Weekly market outlook : Price retracement is here, what's next?

roundnsurge

Publish date: Mon, 04 Apr 2022, 11:37 AM

One of the worst nightmare for traders & investors is getting trapped at the high price. Let’s avoid this unnecessary stress by knowing the overall market trend. Ride it when it is moving up, stay out of it when it is going into a retracement.

In order to react before every trend reversal, we can’t rely on the news or the indicators for the signals to retrace. Because these sources of information are based on what is HAPPENING in the market, which means the market is already down/up. That’s why investors who rely on news or traditional analysis are always late to react. Always enter at the high price & cut loss when the market is down.

We have a way to help everyone to react before the price is down or up with price & volume analysis AKA R&S Operator Analysis. Remember to follow us on Facebook or YouTube, if you find this blog helpful.

What is going to happen in Malaysia stock market in the coming trading days

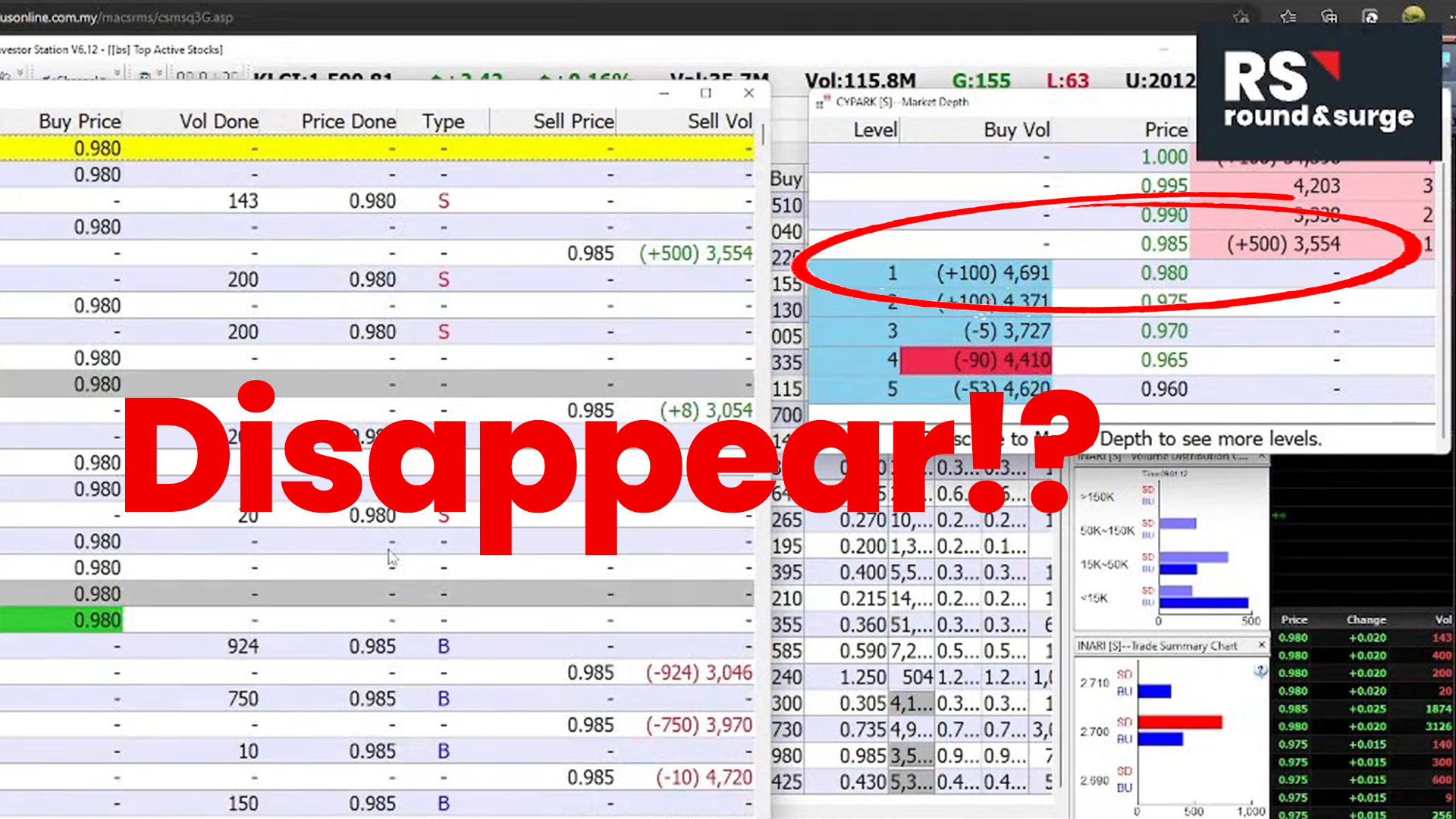

Since last week [ 21 Mar 2022 - 25 Mar 2022 ], most of the stocks in the market are showing signs of retracement from the previous rebound. The previous rebound from the low for some sectors are showing price & volume action of accumulation, which is good news. However, the stock prices are trading sideways with low volumes & fluctuations after the rebound. These price movements are showing that the big boys are not willing to accumulate more at the current price & are waiting for the price to fall lower for the next round of accumulation.

But take note, some stocks rebound not because of accumulation, it is just attracting buyers for profit taking at the low.

The RM 1 & above stocks have gone through the above price movement and we might see the retracement is ending soon. But the penny stocks are going through the above at the moment. For those investors who are watching penny stocks may want to wait for the retracement complete.

We might see overall RM 1 & above stocks start to move higher first & followed by the penny stocks. Get ready to react to the upcoming rebound after the retrace.

For a more detailed explanation join our livestream on 6th of April 2022, 8:30pm on Facebook & YouTube. Follow the link below to join the livestream :

Facebook : https://fb.me/e/1yxhxpBNm

YouTube :

https://youtu.be/2T8xZTXEQKI

To find out more about our Operator Analysis 6 months Pro Training Course, visit this link : https://bit.ly/2Velj7k

Website : www.roundnsurge.com

Facebook : www.facebook.com/roundnsurgeofficial

Instagram : @roundnsurge

Kelvin's Twitter : https://twitter.com/KelvinYap810

Malaysia stock market is a unique market, hence it requires a customized trading approach to tackle & swerve. Many existing traders in Malaysia apply a plug-and-play strategy from overseas stock markets, but it is not necessarily the best strategy to trade in KLSE. This is due to the difference in local and overseas stock market regulation, as well as the size of market participants of institutional fund & retail investors.

“True traders react to the market.” is the backbone of our trading method. Our findings and strategies are developed through years of trading experience and observance of the operating style in the Malaysia stock market.

Disclaimers :

The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associates does not warrant, represent and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever and no reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | Jun 27, 2023

Discover the differences between Callable Bull/Bear Contracts (CBBCs) and structured warrants on the Hang Seng Index (HSI) to maximize your day trading returns.

Created by roundnsurge | May 22, 2023

Discover the incredible profit potential of Callable Bull/Bear Contracts (CBBC). The ability to profit in rising and falling markets, and lower entry barriers make CBBC the superior choice for trader.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.