Triplc Part 1:Why Triplc is too cheap to ignore and Puncak Niaga's role in unlocking its value

Jay

Publish date: Tue, 19 Apr 2016, 04:55 PM

Why Triplc is too cheap to ignore and how Puncak Niaga’s acquisition is about to unlock this deep undervalued company

Disclaimer first: As only HOA is signed at this juncture with no further details available, this article is just to shed some light on the possible acquisition from Puncak Niaga, highlighting the possible outcomes and ascertain the value of Triplc. If you prefer only concrete facts when the companies sign the sales & purchase agreements, you may stop reading here and wait until the companies announce the outcome of the due diligence.

Note: This is a longer than usual article but if you are patient enough, I shall illustrate step by step why Triplc is potentially worth more than RM4.00 per share (last traded RM1.45)

Who is Triplc?

This is how the company describes itself:

“TRIplc Berhad was incorporated in Malaysia on 23 June 1992 as a private limited company under the name U-Wood Holdings Sdn Bhd. It was converted to a public limited company on 12 September 1992 and was listed on the Main Board, now known as Main Market of Bursa Malaysia Securities Berhad on 18 August 1993. The name of the Company was changed to TRIplc Berhad on 12 December 2005.

A Bumiputera company registered with Construction Industry Development Board (”CIDB”) Grade 7 Sijil Perolehan Kerja Kerajaan (“SPKK”), today, the core activities of the Group (“TRIplc and subsidiaries”) are construction, property development, project management services and facility management services. The Company and its wholly-owned subsidiaries, TRIplc Resources Sdn Bhd and TRIplc Ventures Sdn Bhd were accredited ISO 9001:2008 by an internationally recognised certification body, Det Norske Veritas (“DNV”), for their quality management system in project management and construction.”

(Source: Annual Report 2015)

More importantly, what does it do?

If you look at its segment reporting, excluding property investment and investment holding, the main segments are property development, property construction and service concession.

A closer look at their past results, you would notice that property development generates pathetic revenue and low/negative profit. So strip down to basics, it is mainly a construction and concession company so let’s see what kind of contracts they have gained over the years.

|

Year |

Contract |

Value |

|

2003 |

Construction of academic block and students’ accommodations for Universiti Teknologi MARA (“UiTM”) at their campus in Taman Puncak Perdana, Section U10, Shah Alam, Selangor |

RM110.41 million |

|

2003-2010 |

Construction of Zone 1 Phase 1 works of UiTM Puncak Alam Campus consisting of main infrastructure work, hostels for students complete with recreational and sports facilities, academic buildings and facilities for Faculty of Health Science, Faculty of Pharmacy and Students Plaza |

RM1.0 billion |

|

May 2010 |

A 23-year concession to undertake the construction and maintenance of Zone 1 Phase 2 of UiTM Puncak Alam Campus consisting of three (3) faculties to accommodate not less than 5,000 students, hostel accommodation for 2,500 students, 10 units of fellow accommodation, multipurpose hall, maintenance centre, prayer hall, library, student centre, cafeteria and health centre. |

Not available |

Basically they have one and only customer, UiTM. Then look at its shareholders list, the biggest shareholder is Tan Sri Rozali Bin Ismail with about 28% direct and indirect stake.

Put it all together, no prize in getting it right, it’s your typical Malaysia crony company.

And did I forget to mention how their subsidiary’s senior MTN program manage to carry a AAA rating from MARC? Well, it’s guaranteed by Danajamin, that’s how it’s done. So your company gets the contracts from MOE, borrow money based on the contract and guarantees by MOF, sit tight and laugh all your way to the bank. Welcome to Malaysia.

Current state of business without new contract

Zone 1 Phase 1 and Zone 1 Phase 2 construction packages are done by now. Zone 1 Phase 2 is slightly different whereby there is also a concession part. So basically, Triplc did the construction work for UiTM for the first 3 years, then receive a fee for maintaining the building after construction is completed.

That explains why the revenue plummet from FY 2015 onwards as maintenance work carries much lesser revenue than construction.

Moving forward, based on the maintenance works itself, its earnings will remain subdued, most likely RM5-6 million a year, which means it is trading at about 17-20 times PE. It does however have a large net asset base, at about RM152m compared to its market cap of less than RM100m, or RM2.30 per share compared to its last trading price of around RM1.50 per share.

