TDM (2054) THE NEXT TMAKMUR : POTENTIAL TO RISE 100% to 200% BY ECRL BOOSTER, Calvin Tan Research

calvintaneng

Publish date: Wed, 03 Apr 2019, 12:03 PM

Hi guys,

April is here! So is the ECRL (East Coast Rail Link) final signing!

Calvin has highlighted 6 stocks that might benefit from ECRL restoration - AZRB, T7 Global, Lafarge, Prestar, Masteel & TalamT

Now 2 more Stocks are destined to do very well if ECRL is on again -

1) TDM stands for Trengganu Development, Malaysia

Having bulk of its Oil Palm Plantations in Trengganu & 2 Big Hospitals (In Kuantan & Trengganu) TDM Assets will benefit the most compared to many other companies when ECRL is signed

Why will TDM Assets price rise?

Answer:

These are the Advantages of a Direct Rail Link from Port Klang to the Eastern States of Pahang, Trengganu & Kelantan

a) Huge Saving of time & money

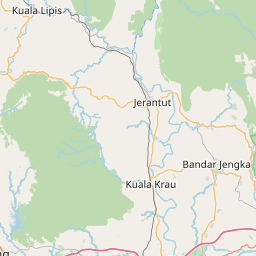

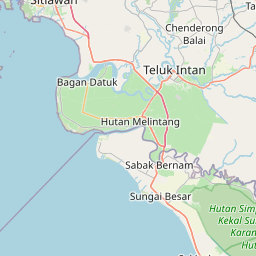

See this map

Distance from Klang to Kuantan

Distance from Klang to Kuantan is 225 kilometers. This air travel distance is equal to 140 miles.

The air travel (bird fly) shortest distance between Klang and Kuantan is 225 km= 140 miles.

If you travel with an airplane (which has average speed of 560 miles) from Klang to Kuantan, It takes 0.25 hours to arrive.

Of course it is not cheap to send by Land Route compared to Sea Route

NOW NO MORE. WITH THE ECRL BELOW THE COST SAVING AND TIME SAVING WILL BE HUGE

ECRL TRAIN WILL TRAVEL HOW FAST PER KM?

See this

https://www.channelnewsasia.com/news/asia/malaysia-east-coast-rail-link-game-changer-cancellation-11239336

THE ELECTRIC TRAIN ON ECRL WILL TRAVEL AT THE SPEED OF 160KM PER HOUR

SO TRAIN FROM KLANG SHOULD REACH KUANTAN PORT WITHIN 2 HOURS (For Road Haulage due to Undulating High land & Low land of KL - Kasrak Stretch It takes more than 5 Hours for Heavy Trailers Transporting Goods Across & also more expensive.

RAIL LINE WILL CUT COST OF TIME & SAVINGS

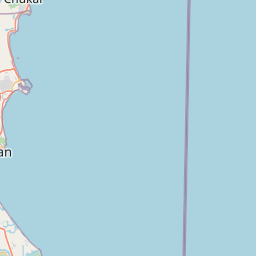

What about Sea Route?

Although Shipping by Sea Route is cheap each KM (About 50% of Train Cost) The Distance being 800 Km compared to Traind route of 225 Km it is STILL VERY MUCH CHEAPER FOR TIME AND COST AT THE BOTTOM LINE

Let's do a simple calculation

Travel by Rail Statistically 225/160km = 1 hour 40 minutes

Travel by Sea (Ship travels at only 37 kph... So 800 divides by 37 = 21.6 Hours

If you pass by the Straits of Singapore ships will have to slow down to only 22km per hour as 1,000 Ships of all sizes pass by this 2 km narrow passage daily

See

SO TRAVEL TIME BY SEA FREIGHT FROM PORT KLANG TO KUANTAN PORT TAKES ONE DAY BUT BY ECRL IT TAKES ONLY 2 HOURS

WHAT ABOUT ITS COSTS

TAKE RM10 PER KM (for example)

IT COSTS MORE THAN DOUBLE BY RAIL COMPARED TO SEA ROUTE

BUT AT 225 KM IF X 2 = 450 AND X BY RM10 = RM4,500

AND BY SEA AT 800 KM X RM10 = Rm8,000

SO THERE IS A SAVING OF Rm3,500 or about 44%

This is only an estimated example.

