Hang Seng Index Futures: Outlook Remains Positive

rhboskres

Publish date: Mon, 25 Mar 2019, 12:48 PM

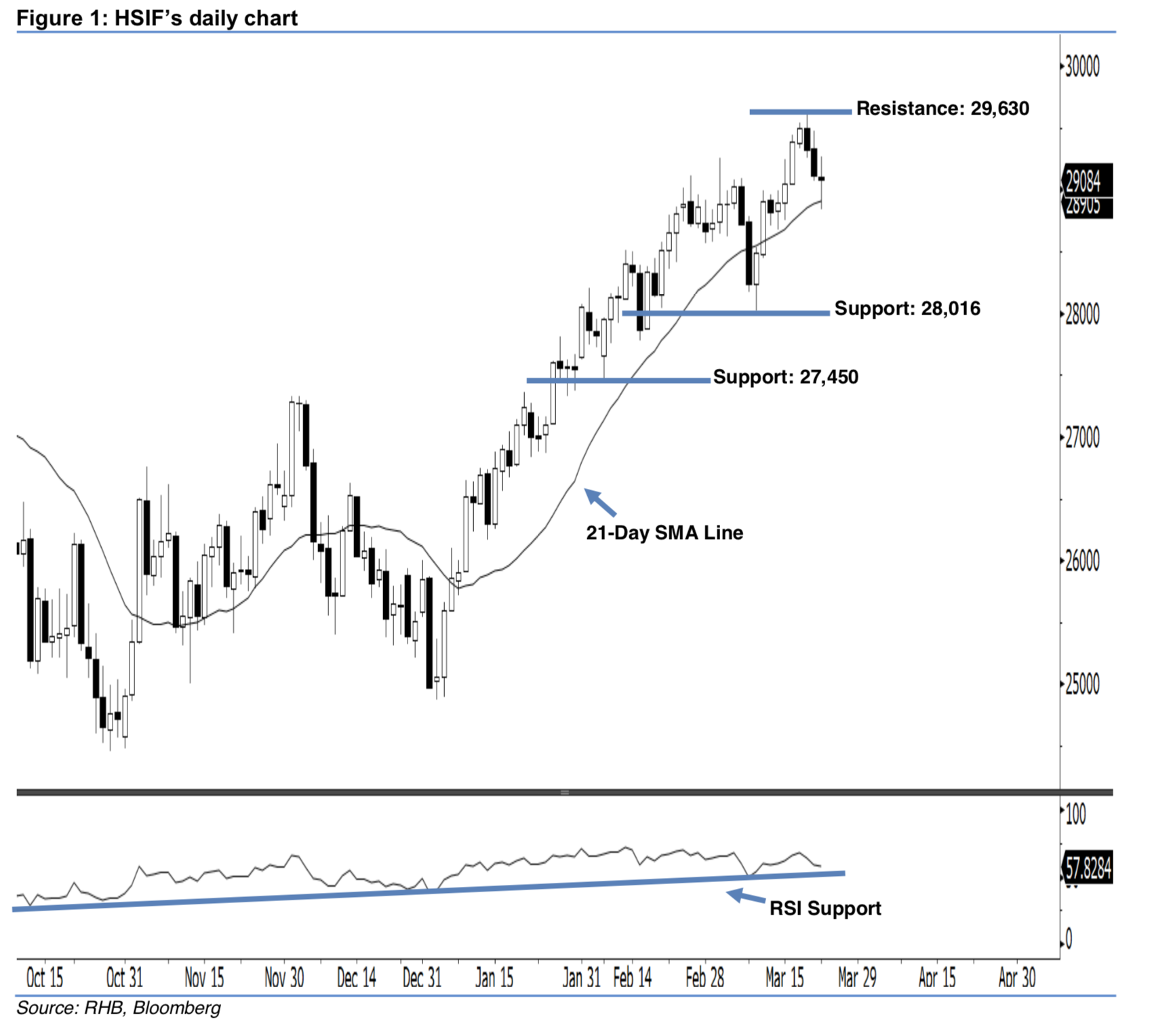

Maintain long positions. The HSIF formed a “Doji” candle last Friday. It settled at 29,084 pts, after hovering between a high of 29,270 pts and low of 28,838 pts. From a technical perspective, we think the bullish sentiment stays intact, as the index continued to remain above the 28,016-pt support mentioned a week ago. With the 21- day SMA line still pointing upwards, this has led us to believe that the rebound that from 11 Mar’s white candle may continue. Overall, we remain positive on the HSIF’s outlook.

Presently, we are eyeing the immediate support level at 28,016 pts, determined from the previous low of 11 Mar. If a breakdown arises, the next support is seen at 27,450 pts, ie the low of 8 Feb. Towards the upside, we anticipate the immediate resistance level at 29,630 pts, obtained from the high of 20 Mar. Meanwhile, the next resistance is seen at the 30,000-pt psychological mark.

Hence, we advise traders to maintain long positions, since we had originally recommended initiating long above the 29,039-pt level on 20 Mar. A stop-loss is advisable to set below the 28,016-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 25 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024