure of the volume of passengers carried by the airline. Number of passengers multiplied by the number of kilometres these passengers have flown

6) Number of flights flown

7) Number of total aircraft at quarter end

Digital and Logistics

8) Number of unique users who visit a site within the month

9) Number of users with an active card

10) Cargo capacity sold and utilised

11) Number of parcels sold and delivered

¹ Capital A Berhad Consolidated Airlines refers to Airlines whose financial and operational results are consolidated for financial reporting purposes and these are the Malaysian, Indonesian and Philippines Airlines.

https://newsroom.airasia.com/news/capital-a-2q2022-preliminary-operating-statistics

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Created by Tan KW | Apr 24, 2024

Created by Tan KW | Apr 24, 2024