DXN Holdings IPO Note – A global powerhouse in health and wellness products

kltrader

Publish date: Thu, 18 May 2023, 09:38 AM

Valuation / Recommendation

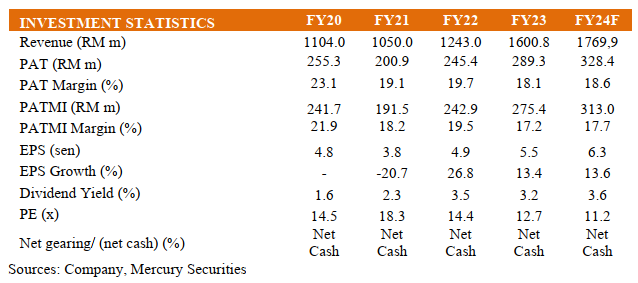

We have a SUBSCRIBE recommendation on DXN Holdings Berhad with a target price of RM0.95 based on FY24F EPS of 6.3 sen and a PE of 15x which is in line with the consumer products & services sector’s FY24F PE.

We like the stock for its global market presence and established integrated supply chain equipped for an attractive expansion plan, well-positioned to leverage on the growth of the global market size of health and wellness product which is estimated by Frost & Sullivan to grow at CAGR of 10.1% from 2022 to 2026. The target price represents a potential return of 35.7% over the IPO price.

Investment Insights

Strong global market presence. DXN Holdings has established a global market presence in 180 countries, with a particularly noteworthy stronghold in highgrowth markets like Peru and Bolivia, with market shares of 33% and 25% respectively. In FY22, DXN's oversea segments contributed to 92.9% of their impressive RM1,243.0mil gross revenue. Despite the challenges posed by the COVID-19 pandemic, DXN has achieved a CAGR of 6.1% in revenue from FY20 to FY22, driven by its highly scalable and sustainable business model and an extensive distribution network encompassing 14.9m registered members with over 3.6m active members as of LPD (31 March 2023).

Established pipeline for global expansion. DXN operates a vertically integrated supply chain in which they in-house manufacture 90.9% (327 SKUs) of their direct selling products in FY22. DXN currently own 2 research & development, 6 cultivation, and 10 manufacturing facilities strategically located in Malaysia, China, India, Indonesia, and Mexico. DXN plans to establish new manufacturing and cultivation facilities in India and China to boost production capacity which is expected to commence in 2Q23. DXN plans to enter into 5 additional markets in Latin America and Africa region by 2024.

Experienced management team. The company is led by Chairman Datuk Lim Siow Jin, the founder of DXN Group, who brings over 25 years of experience in leading the key senior management team. Since its privatization in 2011, the company achieved an 11-year CAGR of 14.5% for its revenue.

Risk factors. (1) Operational non-compliance risk across multiple countries. (2) Product regulatory risk across multiple countries.

Business Overview

DXN Holdings is primarily involved in the sale of health oriented and wellness consumer products consisting of

fortified food and beverages (FFB), health and dietary supplements (HDS), personal care and cosmetics (PCC) and

other products. Additionally, DXN provides laboratory testing services for external clients, offers lifestyle products,

and operates a café to support its core business.

Listing Details

| Listing Date | 19 May 23 |

| New Shares (m) | 160.0 |

| Offer For Sale (m) | 772.68 |

| Funds Raised (Rm m) | 112.0 |

Post Listing

- Ordinary shares (m): 4,985.0

- Market Cap (RM m): 3,500.0

- Free Float: 18.7%

- P/E (FY23): 12.7x

Major Shareholders

- LSJ Global 65.2%

- Gano Global 13.3%

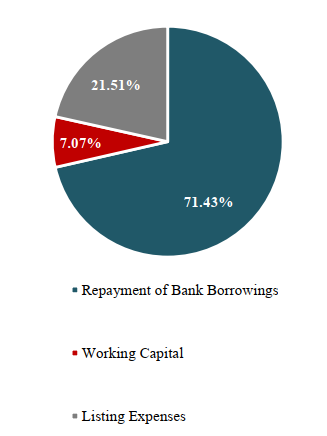

Utilization of IPO Proceeds (RM m)

- Repayment of bank borrowings (Within 12 months) 80.0

- Working Capital (Within 6 months) 7.9

- Defray expenses relating to IPO & listing (3 month) 24.1

Source: Mercury Research - 18 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on KL Trader Investment Research Articles

Created by kltrader | Apr 12, 2024