Timely contract boost

Just as their revenue and profit dries up, they are awarded another contract last February. Guess what? Now it’s Zone 1 Phase 3 of the UiTM campus. This time round it’s RM599m for construction in the first 3 years plus another 22 years of maintenance concession.

To recap, they also announced last September they are selling 338.67 acres of land located in Bandar Sungai Buaya, Mukim of Serendah, District of Ulu Selangor, State of Selangor Darul Ehsan for a total disposal consideration of RM140,148,420.00 to be satisfied entirely by cash. This piece of land is carried in their books at about RM37.2m. Once it is completed, you are looking at a whopping gain on disposal of RM100m which is above their market cap.

Possible outcomes

So what is Puncak buying actually? As there are scant details now, we can only speculate. A general offer is unlikely although not to be ruled out. Most likely outcomes are the acquisition of Triplc Medical (Zone 1 Phase 3) or acquisition of both Triplc Medical and Triplc Venture (Zone 1 Phase 2).

What will the price be like?

Honestly, I don’t know. What I do know that it is unlikely to be reasonable for the transaction price to be determined based on PE or PB. It’s a concession, so most likely discounted cashflow will be used.

But lacking the details, DCF is difficult to be applied, so I’ll be using some shortcuts here and there.

For the Uitm projects, I will try to find out the fair value of Triplc Venture first (Zone 1 Phase 2), then I will use it as a proxy to derive Triplc Medical. Phase 1 is not used as proxy as there is only construction element and not concession.

Fair value accounting

Not much details are provided for Z1P2 contract. So if you look at the construction revenue for FYE 31 May 2012 to 2014, revenue recorded was about RM350m. Here’s where it gets interesting. During 2012-2014, the revenue and profit shot up and they dried up in 2015. This is understandable as from 2015 onwards, the only revenue and profit they recognise will be those of maintenance which is much lesser compared to construction. However during 2012-2014 their cashflows were extremely bad but they improved in 2015 onwards.

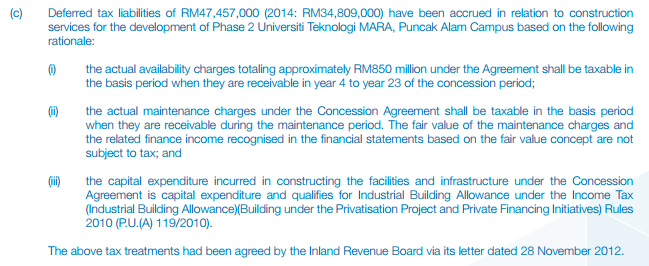

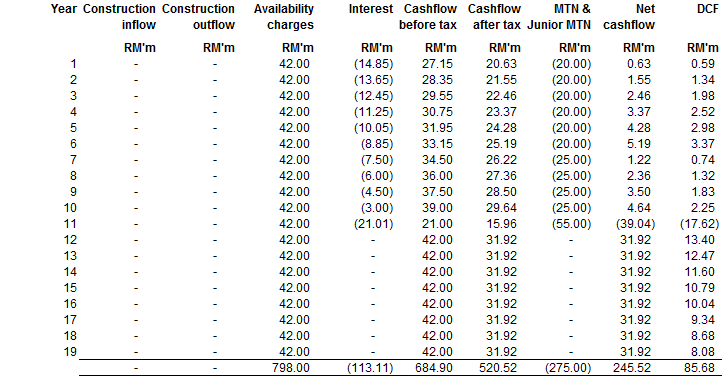

A closer look reveals that most of the construction costs will be paid by UiTM in the form of availability charges which comes to RM42m per annum. So over the 20 years period, Triplc should be paid RM42m x 20 or RM840m. This is confirmed if you look at c(i) of the deferred tax section in the annual report.

This means that the Z1P2 contract value is around RM850m instead of the RM350m revenue recognised. This is due to the fair value accounting whereby the revenue is recognised based on the fair value of the consideration received. In this case, the deferred cash payment of RM42m over 20 long years. So that means they can only recognise RM350m revenue but the actual cashflow will be much bigger. This is why this company has been flying under the radar as its revenue and profit are nothing special, but it will be extremely cash rich in the future.

Z1P2 valuation

So now we have a rough grasp of their accounting, let’s value Triplc Ventures.

