FKLI - Attempting a Breakout

rhboskres

Publish date: Fri, 30 Nov 2018, 05:22 PM

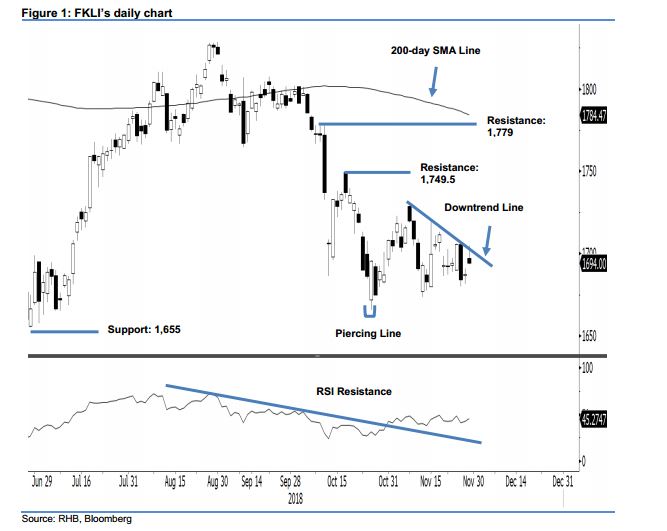

Maintain long positions as extension of a rebound is probable. The FKLI ended the latest session on a positive note – at one point it came near to testing the downtrend line (drawn in the chart). The session’s low and high were recorded at 1,693.5 pts and 1,704.5 pts, before closing at 1,694 pts, indicating a gain of 6.5 pts. Based on the current technical landscape, the overall bias for the index to extend its rebound is still firmly in place. However, to achieve deeper rebound, the index needs to break away from the said downtrend line. Once this has been overcome, chances are high for the index to be able to test our minimum rebound target of 1,749.5 pts. Based on this, we maintain our positive trading bias.

As the probability is still tilted towards extension of a rebound, we recommend that traders stay in long positions – which we initiated at 1,718 pts, or 2 Nov’s closing level. To manage risks, a stop-loss can be placed at 1,655 pts.

We continue to see the immediate support emerging at 1,655-pt level, the low of 28 June. This is followed by the 1,600-pt mark. Moving up, the immediate resistance is now at 1,749.5 pts, or the high of 17 Oct. This is followed by 1,779 pts, the high of 10 Oct.

Source: RHB Securities Research - 30 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024