Why Cscstel? Pure cash steel manufacturing company (281% increase in profit)

itjustabouttheprofit

Publish date: Sun, 28 Aug 2016, 05:20 AM

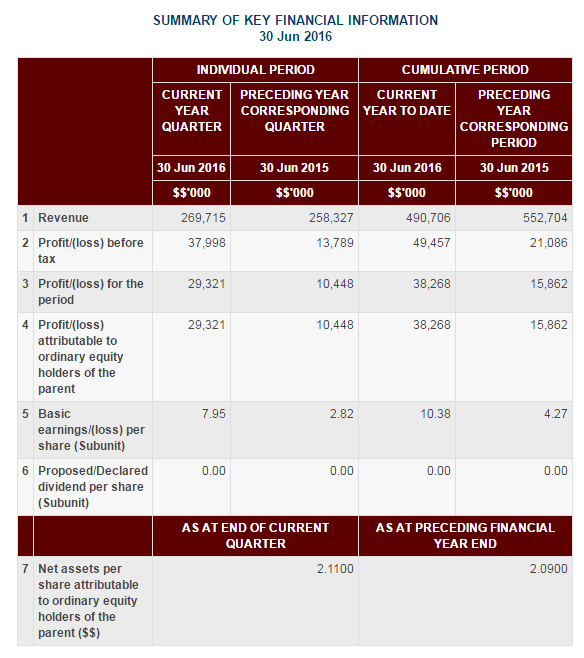

Latest quarter result:

30/6/2016 - 7.95sen

31/3/2016 - 2.43sen

31/12/2015 - 7.47sen

30/9/2015 - 2.77sen

Total - 20.88sen

Current PE ratio : 6.94 (RM1.45)

Net assets: RM2.11

Company background

|

CSC Steel Holdings Berhad, (formerly known as Ornasteel Holdings Bhd), was incorporated in Malaysia on 20 January 2004. After acquiring the 100% equity of both CSC Steel Sdn. Bhd. (formerly known as Ornasteel Enterprise Corporation (M) Sdn Bhd) and Group Steel Corporation (M) Sdn Bhd., CSC Steel Holdings was successfully listed on the Main Board of Bursa Malaysia Securities Berhad on 30 December 2004.

Product: 1) Hot rolled pickled and Oiled Steel 2) Cold Rolled Steel 3) Realzinc / Hot-Dipped Galvanized Steel 4) Realcolor / Pre-painted galvanized steel

For more information, you can refer to the corporate video on the link below: http://www.cscmalaysia.com/video.asp

I am here to ANSWER a simple question. Why CSCSTEL?

1)Net profit jumped by 281% for the quarter ended 30 Jun 2016

2)Pure cash company (RM321mil or equivalent to RM0.84 per share) and best fundamental among other steel company

3) China government's policy to cut steel capacity

4) Others |

1) Net profit jumped by 281% compared to

previous year

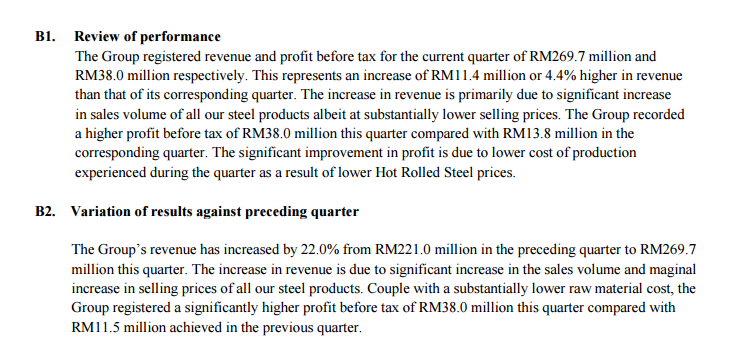

As per quarter report released on last week, the company's profit have significantly improved from 10.4mil to 29.3mil (281% increased from last year)

According the quarter report, the increase in revenue is primarily due to significant increase in sales volume at substantially lower selling prices. Also the significant improvement in profit is due to lower cost of production experienced during the quarter as a result of lower Hot Rolled Steel prices.

2)Pure cash company (RM321mil or

equivalent to RM0.84 per share) and best

fundamental among other steel company

As per 30 June 2016, the company owned RM321mil of cash with zero borrowing, which translated into RM0.84 per share. With the current share price of RM1.45, you paid the company business with RM0.61.

Also, the company net assets is stood at RM2.11, which is 45% discounted from the current share price of RM1.45.

| Year | Earning per share | Dividend per share | Dividend payout |

| 2015 | 14.52sen | 8sen | 55.1% |

| 2014 | -5.72sen | 3sen | N/A |

| 2013 | 7.81sen | 7sen | 89.6% |

| 2012 | 7.51sen | 7sen | 93.2% |

| 2011 | 7.92sen | 7sen | 88.4% |

Refer to the table above, for the past 5 years, the company have consistently paid out more than 55.1% of profit to their shareholders.

| Company | PE ratio | Dividend yield | Profit margin (latest quarter) |

|---|---|---|---|

| Cscsteel | 6.94 | 5.52% | 10.87% |

| Annjoo | -26.87 | 4.07% | 15.80% |

| Masteel | -15.30 | 1.00% | 3.98% |

| Lsteel | -14.97 | N/A | 2.66% |

| Kinstel | -1.55 | N/A | 3.17% |

| Ssteel | -1.8 | N/A | N/A (Loss) |

Refer to the table above, Cscsteel have the lowest PE ratio and highest dividend yield among other steel company. For the profit margin, Cscsteel have the second highest among other competitor.