BUT IT IS DEFINITELY VIABLE AS THE ECRL IS PART OF CHINA'S MARITIME SILK ROUTE (AND CHINA ALREADY HAS FEW THOUSAND YEARS EXPERIENCE WITH THE OLD SILK ROAD TRADE FOR MANY CENTURIES

DEFINITELY IT MAKES BUSINESS SENSE OR ELSE CHINA WOULD NOT SPENT RM5 TRILLIONS FOR THE NEW LAND AND SEA SILK ROUTE OF THIS MODERN TIME!!

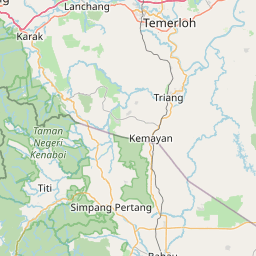

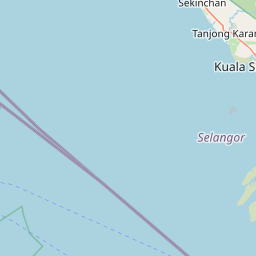

NOW THE BIG QUESTION IS IF ECRL IS ON AGAIN WHY TRENGGANU WILL BENEFIT SO MUCH

THE ANSWER IS OBVIOUS

TDM HAS BULK OF ITS PLANTATION LANDS IN TRENGGANU. AND THEY ARE BOUND TO APPRECIATE IN VALUE. ALSO 2 HOSPITALS... ONE IN TRENGGANU & ONE IN KUANTAN CAPITAL

SEE HOW STRATEGIC TRENGGANU LIES ALONG THE ECRL ROUTE

WHAT OTHER ADVANTAGES APART FROM SAVING OF TIME & MONEY FOR TDM?

THE EASTERN STATES OF TRENGGANU, PAHANG & KELANTAN ARE KNOWN TO HAVE FLOODS DURING THE NORTH EAST MONSOON. MANY ROADS ARE CLOSED TO TRAFFIC AND IMPASSABLE. WITH THE ECRL THE ENTIRE REGION WILL BE OPEN FOR BUSINESS & TRAVELING EVEN DURING MONSOON SEASON

ALL THESE AND MORE WILL UPLIFT THE ASSETS OF TDM

ASSETS OF TDM?

AT 17.5 SEN WITH NTA OF 66 SEN TDM IS SELLING AT A WHOPPING 74 DISCOUNT TO NTA

A LOOK AT ITS NET ASSETS SHOW 4 HOSPITALS

ALL LOCATED IN PRIME AREAS OF TAMAN DESA, KL, PETALING JAYA, TRENGGANU & KUANTAN. HOSPITAL ASSET VALUE ALREADY MATCH TDM BORROWINGS OF RM400 MILLIONS. LEAVING SURPLUS OF MANY PRECIOUS OIL PALM ESTATE LANDBANKS

AND THESE ESTATES ARE CERTIFIED PLUS TDM ALSO TOOK THE TROUBLE TO PROCESS WASTE INTO FERTILIZER

THIS VALUE ADD WAS ALSO DONE BY TMAKMUR WHEN THEY REAR COWS/GOATS IN THE OIL PALM PLANTATIONS

A PRO ACTIVE MANAGEMENT LIKE TMAKMUR WAS TAKEN PRIVATE. NOW CALVIN SEES THE SAME DILIGENCE & INDUSTRY IN TDM

NOT ONLY CALVIN SEE

DR> NEOH SOON KEAN, THE GREAT SIFU ALSO SAW THE POTENTIAL IN TDM. HIS FUND - DYNAQUEST IS IN TOP 30 HOLDERS OF TDM AS WELL AS HIS OWN MONEY ALSO INSIDE - UNDER NEOH CHOO EE (BOTH ARE IN TOP 30 HOLDERS OF TDM SPEAK VOLUMES

SEE (GO TO TDM ANNUAL REPORT)

UNDER TOP 30 HOLDERS

Comining in at Top 11. Neoh Choo Ee & Company, Sdn. Berhad 6,246,640

Coming in at Top 28. Dynaquest Sdn. Berhad 1,475,740

SO BULLISH IS DR. NEOH ON TDM THAT HE BOUGHT 1.475 MILLION TDM FOR HIS DYNAQUEST FUND INVESTORS.

