COMEX Gold - Bears Are in Control

rhboskres

Publish date: Wed, 17 Apr 2019, 04:50 PM

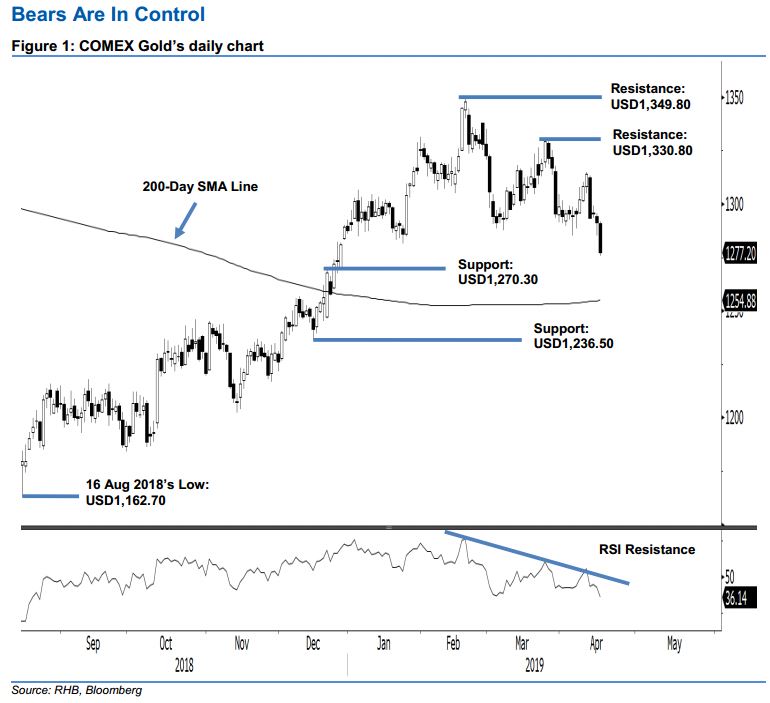

Previous immediate support broken; maintain short positions. The COMEX Gold formed a black candle that at the closing breached below the previous immediate support of USD1,281.50. Session’s low and high were posted at USD1,275.50 and USD1,291.70, before ceasing at USD1,277.20, implying a drop of USD14.10. The breakdown from the said previous immediate support indicates that the commodity’s multi-week correction phase (started from the high of USD1,349.80 on 20 Feb) is still ongoing. This correction phase set in to correct the previous multi-month upward move, which started from the low of USD1,162.70 on 16 Aug 2018. Maintain negative trading bias.

As the retracement leg is still showing signs of extending, we continue to recommend traders stay in short positions. We initiated these positions at USD1,291.30, the closing level of 12 Apr. For risk management purposes, a stop-loss can be placed above USD1,330.80.

Immediate support is revised to USD1,270.30, which was the high of 20 Dec 2018. This is followed by USD1,236.50, the low of 14 Dec 2018. Conversely, the immediate resistance is set at USD1,330.80, which was the high of 25 Mar. This is followed by USD1,349.80, ie the high of 20 Feb.

Source: RHB Securities Research - 17 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024