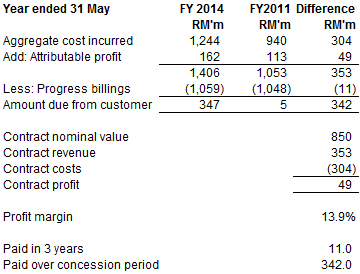

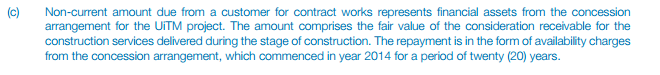

As the construction started from 2011 to April 2014, I took the amount due from customer’s amount and make a comparison. From there I estimated a contract revenue of RM353m which approximates what has been recognised in the 3 years income statement. I also discounted RM42m over the 20 years and include the RM11m above, getting about RM355m. So this confirms what we previously established whereby nominal value of the contract may be RM850m but actual recognised revenue is only about RM350m.

(Correction: As pointed out by kind reader, the Z1P2 contract value is RM266.5m, so included in the above calculation are probably some other construction contracts. So when I estimate the margin below for the Z1P3 contract, it is more of a blended contrcution margin instead of exclusively Z1P2.)

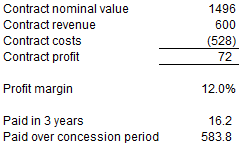

Using similar methods, I get the contract cost, profit and profit margin. These are important for the valuation of our next company.

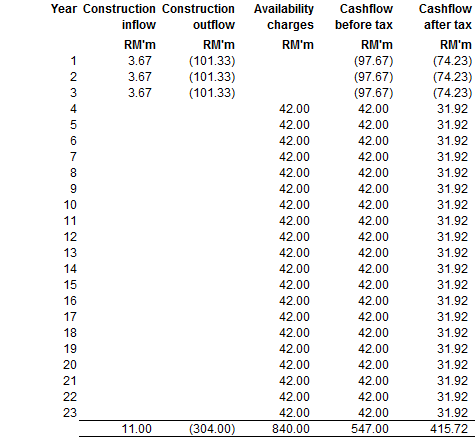

So the project cashflow should look like this.

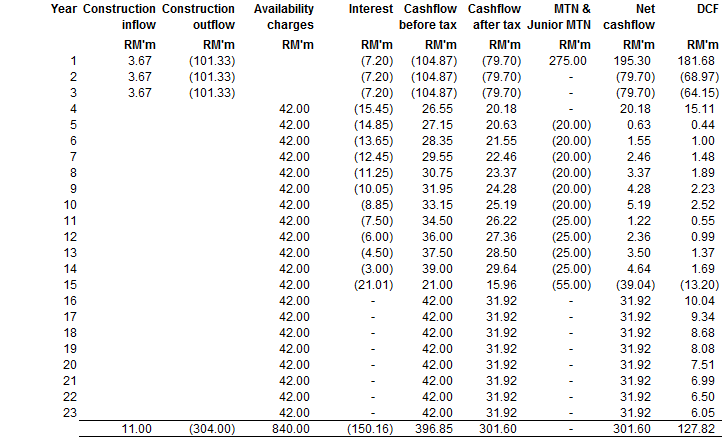

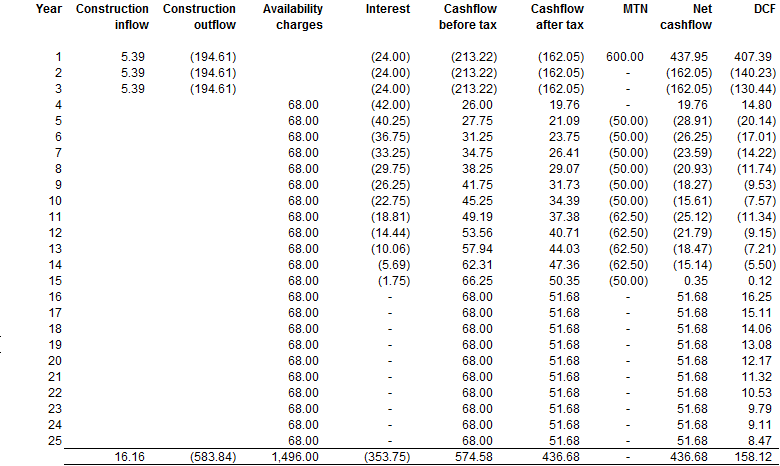

However, not to forget that they have interest cost and still need to pay off their debt. So my rough estimation of the cashflow should look like the table below. (cashflow discounted using 7.5% as disclosed in their annual report)

And since we are now in 2016, if we shift the timeline to estimate the DCF.

