FKLI - Consolidating Near Immediate Resistance

rhboskres

Publish date: Mon, 25 Feb 2019, 10:45 AM

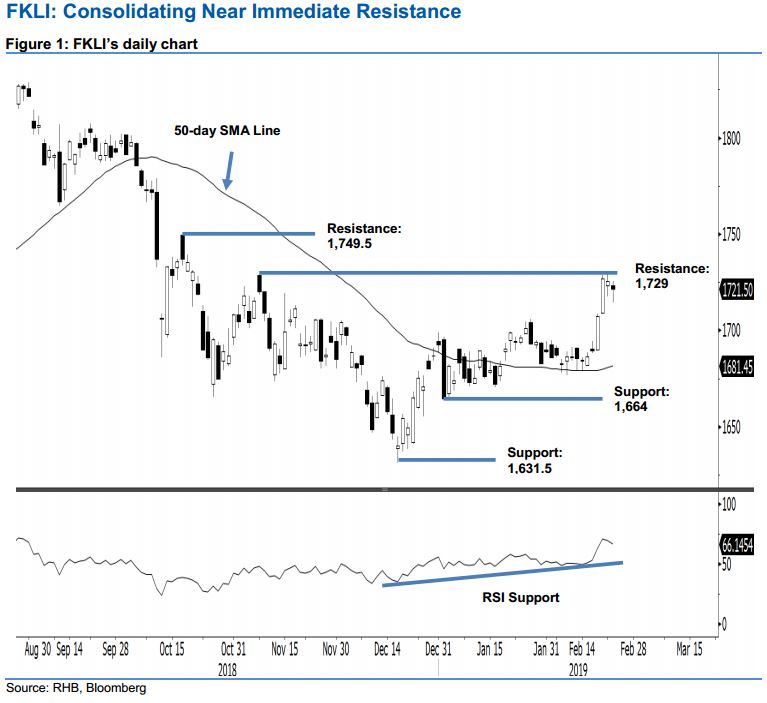

Maintain long positions as the consolidation is developing. The FKLI was trading mostly in the negative zone in the latest session, in the band of 1,714.5 pts and 1,725.5 pts. Towards the session’s end, it managed to narrow its losses to 4 pts to settle at 1,721.5 pts. Based on the latest two sessions, we observe that chances are high that it is experiencing a minor consolidation phase around the immediate resistance of 1,729 pts. This implies that we have not spotted a firm price reversal signal from the said resistance mark. This consolidation is deemed as healthy at this juncture to correct its relatively sharp rebound from the 50-day SMA line area recently. Maintain our positive trading bias.

Given the latest two sessions’ price actions are signalling a consolidation instead of a total price reversal from the said immediate resistance, we continue to recommend that traders stay in long positions. We recommended these positions at 1,707.5 pts, the closing level of 19 Feb. For risk management purposes, the trailing-stop is revised to the breakeven level.

Towards the downside, the immediate support is expected at 1,664 pts, which is the low of 2 Jan. The second support is at 1,631.5 pts, the low of 18 Dec 2018. On the other hand, the immediate resistance is set at 1,729 pts, the high of 8 Nov. This is followed by 1,749.5 pts, the high of 17 Oct 2018.

Source: RHB Securities Research - 25 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024