WTI Crude Futures - Testing the Immediate Resistance

rhboskres

Publish date: Wed, 27 Mar 2019, 05:46 PM

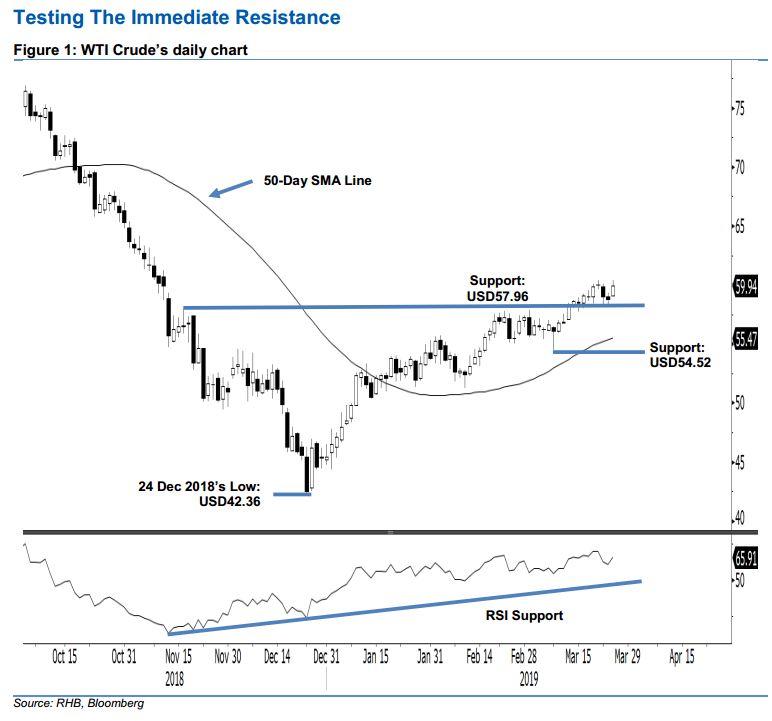

Maintain long positions, as the bulls are still trying to crack the USD60 resistance. The WTI Crude formed a white candle during the latest trading session – at one point, it briefly breached above the USD60 immediate resistance. The session’s low and high was booked at USD59.04 and USD60.38, before closing at USD59.94 – this indicated a gain of USD1.12. Overall, the commodity’s positive price trajectory, which started from the low of USD42.36 on 24 Dec 2018, remains intact. This was after the USD57.96 immediate support was almost tested in the prior session. Based on these factors, we maintain our positive trading bias.

With no price signals to indicate the upward move has been exhausted, we continue to recommend traders to stay in long positions. These were initiated at USD49.78, or the close of 8 Jan. For risk-management purposes, a trailing-stop can now be placed below the USD58.17 level, ie the low of 25 Mar.

The immediate support is set at USD57.96, which was the high of 16 Nov. This is followed by USD54.52, or the low of 8 Mar. Meanwhile, the overhead resistance is eyed at USD60 – a round figure. This is followed by USD63.59, which was the low of 18 Jun 2018.

Source: RHB Securities Research - 27 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024