Is Recession Here or is the market bottom? | Let's see how the Price & Volume Reacts in KLSE

roundnsurge

Publish date: Wed, 05 Oct 2022, 03:24 AM

Retail investors often react a few steps behind to the stock market changes, we are only informed by news or the indices fall. This is why many investors always sell their shares at the wrong time or at the very bottom of the price.

This can be explained due to panic created by the market reaction & reading news. We have to understand 1 thing about news published is mainly to tell us what happen-ED in the market. The media will “TRY” to find the reason for the market reaction by asking some of the professionals in the market. It is a good source to get yourself updated to the market condition. However, if you are an investor or trader, we don’t need a 3rd party to tell us what has happened in the market, because we are looking at it.

If you have been reading financial news, you will notice the stock market always reacts differently after the news is published. For example, there was a reported bear market but a few days later the market started to rebound. This scenario is more commonly seen in the crypto market. This is part of the reason we don’t trade or invest based on news.

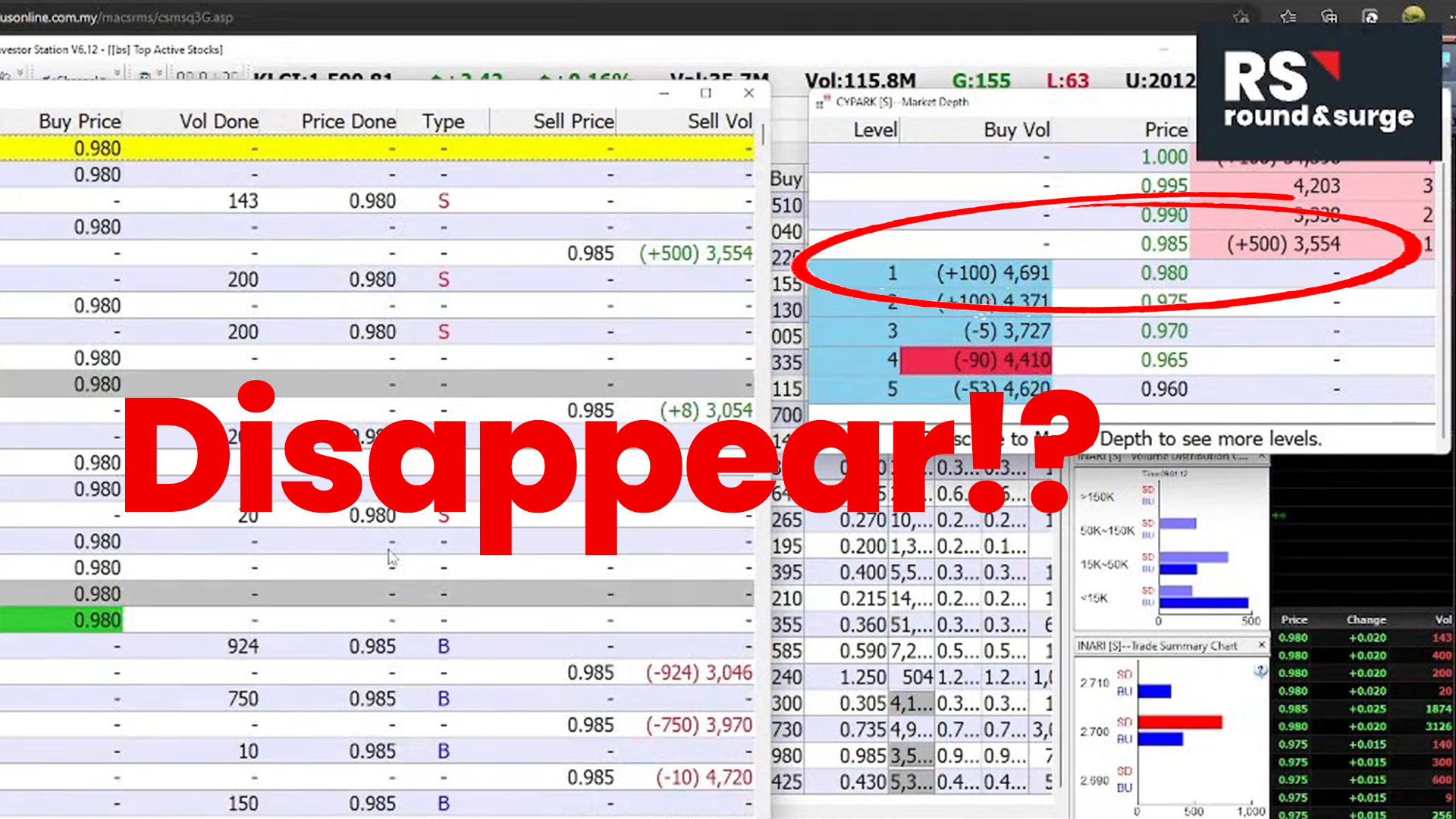

News published is not the first hand information, the 1st hand information will always be the big boys who can move the stock prices. If you don’t want to exit too early and go for bottomless averaging down your position. You need to know whether the big boys are really out of the market or are just false signals created by the big boys to shake off weak sellers in the market.

What do the big boys “say” about the market from their transactions data?