WHILE HE HIMSELF IS EXTREMELY BULLISH TO PUT EVEN MORE OF HIS OWN MONEY UNDER NEOH CHOO EE (HIS OWN PERSONAL COMPANY) AT 6.246 MILLION TDM SHARES

AT 17.5 SEN CALVIN HAS A TARGET PRICE OF 50 SEN FOR TDM WHICH IS SLIGHTLY BELOW 200% UPSIDE

HAPPY INVESTING

BEST REGARDS

Calvin Tan Research

Singapore

COMING UP NEXT

WRITE UP ON MAJU PERAK.

SO TRAVEL TIME BY SEA FREIGHT FROM PORT KLANG TO KUANTAN PORT TAKES ONE DAY BUT BY ECRL IT TAKES ONLY 2 HOURS

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Apr 06, 2024

Discussions

If someone could give us a brief outline of TDM's recent financial performance. Would be very useful.

2019-04-04 07:04

Good morning

I told Uncle Koon, I think in year 2014, to sell off Jtiasa because I saw shale oil hammering crude oil leading to the decline of biodisel which will impact palm oil.

Jtiasa was sold down by Uncle Koon in no time and collapsed to rm1. 00

For the past years since 2014 crude oil has fallen the the low of USD27 per barrel.

That also continues to impact biodisel.

If crude is cheap there is no incentive to use palm oil as biodisel. Not only palm oil stocks suffered. Tekseng which manufacture solar panel also suffered as a result as there is no reason to use expensive solar panel then. I told Wahahaha to sell off all Tekseng above RM1. 00 and I was right

However, Wahahaha took offense and attacked me in Drb when Drb was below Rm1. 00

At long last Drb reached rm2. 00 and Tekseng dropped 70% to below 30 sen and Wahahaha disappeared

Now that Brent crude oil is reaching Usd70 again plus ringgit also collapsed from rm3. 30 to Rm4. 07..palm oil will once more be feasible for biodisel use.

So just as Calvin turned bullish on Carimin on Jan 2018....now I am getting more bullish on oil palm stocks again

Other reasons are China banning canola oil from Canada as they arrested Huawei boss daughter

China promised to buy more cpo from Malaysia

Russia also buying cpo from Malaysia because Malaysia bought Russian planes

India has reduced tax on cpo import

Both Indonesia and Malaysia are using more cpo as biodiesel.

China and India facing acute Air pollution might use more clean tech biodiesel

Euro banning biodiesel use is a misunderstood thing.

They didn't ban biodisel use outright.. They only withdraw subsidies by year 2030

Year 2030 is still 11 years away! So they are still using cpo as biodiesel for next 10 years

There is more worry that Malaysia might run out of oil in 10 years than EU removing subsidies for biodiesel in 10 years time.

So now is the time to turn bullish on Tdm

Tdm has 3 plans now

1. Plan A

Palm oil as the main business. Encouraged by Trengganu Govt its cpo are certified and qualified

It has also followed Tmakmur type of management by utilising assets to the full without wastage by converting palm waste into fertilizer

Being a Trengganu Govt stock it receives free land grants for oil palm cultivation at minimal cost. Trengganu Govt can support Tdm due to over RM1 billion oil revenue from PH Govt as promised in the election manifesto

2. Plan B

Tdm has invested into 4 medical hospitals in prime locations of Tmn Desa, Petaling Jaya, Trengganu and Kuantan. Almost rm400 millions are invested which equal to its borrowings. So they borrow for productive businesses. All the hospitals are growing steadily by virtue of natural growth and progress.

