COMEX Gold - Bulls Taking a Pause

rhboskres

Publish date: Mon, 26 Nov 2018, 10:14 AM

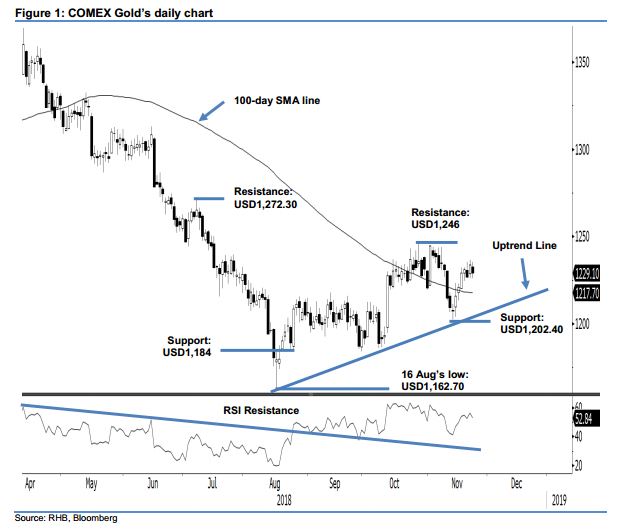

Maintain long positions, as recent sessions’ performances just indicate a pause. The COMEX Gold ended the latest session weaker by USD4.70 to settle at USD1,229.10. This was after it oscillated between a low and high of USD1,226.20 and USD1,235.50. The recent sessions’ price performance resemble the characteristics of a consolidation. By extension, we are not seeing signs that its upward move – which re-started after it came near to testing the uptrend line (as drawn in the chart) on 13 Nov with a low of MYR1,202.40 – is finishing. Lending support to this view is the fact that the commodity is currently trading above the 100-day SMA line. Towards the upside, at the minimum, we expect the immediate support to be challenged. Consequently, we maintain our positive trading bias.

As the COMEX Gold is undergoing a healthy consolidation – before likely resuming its upward move – we continue to recommend that traders keep to long positions at USD1,216. This was 14 Nov’s closing level. For risk-management purposes, a stop-loss can be placed at the USD1,202.40 mark.

The immediate support is expected at USD1,202.40, or the low of 13 Nov. The following support is at USD1,184, which was the low of 24 Aug. Moving up, the immediate resistance is set at USD1,246, ie the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 26 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024

.png)