Ekovest: Answers to most of your questions

Jay

Publish date: Thu, 26 Jan 2017, 07:00 PM

Consider this my CNY gift for you before I go on a break. As time goes by, more and more people has joined Ekovest and hopefully this article (in the form of a simulated Q&A) will help clear some of the confusion that newcomers may have about the company.

Is Ekovest a construction company?

Yes and no. In the past, Ekovest’s main profit contribution comes from construction (and likely to remain so in the near term) but it also owns highways and property development. Under highways, there are Duke 1 & 2 which is held under a subsidiary called Kesturi. Duke 2 is targeted to open by June this year and Ekovest is now constructing SPE (or previously known as Duke 3). Property development segment was not active in the past but now they are doing EkoCheras and EkoTitiwangsa. Longer term plan will be KL River City where Ekovest will clean up the KL River and develop properties all along it.

How significant is the 40% disposal of Kesturi to EPF?

It is very significant. Not only Ekovest gets to monetise the assets, it also gets a hugely creditable partner. Just to illustrate, the RM1.13b consideration for 40% is essentially valuing 100% of Kesturi at RM2.8b. The current market cap of Ekovest is RM2.2b.

Did EPF overpay for Kesturi?

Maybe yes, maybe not. Projections into the future always has a margin of error. As a minority shareholder, I don’t have access to the whole due diligence process but EPF must have like it a lot to pay a good price for it. Highways revenue is all about traffic x toll rates. Toll rates are foolproof under government concession and will be adjusted upwards every few years. Only uncertainty is traffic volume. For outsiders, we only can see the Duke 1 traffic. Duke 2 will start soon and it’s supposed to complement Duke 1 so that part we shall see. And also not forgetting Duke 1 & 2 concession will last until 2059 + 10 years extension option. Most other highways like Plus, SILK will end around 2030s. It’s also due to this extremely long concession period, that’s why EPF is buying at a premium.

What about the highway IPO?

When EPF bought Kesturi, to safeguard their interest, they want Kesturi to achieve an IRR of at least 10% by 5+2 years, either by listing the highways or selling it. Most likely it will be done through an IPO to get the best value. As long as Duke 2 does not underperform significantly and market doesn’t crash for the whole next 5 years, it is likely the IPO can be done and will receive good response. A lot of institutional investors like concession assets (except loss making one like SILK) and EPF’s presence will give a lot of confidence.

As shareholder, will I get a piece of the future highway IPO?

Depends on how the proposal is structured and how much financing Ekovest needs at that time. Post-IPO, Ekovest may want to remain as the major shareholders so investors are likely to subscribe through new shares. Ekovest and EPF as the vendors can also choose to sell some of their shares. For Ekovest, selling their shares will get cash which can be injected into its remaining biz or alternatively, if they don’t need that cash, they can freely distribute to its shareholders.

So what’s the status of the proposals?

EGM was cleared unanimously and government’s approval for sale was also obtained. So now the disposal has become unconditional. The disposal is essentially completed. The rest to be implemented will be the special dividend 25c and 2 to 5 share split.

How will special dividend and share split work?

Special dividend will be 25c (not 28c). After dividend, every 2 shares you own will be split into 5 shares. Ex-date is likely somewhere February.

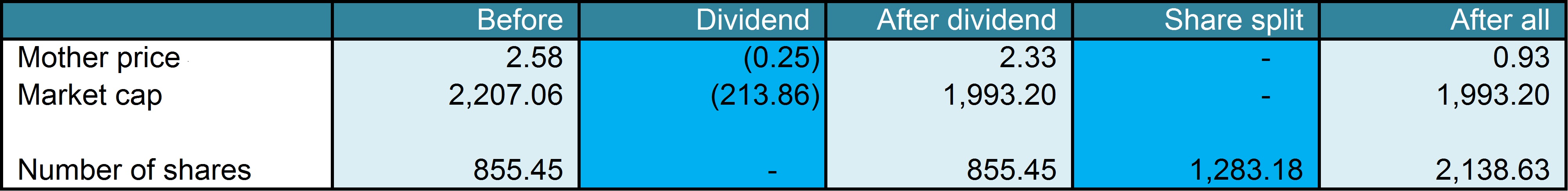

Based on today’s price 2.58, this is what it will look like:

Share price will be reduced by the 25c special dividend. Share split is essentially just arithmetic, market cap doesn’t change, only number of shares, so your share price will be adjusted accordingly. So at RM2.58, after ex-date, it will be trading at RM0.93. With the much lower price and increased number of shares, it is expected that it will be more actively traded and may be more volatile as well.

