Scope Industries (0028) – Sonos smashed earnings expectations by 258%! And what this means for Scope’s results next week and beyond.

Axcapital

Publish date: Sun, 22 Aug 2021, 02:22 PM

In our last KLSE market update (https://klse.i3investor.com/blogs/klsebullrun/2021-07-24-story-h1568782177-Get_ready_for_a_major_KLSE_bull_run_from_now_until_end_2021.jsp) we told investors to look out for updates on Scope, which was our top pick for 2021-22, with multi-bagger potential. Here is why…..

Sonos is Scope’s ultimate customer and how well Sonos does will directly flow through to Scope’s orderbook. This is done via Inventec Appliances, which is Sonos’ manufacturing partner and 10% major shareholder of Scope. Inventec outsources its production to Scope for Sonos’ smart-speakers and audio products.

Last week, Sonos 3Q21 earnings smashed estimates by 258%! And has been doing it 4 quarters in a row. Wall Street expected a loss of $0.17/share but Sonos reported a mega-turnaround profit of $0.27/share!. Revenue also beat expectations by 18% and has done this also 4 quarters in a row. More importantly, management further raised its revenue and EBITDA guidance for 2021.

Why is this important? Because when Sonos does well, so will Scope. Scope is scheduled to report its 4QFY21 next week. Based on remarks made by the senior management of Sonos in their earnings call, Axcapital firmly believes that Scope is on the cusp of a major re-rating after next week’s results.

Sonos CEO, Patrick Spence said that basically they have so much order backlog that it will take the whole of 2022 to fill them…. Guess what? THESE ORDERS ARE COMING TO SCOPE!

In other words, Sonos CFO, Brittany Bagley is saying that Sonos orders to Malaysia has been slower-than-expected due to Malaysia’s covid situation. What this means to us is that the next few quarters and years is when we can expect Sonos orders to Scope to exponentially accelerate! Our channel checks suggest that Scope is nowhere near full capacity at the moment, possibly only at 70%. We expect new capacity to start coming onstream from October 2021.

Axcapital is expecting Scope to report a mind-blowing 4Q21 (YE June) next week, due to Sonos excellent results. We will not be surprised if Scope doubles its profits QoQ (3QFY21 was RM1.8m net profit). Assuming 4Q net profit of RM4m, then for FY22, this could imply minimum net profit of RM20m (if we include some growth from new capacity). The fastest growing tech companies in Malaysia trade at 30-50x PER, which would imply 2022 target price for Scope of 50-90sen at similar multiples.

Investors have seen similar multi-bagger potential from other successful EMS stocks such as Frontken, VS Industries, QES, Genetec, UWC, Dufu etc. Scope has only one institutional shareholder (Affin Hwang Asset Management) and has zero analyst coverage. Its market capitalization of RM350m with a large free float, in Axcapital’s experience as a small-cap analyst and fund manager, will inadvertently attract institutional broking coverage and institutional small cap funds when further evidence of its turnaround gathers momentum in the quarters ahead. This will lead to valuation multiple expansion, into the 50x P/E that typically exemplifies high-growth technology companies. The combination of earnings acceleration and multiple expansion is the KEY to multi-baggers in investments, as it happened in gloves and also technology.

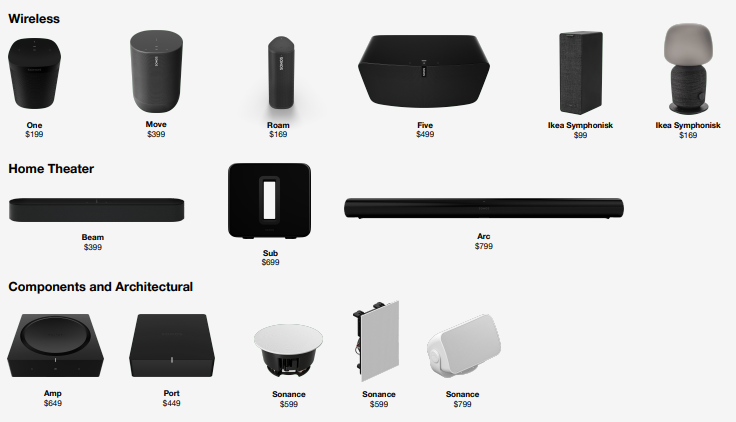

For investor’s interest here is the range of Sonos’ audio products produced by Scope: -

Disclaimer: The views presented herin does not constitute a recommendation or solicitation to buy or sell the securities mentioned herein. All information and opinions expressed are subject to change without notice. The publisher may from time to time have a position in the securities mentioned. This publication is based on pulicly available information and any information from sources are believed to be reliable but we do not make any presentations as to its accuracy or completeness.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Axcapital's investment blog

Created by Axcapital | Oct 17, 2021

Created by Axcapital | Sep 25, 2021