What is BREWING Behind Massive Change of Hand for Sern Kou Resources Warrants?

garyztandslr

Publish date: Tue, 25 Oct 2022, 11:19 PM

As a general rule of thumb in investment / trading, any major changes in shareholding of the key executives or major shareholder of the company should be taken seriously by investors.

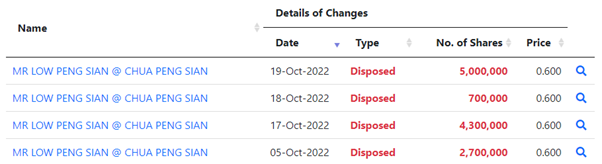

Sern Kou, the mid-stream wood processing company and furniture manufacturer, is seeing massive shareholding changes in the warrants by the company key person Mr. Low Pen Sian @ Chua Pen Sian.

So, what exactly is going on?

For seasoned investors, they would have already noticed that it is impossible for the disposal of warrants to be completed in the open market as there were not enough volume to absorb the shares.

Hence, there must be a new investor in place who had absorbed the 12.7 million units of SERNKOU-WA.

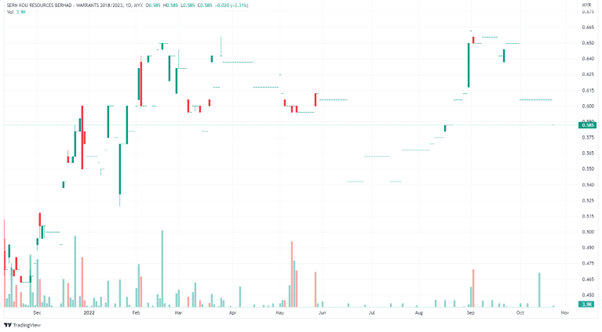

The next question that investors need to ask ourselves – why are they willing to absorb the shares at RM0.600, a slight premium as compared to the market RM0.585 price?

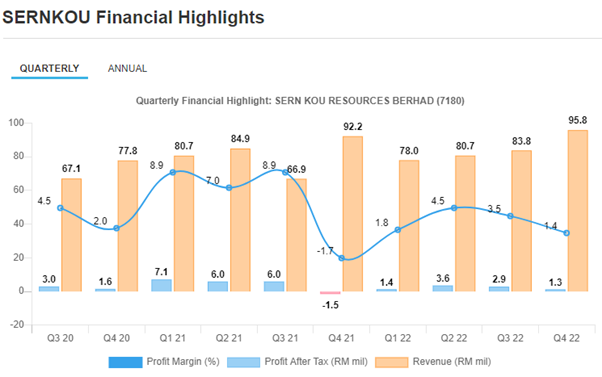

Looking at the fundamentals of Sern Kou, the company is riding well on the rough waves of labour shortage, raw material price fluctuations as well as foreign exchange fluctuations as compared to some other peers.

Notably, Sern Kou is also the only few furniture manufacturers that could enjoy the benefits of costs savings via their midstream wood processing business, but it is also important to note that majority of the revenue and profit of the company comes from the midstream business.

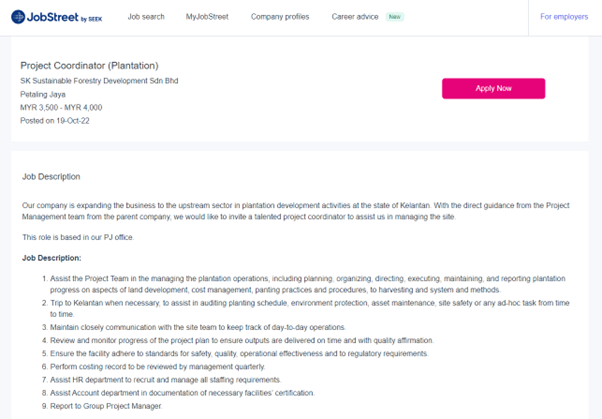

It is also important to point out that under the umbrella of Sern Kou as a listed company, the company had incorporated two new subsidiaries, namely SK Sustainable Forestry Development Sdn Bhd and SK Biotech Sdn Bhd.

A quick search on what SK Sustainable Forestry Development Sdn Bhd is doing online can easily found out that the company is expanding the business to the upstream sector in plantation development activities at the state of Kelantan.

This would mean that the company will be the first wood processing and furniture company in Malaysia that is involved in the upstream business.

And if we were to match with the date of the job posted, it matches with the date of warrants transfer.

Could this mean a new chapter for Sern Kou to come? Should you collect the negative premium warrants of Sern Kou at this juncture?

I will leave the decision-making part to you.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Super KLSE Stocktalk

Created by garyztandslr | Nov 28, 2022