3. Plan C

Plan C is not in the plan but Ecrl will be an impetus to spur its growth and value

Almost all the major assets of Tdm are located in Trengganu and ECRL rail link is passing right across the entire state of Trengganu to Tok Bali in Kelantan which will turn into an oil hub and also a major exporting importing transit hub for oil, goods and people

Tdm.. Now going at all time low...

Buying Tdm at 19 sen is just like buying Carimin at 39 sen

2019-04-04 07:55

Carimin also suffered losses when Calvin called for a buy on Carimin at 39 sen

We invest we future prospect in view not on past bad quarters

2019-04-04 08:30

Calvin also hard sell Carimin at 39 sen

Why not TDM at 19 sen? TDM share price 10 year high was 95 sen so now is very cheap

2019-04-04 08:33

Calvin sounded CARIMIN way before KYY bought into it. Calvin able to see things before others do.

2019-04-04 08:47

SC will investigate and find all the FACTS AND FIGURES CALVIN GAVE ARE WELL SUPPORTED AND SUBSTANTIATED BY EVIDENCE

THERE IS NOTHING FAKE BUT ALL ROCK SOLID TRUTH!!!

2019-04-04 08:49

Malaysia exporting over Rm2 Billions worth of Palm oil to China

https://www.thestar.com.my/business/business-news/2019/03/04/malaysia-to-export-us$891m-of-palm-oil-to-china/

2019-04-04 09:01

INDONESIA BIODIESEL FROM PALM OIL

https://goldenagri.com.sg/b20-biodiesel-mandate-a-lifeline-for-indonesias-palm-oil-sector/

2019-04-04 09:03

MALAYSIA USING MORE BIODIESEL

https://www.businesstimes.com.sg/energy-commodities/malaysia-to-double-palm-oil-used-in-transport-biodiesel-to-20-in-2020

2019-04-04 09:04

India cut tax on palm oil

https://www.nst.com.my/business/2019/01/445996/india-cuts-tax-palm-oil-imports-malaysia-gain-most

2019-04-04 09:05

Malaysia aims to double palm oil sales to Russia

http://www.mpoc.org.my/sub_page.aspx?ddlID=c0e40c71-fa2e-407d-99db-81f4df018856&catid=c0e40c71-fa2e-407d-99db-81f4df018856&id=

2019-04-04 09:07

https://www.thehindubusinessline.com/markets/commodities/palm-oil-prices-to-rise-in-2019-on-robust-demand/article26081528.ece

Palm oil prices to rise in 2019 on robust demand

2019-04-04 09:11

Seems like palm oil industry going in for a turnaround leh! Thanks for the info unker Calvin

2019-04-04 15:03

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/200947.jsp

calvin new favorite counter.

2019-04-04 16:34

you wrote so much articles especially these two weeks without non stop until i cannot see the other writers. i wonder how long you spend time front of your laptop/pc everyday for come out with those articles.

2019-04-04 20:56

buzzly you wrote so much articles especially these two weeks without non stop until i cannot see the other writers. i wonder how long you spend time front of your laptop/pc everyday for come out with those articles.

04/04/2019 8:56 PM

Sorry that I took up so much space.

It takes me about 1 to 2 hours to put my findings & thoughts into each article. But i did alot of reading when i am free.

2019-04-04 22:17

30 Largest Securities Account Holders For Ordinary Shares As At 22/03/2018

No. Name No. of Shares Held %

1 Terengganu Incorporated Sdn Bhd

(A/C No: 098-001-045464245) 766,795,843 46.25

2 Terengganu Incorporated Sdn Bhd

(A/C No: 087-055-045755196) 245,921,610 14.83

3 Kumpulan Wang Persaraan (Diperbadankan) 148,605,950 8.96

4 Citigroup Nominees (Tempatan) Sdn Bhd

Exempt AN For AIA Bhd. 42,184,810 2.54

5 Lembaga Tabung Amanah Warisan Negeri Terengganu 23,482,107 1.42

6 Amanahraya Trustees Berhad

Public Strategic Smallcap Fund 14,828,660 0.89

7 Citigroup Nominees (Asing) Sdn Bhd

CBNY for Dimensional Emerging Markets Value Fund 13,722,720 0.83

8 Citigroup Nominees (Asing) Sdn Bhd

CBNY For Emerging Markets Core Equity Portfolio DFA Investment Dimensions Group Inc 9,189,730 0.55