We will look into the KLCI component stocks & also some of the stocks that are performing really well in the past 6 months to gauge whether they are in the final distribution or have the sign to support the price fall. Please note that the KLCI direction doesn’t represent the whole market. Therefore, we are looking into different groups of stocks to understand the possible outcome of the next trend for us to react to the changes.

Do take note that the content in this blog is based on our own opinions from our analysis. It is not an offer to buy or sell any securities mentioned in this blog. Readers/ viewers should do their own study to make investment decisions & you are responsible for your own investment/trading decision.

We analyse the transaction data of the stocks to gauge the intention of the big boys. In this blog, we will analyse the 5 mins chart price & volume movements to gauge the next possible price direction.

KLCI component stocks

We will analyse the list of component stocks by the gainers & losers to find out whether the big boys are going to support the losers & whether the gainers will continue to mark a higher price. It will be very positive to the KLCI if the majority of the losers & gainers show big boys are supporting the price to mark it higher.

Those stocks with price & volume that show signs of continuation of price markup are mainly the manufacturing stocks. Although the price ended lower for some stocks, the majority of the volume created when the stock prices traded at the lowest price of the day. Some are also showing a very short term price markup pattern in the 5 mins chart.

Conclusion

KLCI performance will remain mixed in the short term. Any investors who want to enter for the long term might need to wait for another confirmation after the recent price rebound. This is to make sure the big boy's intention to mark up is long term & is not just a pump & dump.

If you don’t wish to get trapped at the high price every time you enter into a position. Follow the link below to learn how to identify price fall from the 5 mins chart with the examples of the top performing stocks in the past 6 months.

https://roundnsurge.com/news/identifying-the-true-chart-pattern-breakout-in-klse

If you are still interested find out more about how to identify the price bottom before the big boys start to markup the price to attract buyers. Register an account on our website to watch our recordings on “Advance Technical Analysis to identify precise rebound for KLSE”.

https://www.roundnsurge.com/register

We host webinars frequently to share our Operator Analysis with our followers. The upcoming webinar topic will be “R&S Precise Market Rebound Analysis 101”. Kindly find the registration & webinar details below.

Date: 19th OCT 2022 | 8:30PM | WED

Registration link: https://register.gotowebinar.com/rt/2637283519074972944

Easy way to learn how big boys accumulate shares: https://bit.ly/3AOhUz1

Website: www.roundnsurge.com

Facebook: www.facebook.com/roundnsurgeofficial

Youtube: www.youtube.com/c/RoundSurgeoperatoranalysis

Instagram: @roundnsurge

About Us

Malaysia's stock market is a unique market; hence it requires a customized trading approach to tackle & swerve. Many existing traders in Malaysia apply a plug-and-play strategy from the overseas stock market, but it is not necessarily the best strategy to trade in KLSE. This is due to the difference in local and overseas stock market regulation and the size of market participants of institutional funds & retail investors.

“True traders react to the market.” is the backbone of our trading method. Our findings and strategies are developed through years of trading experience and observance of the operating style in Malaysia’s stock market.

Trading Account Opening

They are offering an Intraday trade brokerage rate at 0.05% or RM8 whichever is higher for day trading stocks RM 50,000 & above-transacted volume (buy sell the same stocks on the same day). Buy & hold at 0.08%or RM8 whichever is higher.

Open a cash account now at the link below:

https://registration.mplusonline.com/#/?drCode=R311

As Kelvin’s trading client, you will be exclusively invited to join Kelvin’s weekly webinar and telegram group. Click here to join.

For more inquiries contact him by email: kelvinyap.remisier@gmail.com or 019-5567829

If we have missed out on any important information, feel free to let us know and feel free to share this information but it will be much appreciated if you can put us as the reference for our effort and respect, thank you in advance!

This blog is for sharing our point of view about the market movement and stocks only. The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associated persons do not warrant, represent, and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever. No reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge. It is not advice or recommendation to buy or sell any financial instrument. Viewers and readers are responsible for their own trading decision. The author of this blog is not liable for any losses incurred from any investment or trading.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | Jun 27, 2023

Discover the differences between Callable Bull/Bear Contracts (CBBCs) and structured warrants on the Hang Seng Index (HSI) to maximize your day trading returns.

Created by roundnsurge | May 22, 2023

Discover the incredible profit potential of Callable Bull/Bear Contracts (CBBC). The ability to profit in rising and falling markets, and lower entry barriers make CBBC the superior choice for trader.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.

Discussions

I just hope so, mkt oredi bottom.

I cannot tahan anymore longer, pain is all around me now !

2022-10-05 14:47

WASHINGTON (Oct 5): US mortgage rates jumped to a 16-year high of 6.75%, marking the seventh-straight weekly increase and spurring the worst slump in home loan applications since the depths of the pandemic.

https://www.theedgemarkets.com/article/us-mortgage-rates-rise-seventh-week-highest-16-years

>The housing/real estate market can collapse when borrowers can not repay the much larger monthly installment.

2022-10-05 23:41

We have been in bear market like forever now! We haven't seen the bull for the longest time!

2022-10-06 14:44

speakup

bottom over already lah

now is bull!

2022-10-05 11:05