Also, Cscsteel is the only net cash and zero borrowing company among other steel company.

3) China government's policy to cut steel

capacity

As per bloomberg's news attached, China's have plans to cut steel capacity by 45million by allocate a total of 100billion yuan to help local authorities and state-owned firms. With the capacity cut, the supply of steel will be decreased. It is good for the company as most of the steel in Malaysia imported from China.

Refer to the quarter report stated in point 1, sales volume of the company have been significantly increased. As China's government have plans to cut steel capacity, i foresee that the sales volume will maintain or increased for the outcoming quarter.

4) Others

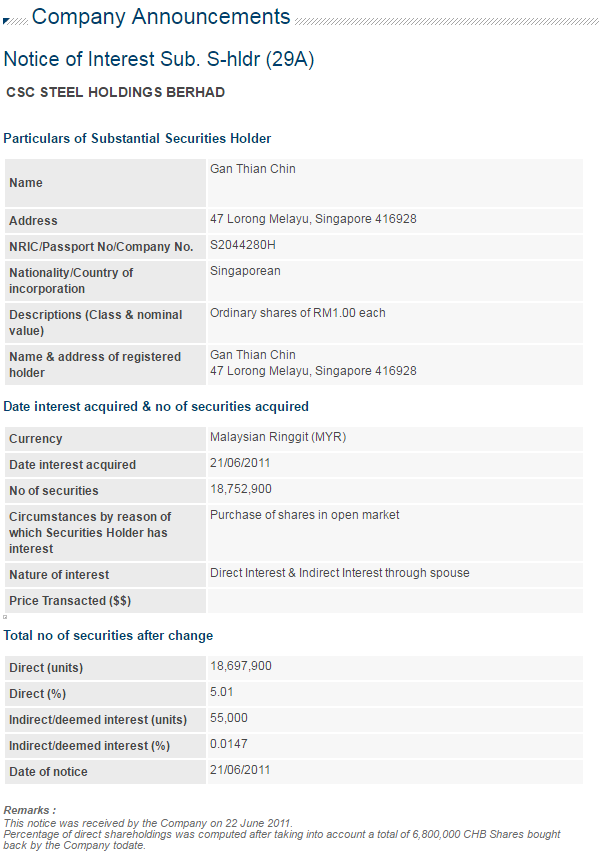

- Disposal from second largest

shareholder, Mr Gan Thian Chin

Let's talk about some history of Mr Gan Thian Chin.

On 21/6/2011, Mr Gan Thian Chin have become the substantial shareholder for the company.

According to the bursa annoucement, he have purchased the company's share from early 2011 until 13/1/2012.

During the period, the share price have been dropping after the release of quarter result on 30 Jun 2012. The share price have not recovered since then until recently the share price have been spiked to above RM1.30.

I have read throught the annual report since 2011 to 2015 and find out that Mr Gan did not have any relation to the management of the company.

The reason of disposing the share might be due to the share price increased near to the his entry price during 2011 and 2012.

Hence in my opinion, the disposal of Mr Gan recently provided us a good oppurtunity to collect the share at cheap price.

Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Jun 05, 2016

Created by itjustabouttheprofit | Apr 16, 2016

Discussions

U all can keep on promoting but share price will not go up..why? Cuz secret or advantage know by everyone is not an advantage or secret anymore

2016-08-28 10:15

Thank you moneysifu for sharing the information. It didnt aware on the news.

2016-08-28 12:19

Well said.

Hmm. Is about sentiment of investor.

As long steel price remain in this level and mega steel still remain closed.

Then cscsteel can go further

2016-08-28 22:58

good explanation and very clear mind what can do. Good job for Mr.Gan let us to collect at the low price.

2016-08-29 08:14

Mr Gan no longer a susb. shareholder. He is still holding 21,179,600 shares as of 19Aug. If he throws 1m+ shares/day, he would finish throwing in just/less than 20 trading days.

2016-08-29 09:36

Please read yourself if it is Taiwan or China Companies, or you can read annual report for more details:

CSC Steel Holdings Berhad mainly owned by China Steel Corporation (46.37 percent) via its subsidiary, China Steel Asia Pacific Holdings Pte. Ltd.. China Steel Corporation currently is the largest integrated steel maker in Taiwan and 23rd largest steel producer in the world.

2016-08-30 01:10

moneySIFU

Haha, said everything, very clear & well written article, itjustabouttheprofit, good job!

But miss one thing as follows:

The Royal Malaysian Customs Department will enforce the collection of anti-dumping duties and this measure will be effective for five (5) years, from 24 May 2016 to 23 May 2021. With the imposition of anti-dumping duties on imports of Cold Rolled Coils of Alloy and Non-Alloy Steel from the alleged countries, it is expected that the issue of unfair trade practices will be addressed.

See full press release: http://www.miti.gov.my/index.php/pages/view/3343

Ps: thanks to sharing by optimushuat on 24/05/2016.

2016-08-28 08:44