9 Amanahraya Trustees Berhad

Public Islamic Select Treasures Fund 6,777,480 0.41

10 Amanahraya Trustees Berhad Public

Islamic Treasures Growth Fund 6,331,600 0.38

11 Neoh Choo Ee & Company, Sdn. Berhad 6,246,640 0.38

12 Citigroup Nominees (Asing) Sdn Bhd

CBNY For DFA Emerging Markets Small Cap Series 4,725,420 0.29

13 Eng Bak Chim 4,631,000 0.28

14 UOB Kay Hian Nominees (Asing) Sdn Bhd

Exempt AN For UOB Kay Hian Pte Ltd (A/C Clients) 4,133,880 0.25

15 Kumpulan Pengurusan Kayu Kayan Trengganu Sdn Bhd 3,140,016 0.19

16 Megategas Sdn Bhd 2,938,610 0.18

17 Amanahraya Trustees Berhad

Public Islamic Opportunities Fund 2,860,600 0.17

18 Citigroup Nominees (Asing) Sdn Bhd

Exempt AN For OCBC Securities Private Limited (Clients A/C -NR) 2,563,550 0.15

19 Tai Tsu Kuang @ Tye Tsu Hong 2,420,000 0.15

20 Chung Chin-Fu 2,356,860 0.14

21 Soon Lian Huat Holdings Sdn. Berhad 2,233,000 0.13

22 Wong Shew Yong 2,220,790 0.13

23 Yeong Cherng Sdn Bhd 1,980,000 0.12

24 Maybank Nominees (Tempatan) Sdn Bhd

Pledged Securities Account For Tan Boon Huat 1,918,310 0.12

25 Pretam Singh A/L Chanan Singh 1,675,630 0.10

26 Low Geat Hong 1,662,700 0.10

27 Cheng Gek Hong 1,491,890 0.09

28 Dynaquest Sdn. Berhad 1,475,740 0.09

29 Ti Geok Chiam 1,333,930 0.08

30 Tan Hock Kien 1,306,450 0.08

TOTAL 1,331,155,526 80.28

2019-04-04 23:42

HI GUYS

STALE BULL MUST BE CLEARED BY NEW INVESTORS TAKING OVER FIRST

AFTER THAT VALUE INVESTORS WILL CONTINUE TO SEE VALUE AND BUY UP ALL CHEAP TDM SHARES

FOR DESTINI IT HAS MOVED UP FROM ITS LOWS AND RESTING. GOOD RESULTS SHOULD PROPEL IT UP AGAIN.

FOR TDM IT IS VERY CHEAP AND OVERLOOKED DUE TO CPO DOWNTURN

FEW PEOPLE ARE AWARE OF THE CO-RELATION BETWEEN CRUDE OIL AND CPO

THE COLLAPSE OF CRUDE I YEAR 2014 CAUSED THE COLLAPSE OF CPO INDIRECTLY (BIODIESEL PRICE RISES OR FALLS WITH CRUDE OIL)

SO THE REVIVAL OF CRUDE OIL WILL ALSO REVIVE CPO PRICES AGAIN

2019-04-05 08:04

Posted by calvintaneng > Apr 4, 2019 2:55 PM | Report Abuse

MAJU PERAK (8141) MAJULAH PERAK BY GEELY - PROTON PARTNERSHIP IN EXPANSION & GROWTH, Calvin Tan Research

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/200947.jsp

2019-04-05 08:34

bulldog

Yes....the next darling counter

2019-04-03 12:36