(As mentioned above, contract value for Z1P2 has been pointed out to be RM266.5m. However, assuming Z1P2 margin is similar to Triplc overall construction segment margin, the above calculation stil stands.)

We can also see from the annual report where it states that the amount due from customer is actually also fair valued.

If you recall from the contract revenue table, the amount due from customer is about RM340m, which means this RM340m is equal to the management’s estimate of the fair value of the future receipts from UiTM for Z1P2. But this is before accounting for interest (and maybe tax) and debt repayment. If those are taken into account, the equity value would be much lower.

In other words, I am estimating Puncak should pay a fair value of about RM80m to access the RM800m in the future and take on any future interest, tax and debt repayment (about RM275m).

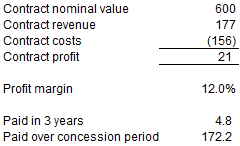

Z1P3 valuation

Based on the above margin estimated, we estimate the Z1P3 contract details as follows.

Let’s make another assumption that everything is similar to Z1P2 including the borrowings structure (amount raised relative to cost, repayment schedules, interest etc.).

Which means the fair value of Triplc Medical is about RM100m.

Bullish case

The above valuation was premised on Triplc Medical getting RM599m in future payments, so present value of revenue, costs and profits are much lesser. But as rightly pointed out by one of our forumers, it is likely the RM599m is present value! Links please see here: http://www.thesundaily.my/news/1594972

It fits. Uitm, hospital, RM599m etc. But knowing politicians, they always exaggerate things so I’m not going to consider the RM8.2b but apply similar assumptions as Z1P2. So project details and DCF value should be as follows.

So even if they only receive RM1.5b and not RM8.2b, we can expect the value to go up by almost 60%.

Summary valuation

In summary, I am valuing the subsidiaries of Triplc as below:

|

|

Approximate fair equity value |

|

Triplc Ventures |

RM80m |

|

Triplc Medical

|

RM100m/150m |

I do note that my valuation does not take into account general operating costs . My rationale is once construction is completed, renting out the campus should not incur much cost. Do also note that the calculations above only take into account the construction element of the contracts and not the maintenance part. So all in, I do think the maintenance income is sufficient to offset the general costs.

Recall that Puncak has received about RM1.5b from disposal of its water business. After paying special dividend about RM0.5b, they still have RM1b warchest. So they won’t have any funding problem if they really want to swallow these 2 main subsidiaries of Triplc.

My speculation is that they will acquire 1) Triplc Medical or 2) both. It does not make sense for them to acquire Triplc Ventures only. Yes cashflows are great but not much revenue or profit can be recognised, which may not appeal to Puncak shareholders.

Protection of shareholders

The crony companies are usually infamous for their poor corporate governance standards. However in this case, as Rozali is the major shareholder of both Puncak and Triplc, it is a related party transaction. Therefore, independent advisers will need to be appointed to advise the minority shareholders of both companies (assuming the transaction is substantial enough for Puncak). Well, I always doubt the independence of these so called “independent advisers”, but with these provisions in place, at least the advisers will try to make the price “look fair and reasonable”. In the case of Triplc, if indeed Puncak is buying both subsidiaries, this may be a major disposal and would require at least 75% of shareholders’ approval (excluding related party).

Fair value per share

If you have read so far, congratulation on your patience and let’s get to the most important part. Since the catalyst of the company are disposals, I prefer estimating the fair value based on net cash per share.

|

Disposal of subsidiary |

RM180m/230m |

|

Disposal of land |

RM140m |

|

Net cash excluding Triplc Ventures debts |

RM 25m |

|

Total equity value |

RM345m/395m |

|

|

|

|

Shares outstanding |

66m |

|

Add:ESOS (assume 10%) |

6m |

|

Total shares |

72m |

|

Blue sky scenario valuation |

RM4.79/RM5.49 |

So current share price is extremely cheap!?

Yes but it’s cheap for a reason.

Firstly disposal of subsidiaries value is based on my estimate, whether the acquisition happens and the details remain unknown.

Secondly, disposal of land is targeted to be completed by end 2016. Who needs 1 whole year to complete disposal of land? I did mention about these companies’ corporate governance standards right?

