COMEX Gold- Struggling Near the 20-Day SMA Line

rhboskres

Publish date: Thu, 09 Sep 2021, 05:34 PM

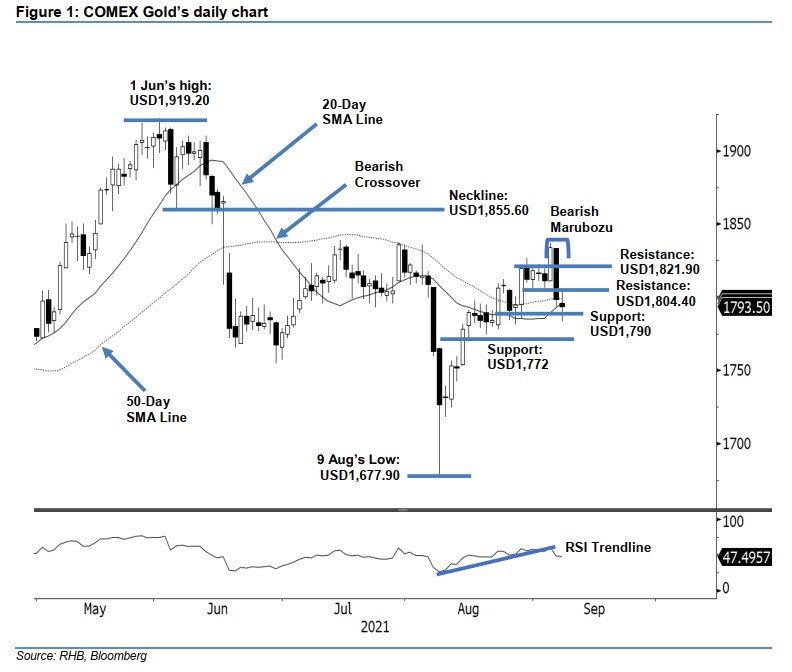

Maintain long positions. The COMEX Gold extended the bearish price action seen since 7 Sep, correcting USD5.00 to settle at USD1,793.50. After opening at USD1,796.10, the commodity attempted to test the USD1,804.40 day high. The positive momentum was weak, and was followed by another correction towards the USD1,783.10 day low before bouncing to close at USD1,793.50. A long lower shadow was spotted during the latest session, which showed that the bulls have not given up yet, though struggling to stay on top of the 20-day SMA line. If the yellow metal manages to stage a rebound in the immediate session, this may avert a breach below the 20-day moving average. Otherwise, falling below the moving average may attract further selling pressure. As of now, we still maintain our positive trading bias until the trailing-stop threshold is triggered.

We recommend traders maintain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For risk management, the stop-loss mark is set at USD1,790, which trails the 20-day SMA line.

The nearest support is marked at the USD1,790 whole number, followed by USD1,772 – 16 Aug’s low. The immediate resistance is seen at USD1,804.40 – 8 Sep’s high – and followed by USD1,821.90, ie 31 Aug’s high.

Source: RHB Securities Research - 9 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024