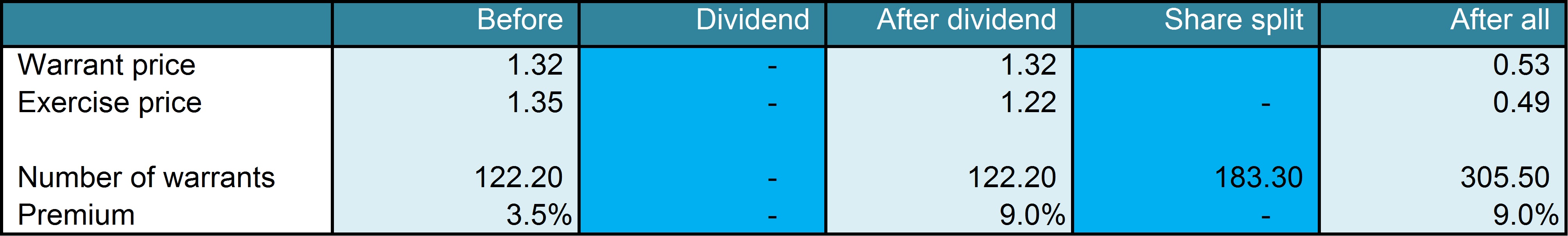

For warrants:

Calculations:

All these formulas you can refer back to the by-laws (which most people don’t read) when the warrants were first listed. It’s all there.

So warrant is diluted by dividend?

Yes, all warrants are diluted by dividend. That’s why for companies that pay generous dividends, warrant premium is not very high to take into account future potential dilution. But for special dividend, exercise price is adjusted so warrants are impacted but not as much.

So should I choose mother or warrant?

If you like Ekovest, both are good choices depending on your preference. To invest in warrants, what you need to be aware of is premium. In lay man’s term, premium is the extra amount you effectively pay if you buy warrant today and exercise it to mother shares instead of buying mother share directly.

So why do people pay a premium and how much should the premium be? Imagine if you buy Ekovest today at RM2.58 and it shot up to RM3, you get 16.3% return. Warrant which is in-the-money now will also probably move by similar quantum, so say from RM1.30 to RM1.70 (up 40c, slightly lesser than mother), that’s 30.8% return. The leverage effect is huge.

And for those who study classical option pricing model will know that the longer the time to expiry, the higher the intrinsic value or the higher the volatility will all translate to a higher premium. Ekovest warrant has another 2.5 years to expiry and it is still an uptrend stock so it still has healthy volatility (compared to bad volatility which goes down). Intrinsic value is what you think Ekovest is worth. Combined, the premium one is willing to pay will be different from the other, depending on your views on the company.

To sum it up, Ekovest WB will give you higher return when mother goes up, higher losses when mother goes down and is not entitled to any dividend (value will be slightly diluted every time dividend is paid)

Is the current trailing PE around 11 times considered cheap?

In the quarter before this, there’s a large revaluation gain. If you take it out, PE is much higher. And as some sifu pointed out, the construction margin for last quarter was also exceptionally high, probably because of some larger recognition as Duke 2 is near completion and commencement of SPE. Normalised PE probably will be much higher around 20+ times. But if you look at just PE, then you are missing the big picture.

First on highways. Highways most of the time does not contribute much in net profit. The EBITDA is high, but most of the profit will be chewed away by amortisation and interest expenses as large borrowings are incurred to construct it. But once the borrowings are cleared, it will be a cash machine. So using a PE method is inappropriate. DCF is the method that should be used but we don’t have much information available. This is where EPF comes in. They have done their due diligence and they think that Duke 1 & 2 is combined worth RM2.8b. Did EPF overpay? I already addressed this above. So depending on your confidence with EPF, you can value the highway segment using their valuation as a basis and apply a, what I like to term, “confidence deficit discount” you feel like.

