WTI Crude Futures - Flirting With the Immediate Resistance

rhboskres

Publish date: Fri, 15 Feb 2019, 05:36 PM

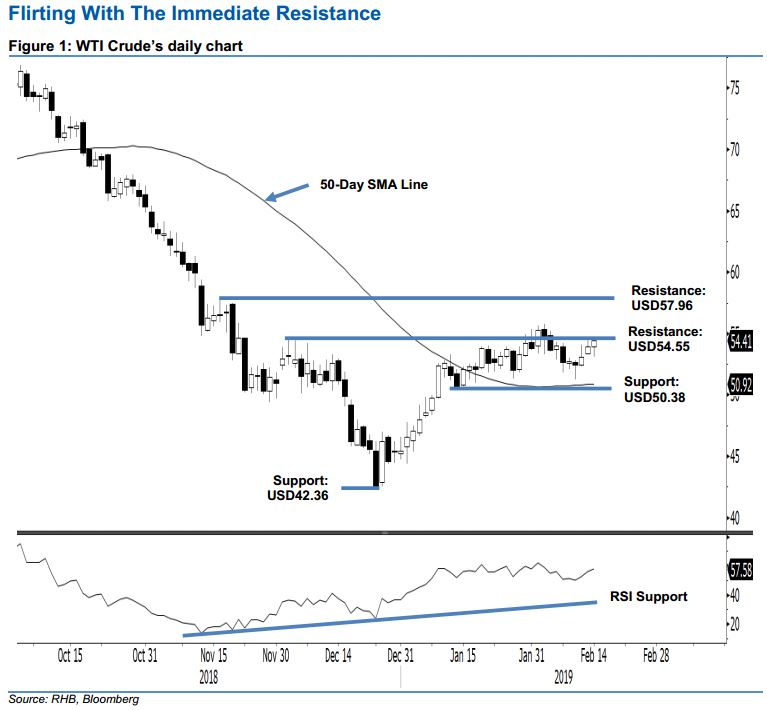

Maintain long positions as the immediate resistance is being challenged. The WTI Crude performed positively in the latest trading, at one point it tested the immediate resistance of USD54.55. Intraday movements were volatile as the bulls and bears battled around the said resistance, the low and high were at USD53.08 and USD54.68, before it closed USD0.51 higher at USD54.41. Overall, the commodity’s rebound that started from the low of USD42.36 on 24 Dec 2018 is still in place. Towards the upside, a firm breach of the said resistance would likely mark the end of the commodity’s consolidation phase around the 50-day SMA line and open the gate for further upward moves. Maintain long bias.

Given that the probability is higher for the black gold to extend its rebound, we continue to recommend traders to keep to long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stop-loss can be placed at the breakeven level.

The immediate support is pegged at USD50.38, which was the low of 14 Jan. The following support is at USD42.36, or the low of 24 Dec 2018. On the other hand, the immediate resistance is set at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 15 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024