(TapDance) Low Risk High Return (9) – Dominant Enterprise

tapdance

Publish date: Thu, 12 Nov 2020, 11:30 PM

Summary

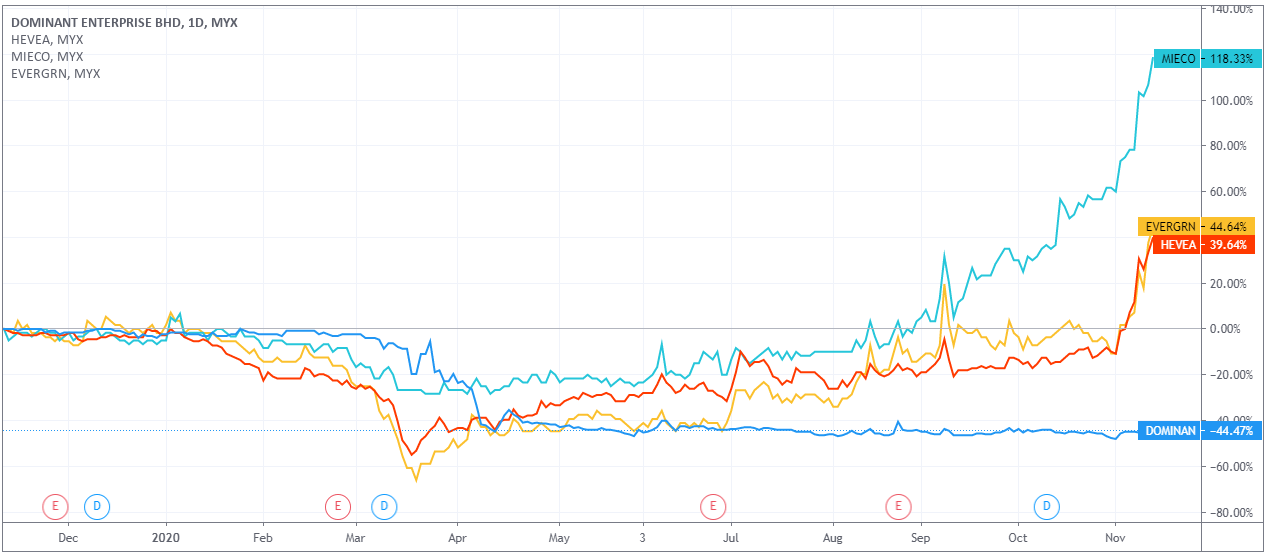

Dominant - a forgotten candidate - is expose to the furniture theme. It is still trading at MCO panic selling level when its peers have since all ran-up by more than +150%.

The laggard can only explain away by its ultra-low profile with zero institutional investor and sell side followings despite a decent track record since 2003.

Dominant’s earnings growth which broadly matches with its market cap growth (i.e. 4x) plus the decent ~6% DY reassures that it will not be a value trap and trades cheap for long.

Moreover, the co.’s timely capacity expansion which should be ready by late 2020 will come in handy amidst the robust order environment.

Catalyst(s)

-

Aggressive ASP upward revision (+20 to 30%) from robust furniture orders driven by

- US new-home sales growth and

- suburban migration

- Work-from-home

- Trade war led order diversion

- Timely capacity expansion

- Higher institutional coverage / following

- Sustainable DY of ~6%

Description

Dominant is a (furniture) wood related product manufacturer hence an indirect beneficiary from our local furniture industry’s robust demand.

Channel checks confirmed that wood and upholstery furniture orders' lead time has extended from the usual 2 months to now 7 and 4 months (i.e. June / March 2021) for wood and upholstery funitures respectively.

Particleboards generally have an aggressive 20 – 30% ASP rise from pre-MCO level, confirms by UOBKH research report released days ago. The furniture-board manufacturing industry that has been plagued by overcapacity since 2019 is now officially over.

Apart from the global work from home (WFH) trend, the furniture trade is also enjoying from the 'suburban pull' factor occurring especially in the US and UK – driven by the intention to minimize pandemic contamination risk from the cities.

These households – are the ones keeping their job – and of higher net-worth – are unlikely to skimp on home refurbishment budget. Home improvement budget is also expanded as alternative spending opportunities are scarce currently. The ultra-low mortgage rate fuels the trade.

WFH - or hybrid WFH - trend is here to stay post pandemic era as mentioned by surveys and studies conducted by interviewing numerous corporate chieftains. The spike in furniture orders seen thus far may only be the tip of the iceberg.

The US-China trade spate results in order diversion is a structural change. Trust amongst the two nation will not recover in years, that is if it does. Manufacturers alike will diversify supply chain to mitigate future operation disruption.

When Vietnam production cost escalates in recent years and no longer cheap, Malaysia government bans the export of rubber wood sawn timber benefiting our local furniture industry for a cost competitive operating environment.

Valuation

Dominant is not a value trap and will not stay cheap for long. Its revenue and operating profit has broadly grown by 3x and 4x respectively from 2006 to 2019. During which its market cap has also grown by 4x.

It will be trading at 4x PE if earning recovers to FY03/19 level based on its existing market cap of ~RM115m. This is excluding all the above mentioned suburb migration, ASP rise and trade war order diversion etc.

Dominant’s timely production capacity expansion (complete by late 2020) will take advantage of the furniture order spike.

Why the opportunity?

Dominant’s share price still hovers at MCO panic selling level whereas the particleboard manufacturers’ share price has generally ran-up significantly.

One possible explanation is the (acute) lack of sell-side coverage and institutional following. There’s zero institutional shareholder in the company's major shareholders list despite the long established track record that dates back to 2003.

Today’s market sentiment favors those with alarmingly hot traded volume and comments in various social platforms. Not all under-followed stock is a solid idea. However, an undervalued stock idea simply cannot be widely followed.

Catalyst

-

Aggressive ASP upward revision (+20 to 30%) from robust furniture orders driven by

- US new-home sales growth and

- suburban migration

- Work-from-home

- Trade war led order diversion

- Timely capacity expansion

- Higher institutional following

- Sustainable DY of ~6%

Note: Please follow this post for future updates

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Obscure ideas

Discussions

Can look at Dominan 7169 which 100 percent complies golden rule.

Profit breaking high but share at march level.

Uncle kyy let recover from glove big lost.

2021-02-28 22:35

Profit margin & ROE are much lower if compared to Pohuat & Lii Hen.

Lii Hen total trade receivables is 0.74 month of latest QR sales

Pohuat total trade receivables is 0.94 month of latest QR sales

While Dominant total trade receivables is 2.52 months of latest QR sales

2021-03-01 02:00

Pohuat total liabilities is 141mil, 33% of total equity

Liihen total liabilities is 177mil, 42% of total equity

While Dominant total liabilities is 239.9mil, 77% of total equity

2021-03-01 02:01

Another key factor is Pohuat & Liihen seem commanded much higher profit margin for their products than Dominant

ROE of Dominant also only half of the 2, historically

Pohuat & Liihen PE is about 8.8 times, may be that’s the main reasons why market valued lower on Dominant

2021-03-01 02:02

.png)

Young Money

Undervalue Gem DOMINANT

Reasons:-

-ASP

-Leadtime

-US furniture boom

2020-12-02 14:13