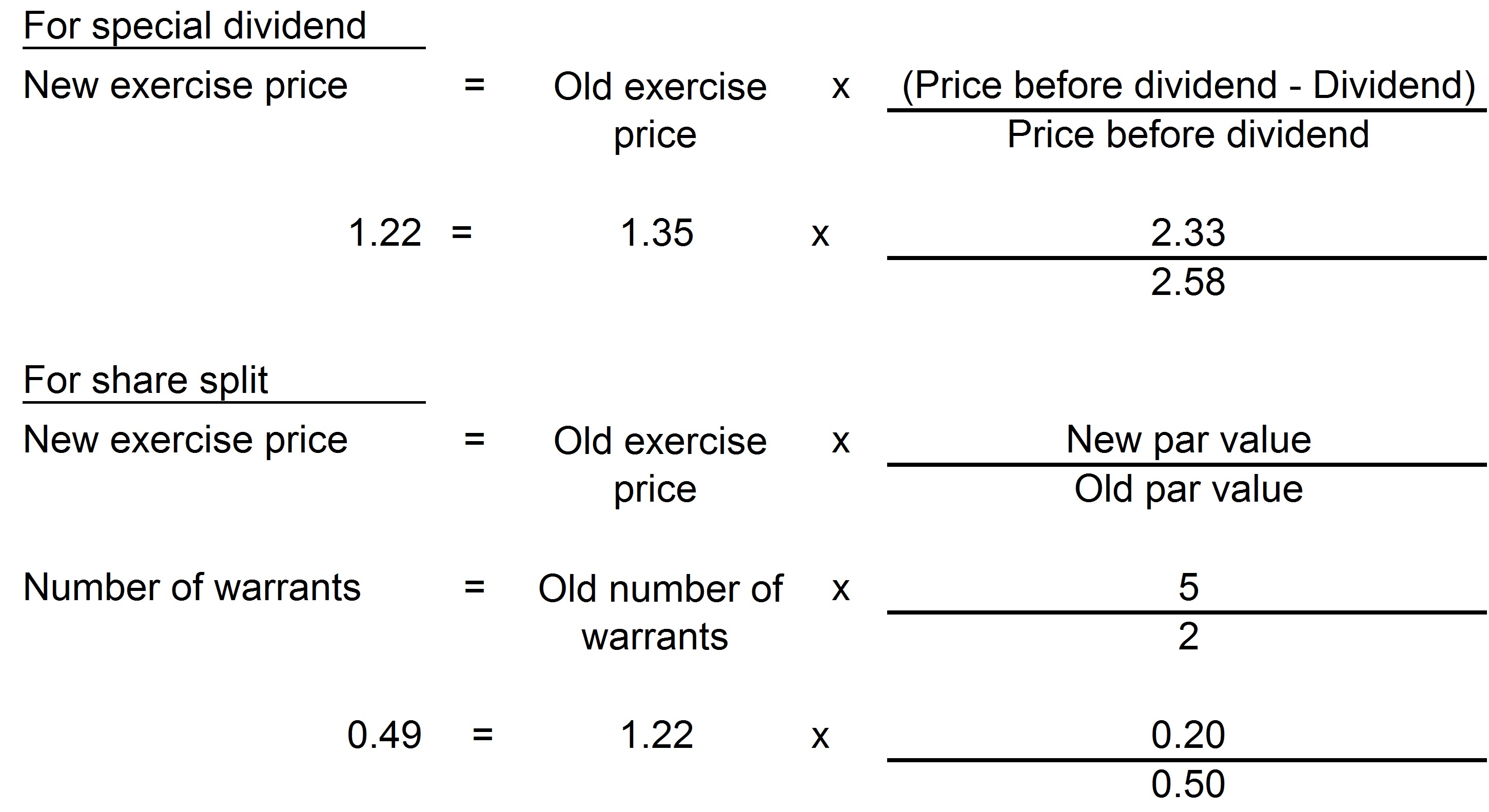

Next on construction. In FY2014, construction revenue was RM284m, 2015 was RM619m. Last quarter was around RM155m. But for construction looking at past revenue is useless. Orderbook is the indication of what future revenue would look like. Back in Oct 2016, the orderbook is around RM5.3b. For the past 3 months alone, they have won around RM1b new contracts and an approval in principle from the government for highway construction another RM6.3b. So at least for the next few years, you can sleep well and know that sales is secured, all they need is to seal it (by completing the construction work).

Do note that Duke 2A is included here but it is considered uncertain yet. Also Duke 2A is 75% owned by Ekovest, but I assume that construction jobs will be all passed to Ekovest as I don’t think the partner has the ability to do the job.

