WHILE the Malaysian Communications and Multimedia Commission’s (MCMC) “Notice of No Objection” on the proposed Celcom-Digi merger yesterday (June 29) has removed a regulatory impediment on market consolidation, the 5G policy overhang and uncertainty could still weigh on stock/sector sentiment.

As it is, RHB Research expects the Government to extend the deadline for the equity stake in Digital Nasional Bhd (DNB) with a shareholder agreement likely to be sealed in July.

“We continue to prefer fixed line plays over mobile. Key risks: competition, regulatory setbacks, and weaker-than-expected earnings,” reiterated analyst Jeffrey Tan in a telco sector review.

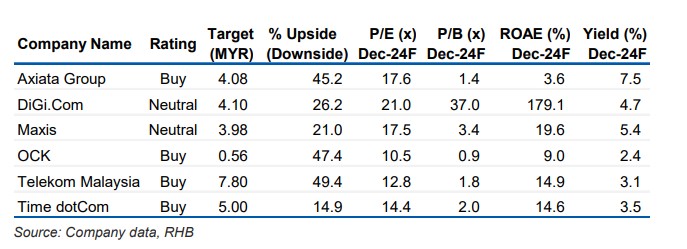

More broadly, the research house has retained its “neutral” outlook on the telco sector with its preferred picks being Telekom Malaysia Bhd (TM), Time dotCom Bhd and OCK Group Bhd.

Stressing that the DNB equity deal “may be nigh but the devil is in the details”, RHB Research – citing a report by theedgemarkets.com – said the six telcos (including Celcom, Digi, Maxis, and U-Mobile) are likely to sign shareholder agreements in early July for a circa 12% stake each in DNB valued at about RM200 mil.

“The report also said wholesale pricing will be discounted until 80% coverage is achieved by DNB (2024 target),” the research house pointed out. “The latter suggests some indulgence has been extended for agreements to proceed for which the market may view positively.”

With regard to the aye by market regulator MCMC to the merger of Axiata Group Bhd and Digi.Com Bhd yesterday, RHB Research said the final outcome rests on Celcom-Digi committing themselves to certain undertakings to address competitive concerns.

“Overall, we view the remedies as fair given that execution is staggered over two to three years post-merger completion (end-2022),” opined the research house.

Despite having to forego 70MHz of spectrum, RHB Research said the MergeCo would still retain 67% of the combined spectrum resources (140MHz) to support its larger/extended customer base. This is still ahead of Maxis which has the second-largest spectrum block (110MHz).

“The regulator will reimburse the upfront spectrum costs incurred on a pro-rata basis based on the remaining years of spectrum,” noted RHB Research. “We believe the spectrum deficit can be compensated by optimising the current spectrum resources and some capacity investments.”

On the structural separation of the wholesale business from retail, the research house said this would alleviate concerns by new/existing mobile virtual network operators (MVNO) of the MergeCo exerting control over wholesale prices and imposing strict conditions, notably market access/segmentation.

“The removal of exclusive dealerships should also level the playing field, especially in areas where the MVNOs have an edge, for example, Celcom in Sarawak though the impact can still be buffered by building a strong single corporate brand in our view,” added RHB Research. – June 30, 2022