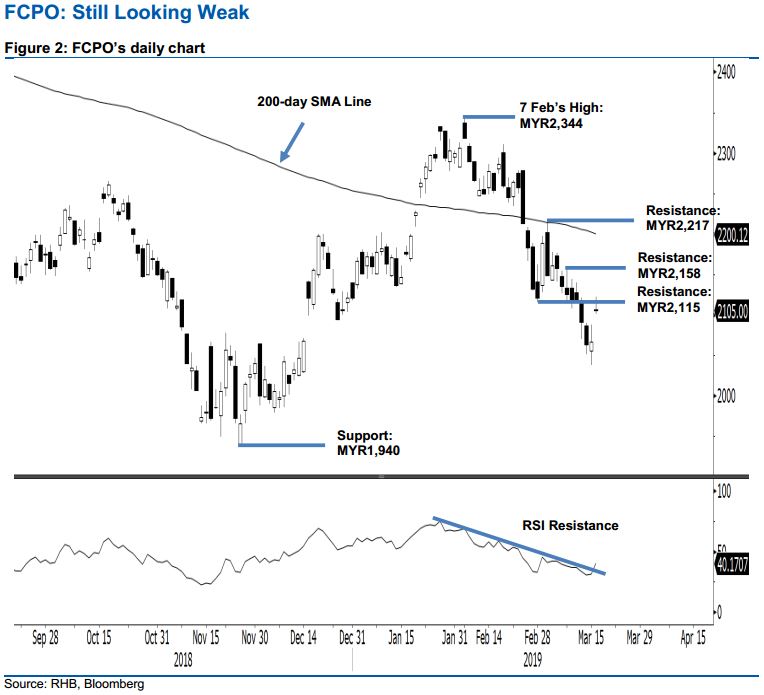

FCPO - Still Looking Weak

rhboskres

Publish date: Tue, 19 Mar 2019, 09:25 AM

No clear signal of a rebound yet; maintain short positions. The FCPO shed MYR8 and closed at MYR2,105 yesterday. The low and high were at MYR2,101 and MYR2,122. The commodity’s overall weak bias, which set in after the failed attempt to breach above its long-term downtrend line (please refer to our report dated 18 Mar) on 7 Feb, is still firmly in place. For now, as long as it is still capped by the MYR2,158 level, the bias is still tilted towards the extension of the retracement leg – as this indicates the bulls are not strong enough to – at the minimum – stage a rebound. We maintain our negative trading bias.

With no sign of a trend reversal, we continue to recommend that traders stay in short positions. These were initiated at MYR2,089, the closing level of 13 Mar. To manage risks, a stop-loss can be placed above MYR2,158. The immediate support is maintained at MYR1,940, the low of 27 Nov 2018.

The following support is at MYR1,900. Moving up, the immediate resistance is set at MYR2,115, the low of 28 Feb. This is followed by MYR2,217, the high of 4 Feb.

Source: RHB Securities Research - 19 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024