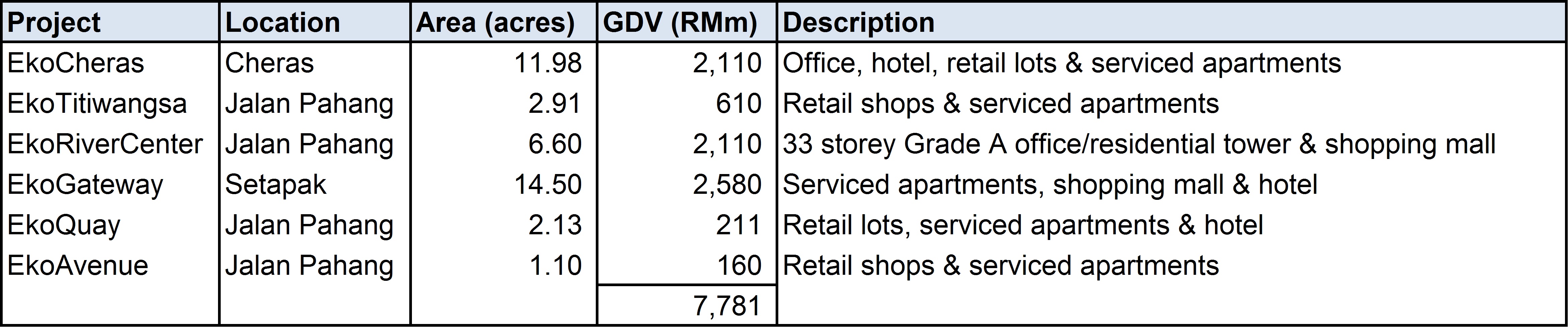

For property development, past 2 years revenue is only around RM50m and profit around RM10m. But last quarter alone revenue was RM18m and profit about RM5m. There are signs that Ekovest is ramping up the property segment. On the pipeline Ekovest is planning property development GDV worth RM7.8b but that’s in the future. For now, only around RM2.7b is in the works (EkoCheras and EkoTitiwangsa). The rest will come later and they already have the land.

In conclusion, using simplistic PE you will only get a glimpse of what the future holds for this company. It is good that the company already has all these plans and it does seem challenging but achievable. The CEO is also targeting to transform the company to a RM10b market cap company in a few year’s time. It’s a bit ambitious if you ask me, but hey it’s good that he has high targets isn’t it?

Last question, why is Dato Harris keep on selling Ekovest shares?

Beats me, I honestly don’t know. All I know is Dato Harris is not the biggest shareholder of Ekovest, he is not a director and he has been selling shares all the way from when Ekovest was trading below RM1.50. Again if you simply take his disposal as signs of Ekovest being overvalued, then you miss the big picture again. He kept on selling and Ekovest price keep soaring. And do notice when he sells, many of them are off-market in big blocks. The buyers are most likely institutional investors or high net worth individuals. So if Dato Harris needs cash (for whatever reason) and there are ample serious investors willing to buy, I don’t see an issue with it.

*I hope that after this simulated Q&A session, now you get to understand this company better.

Here I wish everyone a prosperous CNY and a good year ahead for you and your family.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Jay's market diary

Created by Jay | Nov 17, 2018

Created by Jay | Nov 05, 2018

Created by Jay | Oct 14, 2018

Discussions

10b market cap by 2020 according to my highly respected Dato LKC, and you wondered why most of the i3 credible sifus are in this counter. Idw to name it out here, can check it at the Eko forum.

2017-01-26 19:43

I think the warrant price after split & special dividend is wrong at 53 cents.

Should it be [RM1.32-(RM1.35-RM1.22)] x 2/5 = 47.5 cents?

2017-01-26 22:05

One of the best articles so far in i3, honest, fair & easy to understand. Thank you for sharing & writing, Jay

2017-01-26 22:07

Guys can click in cheated and see his comments in i3 so far. Haha, what a stray dogs who pee anyhow everywhere. useless fella

2017-01-26 22:35

I strongly believe that this "cheated" is kepala tak berotak, that's why he named himself "cheated", because he is acting stupid no matter how many thousand times the question were answered & explained.

2017-01-26 22:39

Good stock to own. Plan to add further. Cares about Dato Haris selling, he already made his bucks, so he exit the business.

2017-01-30 16:16

Jay, you seldom write. I think you can help us more here by writing more....Your inputs really good, if not great one

2017-02-01 01:57

Very nice article, shoot all the points, i didnt waste any single second reading this

2017-02-02 12:59

don't even look at trailing PE ratio.....

this company is not about PE ratio because most of its profits is from one off construction profits of its toll roads.

This company is about its assets and potential.

2017-02-02 13:36

thanks. I only write when there are enough materials and it's something that others haven't picked up or are not writing about it. I don't like to produce just another generic article

2017-02-02 18:18

this post is great! i learn more about ekovest as im in my progress of analyzing this stock and the company.. thank you

2017-03-03 15:53

glad to see after some time people are still reading. shows that they are researching rather than blindly go in

2017-03-03 15:58

Wonder where are these jokers, "sell" & "cheated"? They always jumping like monkeys everywhere they go.

cheated If Ekovest damn good Dato Haris should buy not sell.

26/01/2017 22:18

2017-03-03 17:07

hi jay, for ekovest duke 1&2 and SPE highway, who will bear the construction of all these highways cost, isit ekovest itself or the government. Hope you can clarify this. thanks.

2017-06-10 15:09

VenFx

Big like to Ekovest simulated Q&A.

Gd job Jay.

2017-01-26 19:25