A GROOMING instructor has come forward to admit that she has also become an online banking scam victim after Putrajaya Hospital consultant physician and nephrologist Dr Rafidah Abdullah highlighted her losing RM13,000 to three unauthorised transactions in her CIMB Bank account.

Self-employed Lily Natty Elegance claimed on her Facebook posting dated Aug 20 that RM11,688.16 “vanished” in two transactions from her Public Bank current account under the name Ageless Haven Resources, leaving her account with zero amount.

It seems that the modus operandi – even the recipient’s bank for that matter – bears much similarity to that experienced by Dr Rafidah.

“No TAC (transaction authorisation code), text, call or anything at all. I’ve lost faith in Public Bank,” she decried her fate.

“They (Public Bank) did not offer cooperation at all as if I was the one who gave away the TAC number (to the culprit) when I myself didn’t even receive any SMS or calls. This is so irresponsible as I didn’t download any (fraudulent) apps.”

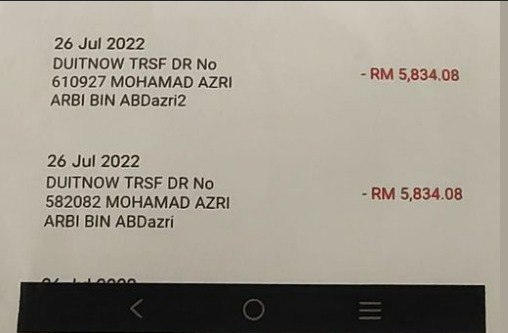

Lily Natty further lamented that even Hong Leong Bank where the funds from her Public Bank account were transferred to one “Mohamed Azri Arbi Bin Abdullah” could only suggest to her “to change my password, delete internet banking and do transaction over the counter”.

“Public Bank has confirmed that it was the job of a scammer and that my phone has been hacked … they can only advise me to cancel my internet banking as it is no longer safe,” she revealed in a FB posting.

“Imagine that this has to happen so soon after I become active once more after two years of lockdown when I lost my source of income … Natty (referring to herself) was shocked for a few days – no tears – but one night after maghrib (sunset), I really broke down.”

In an update on her FB page, Lily Natty said after her plight became viral, the Mohamed Azri Arbi to who was supposedly the beneficiary of the fund DM (direct message) her that he, too, had lodged a police report to clear his name after being informed by his wife that his name has gone viral in the social media.

“He promised to cooperate with me to clear his name. He does not know who is responsible. Anyway Public bank still doesn’t want to be responsible (it kept blaming me for giving out my TAC number when I didn’t do so) while Hong Leong is silent on the matter,” she shared.

In his police report, Mohamed Azri denied that he was the culprit with the justification that he no longer uses the said Hong Leong Bank account since he dropped his ATM card two month ago (no mention if he did lodge a police report when he first lost his ATM card).

In light of a surge in the number of online banking scams, PKR information chief Fahmi Fadzil has recently proposed the formation of a task force to help victims seek legal redress.

The Lembah Pantai MP also questioned why action by the Government, banks and banking associations has proven to be ineffective in dealing with scammers who had been using a similar modus operandi.

He said the finance, communications and multimedia, home affairs, and law ministers, among others, must work on a solution to lessen and eradicate scamming in Malaysia.

He also urged the Association of Banks in Malaysia (ABM) and the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) to explain how banking security systems could be exploited by such scammers.

“The existing security systems – especially for online banking – must be urgently revamped, including the implementation of two-factor authentication and the use of International Mobile Equipment Identity (IMEI) numbers for suspicious transactions,” he added. – Aug 23, 2022