[OWG] Only World Group [5260] : Is It Going To Be A Focal Point In The Near Future?

thethinker

Publish date: Mon, 30 Jan 2023, 02:30 PM

In 2022, while many countries recovered from the Covid-19 pandemic and others experienced turmoil, Malaysia experienced a year of recovery. Despite facing economic challenges, there are signs of hope in the tourism industry, indicating a light at the end of the tunnel.

The domestic tourism industry's recovery suggests that the toughest times for Only World Group Holdings Bhd (OWG) are likely behind them.

The Covid-19 pandemic significantly impacted the group's F&B outlets, water amusement parks, and family attractions situated in tourist hotspots and shopping centers, such as Genting Highlands in Pahang, Komtar Tower in Penang, and Klang Valley.

OWG's turning point is the resurgence of tourism after Malaysia's shift towards endemicity, which will drive increased traffic to its F&B outlets and family attractions.

As of June 21, Malaysia has exceeded its goal of 2 million incoming tourist arrivals for the year.

OWG's most of its outlets are situated at Genting Highlands, which accounted for 40% of the group's 2019 revenue, and is now experiencing a rise in foot traffic.

The pent-up demand for travel, the ringgit's depreciation, and the opening of the Genting SkyWorlds theme park provide strong support.

Given the solid recovery momentum and expected stronger seasonal earnings in H2, better business volume is expected in the group's F&B outlets and family attractions, leading to improved earnings in the future.

Minister Datuk Seri Tiong King Sing stated that the Ministry of Tourism, Arts and Culture (Motac) aims to attract 5 million tourists from China in 2023, up from 3.1 million in 2019.

Reference: Motac targets arrival of five million tourists from China this year, says Tiong

The Ministry of Tourism, Arts and Culture (Motac) in Malaysia aims to attract 5 million tourists from China this year, which is a significant increase from 3.1 million in 2019, according to the Minister, Datuk Seri Tiong King Sing. The target was set following China's decision to reopen its borders on Jan 8, three years after restrictions due to the Covid-19 pandemic. The target is expected to be achieved when China allows group tour services to 20 countries, including Malaysia, to resume on Feb 6. Tiong assured that every Chinese tourist will undergo a Covid-19 screening test before coming to Malaysia and urged Malaysians to continue prioritizing their health and follow standard procedures to prevent the spread of the disease. The Malaysian Association of Tour and Travel Agents (Matta) has faith in the Ministry of Health to manage the arrival of Chinese tourists just as they did with travelers from other countries.

The official opening of the Genting SkyWorlds Theme Park was on February 8, 2022.

Reference: Genting SkyWorlds Theme Park is officially open

The subsidiary of Genting Malaysia Bhd, Resorts World Genting (RWG), has announced that its theme park, Genting SkyWorlds, has opened on February 8th, 2022. The park, which is said to have cost around $800 million, features 26 rides and attractions and can accommodate up to 20,000 visitors at 50% capacity due to COVID-19 guidelines. The park had previously been intended to be a 20th Century Fox World-branded park, but changed its name to Genting SkyWorlds after the acquisition of 21st Century Fox by The Walt Disney Company. Investment banks Maybank, RHB Research, and Public Investment Bank have given positive recommendations on Genting Malaysia Bhd due to the opening of the theme park and the expected boost to tourism.

The opening of the Genting SkyWorlds Theme Park is expected to bring in more tourists to Genting, boosting the revenue of OWG.

Share Price vs. Fair Value

The intrinsic value of Only World Group Holdings Berhad was determined using the data sources, inputs, and calculations listed below.

The calculation of the discount rate is a crucial aspect of discounted cash flow analysis, and I will outline the process here.

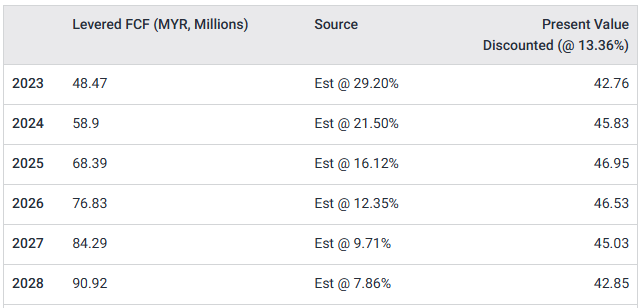

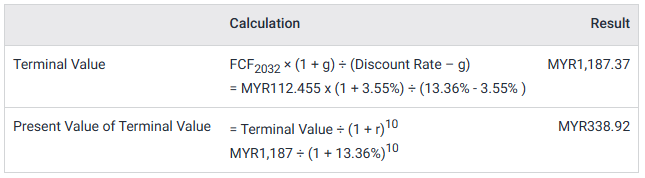

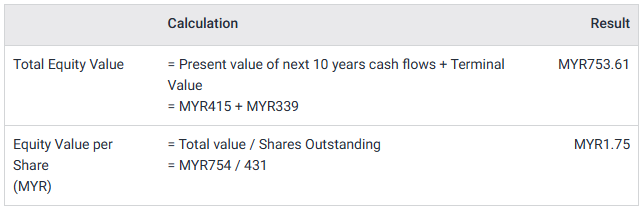

The intrinsic value of Only World Group Holdings Berhad is computed through the 2-stage method of discounting future cash flows to present value. The first stage involves using analyst estimates of cash flows for the next 10 years, while the second stage assumes stable growth in perpetuity.

From the calculation above, the fair value of OWG was determined at RM1.75.

OWG has enough cash reserves to sustain operations for over 3 years, even though it is not currently profitable, as long as it continues to generate positive free cash flow.

In conclusion, the revenue and profits of OWG are expected to increase as a result of an influx of tourists to the country in the near future, thereby driving an increase in OWG's stock prices.

It is my hope that the information provided in this article will be useful for all investors. My intention is simply to share information about a company that has the potential to bring profit to investors. Ultimately, any decision made is up to the individual.

if you are interested in becoming a part of The Thinker Syndicate, please join our private group to get the latest updates on how you can become a trader who always gets early information in trading.

JOIN NOW

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Thinker Touch

Created by thethinker | Aug 24, 2023

Created by thethinker | Jul 04, 2023

The information provided here is for educational and informational purposes only. It should not be considered as financial or investment advice.

Created by thethinker | Jun 27, 2023

Created by thethinker | Jun 19, 2023

Trading carries risks. Information provided is for educational purposes only, not financial advice. Conduct research and seek guidance from a financial advisor.

Created by thethinker | Jun 14, 2023

Created by thethinker | Jun 12, 2023

Created by thethinker | May 23, 2023

Created by thethinker | May 22, 2023

This article is for informational purposes only and should not be considered as financial advice.

Created by thethinker | May 15, 2023

speakup

wonder why this article comes out when OWG already up 50%

if really wan bantu i3 investors, this should be out when OWG was 45 or 50sen

2023-01-31 09:58