Something Is Brewing Inside IPMUDA [5673]

thethinker

Publish date: Tue, 17 Aug 2021, 11:05 AM

HELO FELLOW TRADERS,

LET'S TALK ABOUT IPMUDA

KAF Equities has initiated coverage on Ipmuda Bhd with a target price of RM1.60 and a “buy” call.

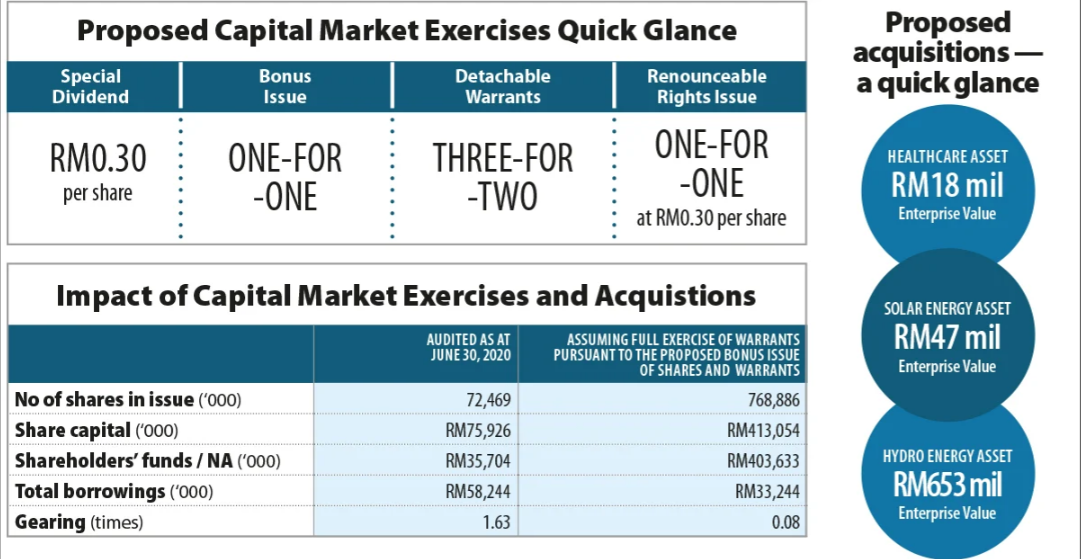

IPMUDA has made game-changing moves and expanded into diversified sectors within one financial year, post structural and ownership changes, after a series of direct and indirect share disposals by the previous substantial shareholder. This was subsequently followed by a complete change in leadership at the board and management levels. Leveraging the new vision brought by the new leadership, this shift is a pivotal change for “IPMUDA 2.0”, which will turn 46 this year.

More articles on The Thinker Touch

Created by thethinker | Aug 24, 2023

Created by thethinker | Jul 04, 2023

The information provided here is for educational and informational purposes only. It should not be considered as financial or investment advice.

Created by thethinker | Jun 27, 2023

Created by thethinker | Jun 19, 2023

Trading carries risks. Information provided is for educational purposes only, not financial advice. Conduct research and seek guidance from a financial advisor.

Created by thethinker | Jun 14, 2023

Created by thethinker | Jun 12, 2023

Created by thethinker | May 23, 2023

Created by thethinker | May 22, 2023

This article is for informational purposes only and should not be considered as financial advice.

Created by thethinker | May 15, 2023