So until these 2 catalyst actually happen, the price is unlikely to shoot up anywhere near RM2.00, let alone RM4.00.

But I think it’s still too cheap to ignore this company!

Even without Puncak, the company

1) Is profitable every year;

2) Cashflow expected to get better;

3) Holds the Z1P3 contract;

4) UiTM continuous contracts;

5) Danajamin assistance for financing;

6) Disposal of land will unlock value which is higher than current market cap; and

7) Potential of special dividend or capital repayment (once disposal completes, they probably have to distribute most of it to avoid falling into PN16)

Of course I will have to update my assumptions once the S&P is signed. Until then, whether you choose to enter now, enter later pending announcement or shy away from this company, thanks for reading this far for an extremely long article.

#The author do hold Triplc shares and all above estimations are based on his understanding on the company’s accounts. If there are any errors, please feel free to point out. Thanks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Jay's market diary

Created by Jay | Nov 17, 2018

Created by Jay | Nov 05, 2018

Created by Jay | Oct 14, 2018

Discussions

You have to be careful with the DCF calculation. For the venture, only 20% of the DCF value is accounted for in the first 10 years, and 51% for medical. If you only go as far as 10 years, those 2 will only come up to EV of 235mil or $3.26.

2016-04-20 08:23

@Ricky Yeo thanks for the comment. yes I agree with you as they need to pay off the debts in the earlier years. the company will only reap the benefits in later years

2016-04-20 08:51

@ckk2266 thanks for highlighting that. missed that one out but the valuation shd still b correct as we have entered the availability charges phase. that estimation was only to try to estimate d profit margin

2016-04-20 13:52

there are no details on Z1P3 contract yet. If Z1P2 was RM266m but actual payment was RM850m over 20+ years, I wonder if the RM599m Z1P3 the actual payment would be over RM1.5b? what I'm estimating now is the opposite, meaning RM599m as actual payment and revenue/costs/profits are much lower. If indeed is the other way round, the value of Triplc Medical could b mind blowing

2016-04-20 13:55

@ckk2266 thanks a lot. indeed mind blowing!!! maybe I'll try doing a separate scenario if that is true

2016-04-20 17:07

thanks guys for the inputs, especially ckk2266. there's really only that much I can do in half a day after they announce the HOA, that's why all your feedbacks are much appreciated

2016-04-20 17:08

hi guys I have added a section based on the sun article. now let's see how this all pans out :) market cap now is only RM100m

2016-04-20 19:25

被严重低估的"建筑"股

Triplc 5622

与其说Triplc是建筑股,倒不如说它是家MARA大学寻租包赚股。

它的生意模式是拿政府合同建MARA的校舍赚建筑费。

然后最特别包赚这点是建好后把校舍租给MARA长达20余年,享有稳定的租金来尝还固定的低息贷款(以供建筑MARA校舍)。

过去完成的MARA校舍,目前享有每年稳定超过每股一毛的净利。

而今年2月又取得新的MARA医院校舍的寻租包赚合同RM5.9亿,相信很快又能给公司带来新的成长!

目前股价:RM1.75

目标价:RM3.50

EPS:RM0.11

本益比:16

【利好】

1)公司股票数量少,只有66,446,085股,市值仅1.15亿。容易炒高!

2)公司有60千多万现金

3)公司去年9月收了2%的订金以RM140m的高价卖了一片成本仅RM37m的土地。大约可在下半年完成,每股可净赚RM1块以上!

4)卖地以后,公司现金将成长到RM2亿或每股RM3,很有可能开始派息或大额资本回退。

5)今年4月18日与Puncak Niaga签了售卖生意意向书,如果成功,每股现金将增加到RM3.5-RM4.5之间!

【风险】

1)地的买主放弃2%订金,放弃买地(可能性不大,因为买主是雪州政府的子公司)

2)Puncak Niaga放弃收购(可能性不大,因为Puncak和Triplc有相同的大股东)

【后语】

买股最重要不仅是要买低估的公司,也要配合时势。估计8月18日Puncak Niaga将会出价买Triplc,这是一个股价被大幅炒高释放价值的最佳时机!

(买卖自负)

2016-06-11 14:19

jayloh

please do note that inclusion of debt and interest increases the DCF value. this is because their finance costs is lower than the discount rate

2016-04-20 06:53